Does high-frequency trading do more harm than good?

The recent publication of Michael Lewis’s book, “Flash Boys,” has reignited debate about high-speed computerized trading. The practice has many defenders in spite of the dangers highlighted in the book. CFA Institute polled readers of its CFA Institute Financial NewsBrief to uncover their views.

The recent publication of Michael Lewis’s book, “Flash Boys,” has reignited debate about high-speed computerized trading. The practice has many defenders in spite of the dangers highlighted in the book. CFA Institute polled readers of its CFA Institute Financial NewsBrief to uncover their views.

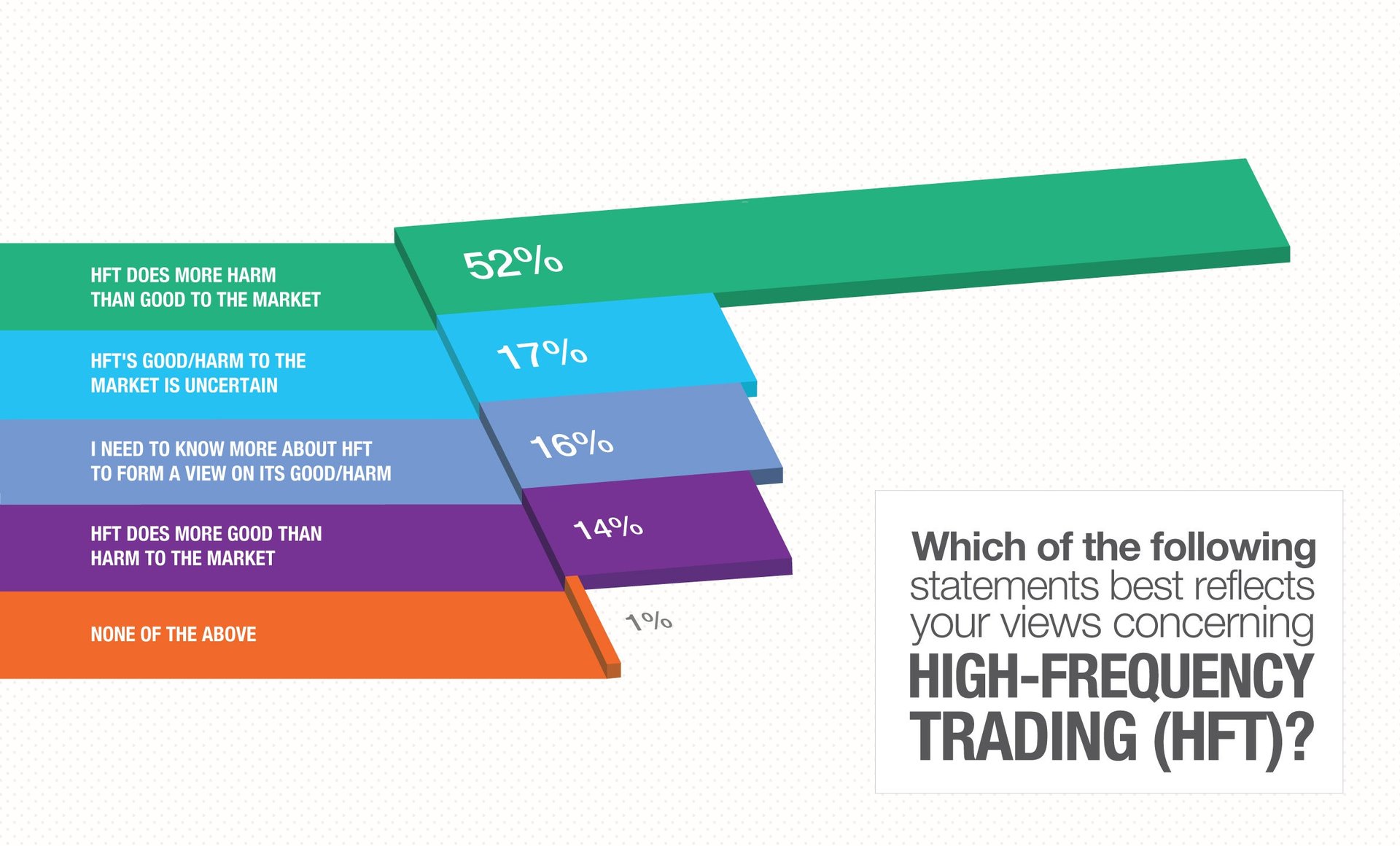

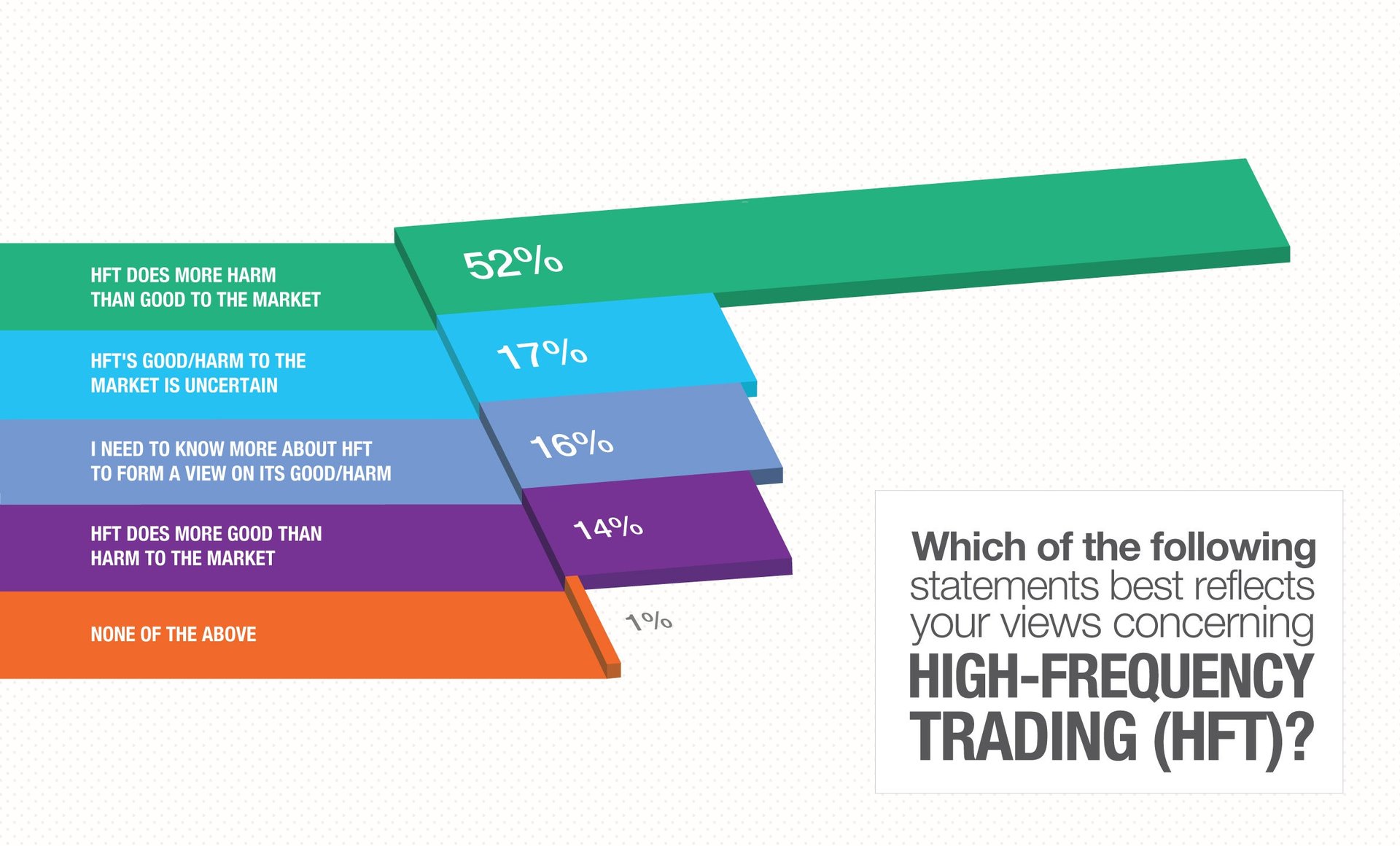

The results of the poll reveal that more than half of the 950 respondents believe that HFT does more harm than good, and 17% believe its impact is uncertain, compared with 14% who believe it does more good than harm.

Proponents of HFT argue that it improves liquidity and price discovery, which facilitates market efficiency and thereby the allocation of capital. Critics argue that HFT’s liquidity is unreliable because of large-scale order cancellation and its contribution to price volatility outweighs any improvements to price discovery. Some critics see HFT as an arms race in technology; others as an exacerbation of the systemic problem of short-termism. Proponents of HFT are likely to see critics’ views as misconceptions. But in the wake of the Great Recession, when such ideas as free market capitalism and the efficient market hypothesis have lost support and trust in financial services has waned, such opinions against HFT should come as no surprise.

If you would like to learn more about HFT, you can find articles and blogs examining the issue on CFA Institute’s website. The poll was featured on the CFA Institute Enterprising Investor blog, a forum which includes practical analysis of a broad range of current issues in finance and investing.

This article is written by CFA Institute and not by the Quartz editorial staff.