Investors are starting to think Blackberry has a future

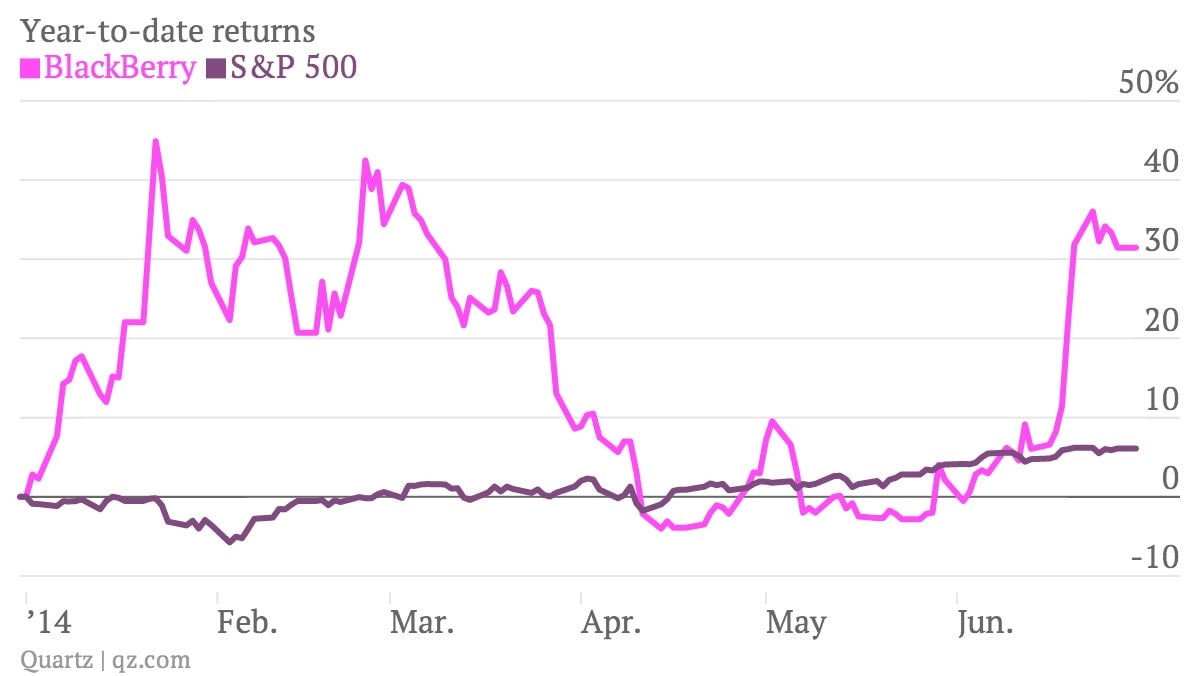

It’s been a wild ride, but BlackBerry shares are actually having a pretty decent 2014. The stock is up around 30% this year, compared to a 6% rise for the S&P 500.

It’s been a wild ride, but BlackBerry shares are actually having a pretty decent 2014. The stock is up around 30% this year, compared to a 6% rise for the S&P 500.

BlackBerry now appears to have broken out of its share price death spiral, but questions about its future remain. For one thing, the company’s 2014 share-price resurgence is off a really low base. Between 2010 and 2013, the stock plummeted by some 87 percent as its once-pioneering smartphones, with their tiny keyboards, hemorrhaged market share to touchscreen devices, most notably Apple’s iPhone. Goldman Sachs estimated that the company now accounts for less than a 1% share of smartphone sales, compared to a peak of around 20% in 2009.

Chief executive John Chen has set about transforming BlackBerry from a device maker into a mobile solutions company. The company’s most recent quarterly earnings were stronger than expected, but analysts at Credit Suisse are still worried that the company is burning through too much cash. Once the benefits of real estate sales and tax refunds are taken into account, BlackBerry still spent $255 million during the quarter.

The jury’s out on the Chen transition at a corporate level. But BlackBerry basically admits it has a serious perception problem among consumers. Last week it resorted to the unusual public relations tactic of setting up a fact-check portal, which it says it will use to counter the ““smoke and mirrors” marketing tactics” being spread by its competitors.