Men make more money than women even when they’re (legally) insider trading

At a company’s top ranks, the pay gap and paucity of women is all too well known. Now there’s a third area where women lag behind their male executives: insider trading.

At a company’s top ranks, the pay gap and paucity of women is all too well known. Now there’s a third area where women lag behind their male executives: insider trading.

Male executives make substantially more than women when selling their company’s stock legally, according to a recent study (pdf) from researchers at Bryant University and the University of Michigan. It’s more evidence that there’s a boys club at the top.

Past research has found executives tend to earn excessive positive returns when buying and selling their company’s stock, something the researchers confirm using SEC data from 1975 to 2011.

“On average, executives of both genders time their purchases when the stock price is at its lowest, indicating that they are trading on information,” the authors write.

Both sexes profit, but men earn far more and trade more frequently and at higher volumes. This suggests female executives have less access to information or informal networks even if they’re technically the same status as their male counterparts. The phenomenon exists even within job categories, like when everyone’s a senior VP or above (the “top executives” category in the study) or when members of the board are separated out, not just when men hold more senior positions.

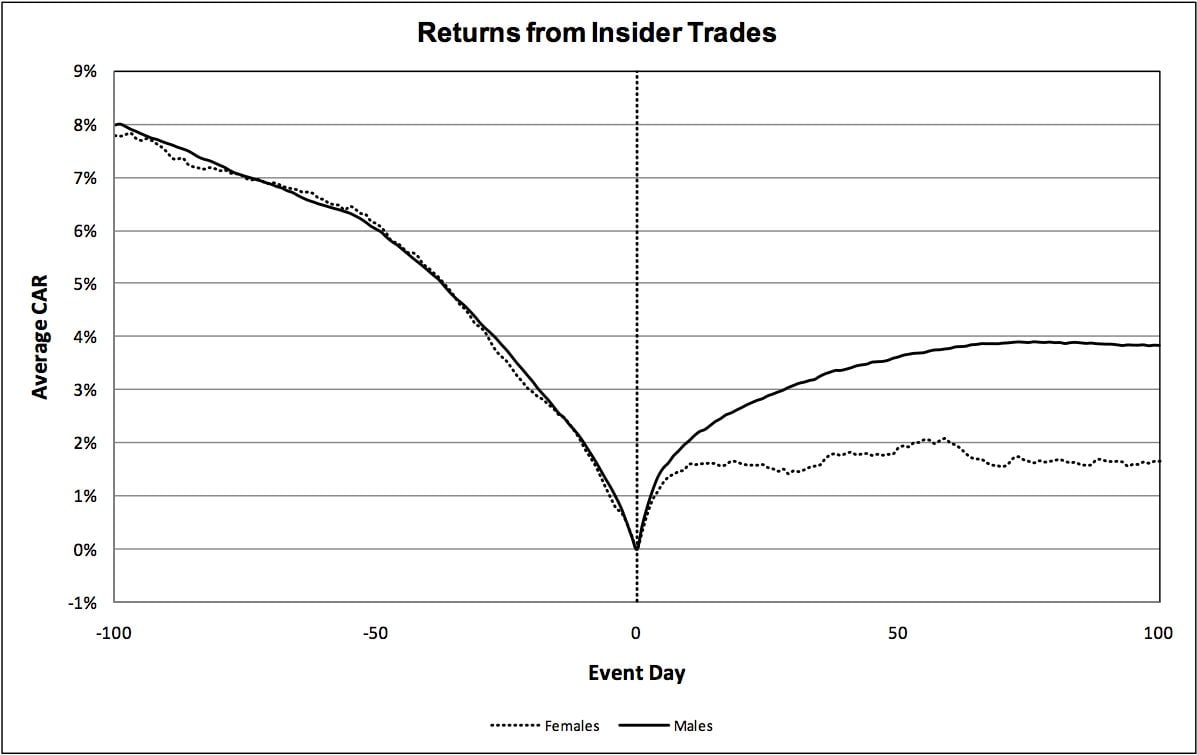

The average return for men is 3.2% compared to 1.6% for women. Here’s the chart showing returns broken out by gender. The “event day” refers to a purchase of stock:

Prior research has found than male executives tend to be less risk averse and more confident than women, which could account for some of the excess return.

In order to rule that out and confirm the information gap, the authors divided executives into categories by trade size and value. Even then, male executives earn greater returns. If the differences were due to attitude, men would be trading larger amounts on worse information, which should reduce their return.

Where the level of female executives is relatively high, proxied by the amount of female trading, gender differences disappear and women have similar returns, likely due to greater information access.

“Our results seem to suggest that male executives and female executives have non-overlapping networks, giving the top males executives an edge in gathering asymmetric information,” the authors write.

That information gap likely doesn’t stop at trading and may help explain why there are so few women at the top. Most information spread informally between friends and colleagues isn’t geared toward making a profit but rather toward giving them some kind of advantage.

And the proportion of trading itself tells a story: women made up only 4.4% of the transactions in the dataset, and 3.8% by dollar value. Less than 6% of the executives in the study were women. It’s tougher to rise through the ranks when the vast majority of the people you’re competing with have far better information in both the market and the work place.