Barclays’ secretive trading business has plunged since regulators yanked it out of the shadows

Barclays’ so-called “dark pools” are draining fast. The UK financial institution has seen shrinking trading activity in those secretive trading venues, where buy and sell stock orders are placed outside the scope of traditional, well-established exchanges like the New York Stock Exchange and Nasdaq OMX.

Barclays’ so-called “dark pools” are draining fast. The UK financial institution has seen shrinking trading activity in those secretive trading venues, where buy and sell stock orders are placed outside the scope of traditional, well-established exchanges like the New York Stock Exchange and Nasdaq OMX.

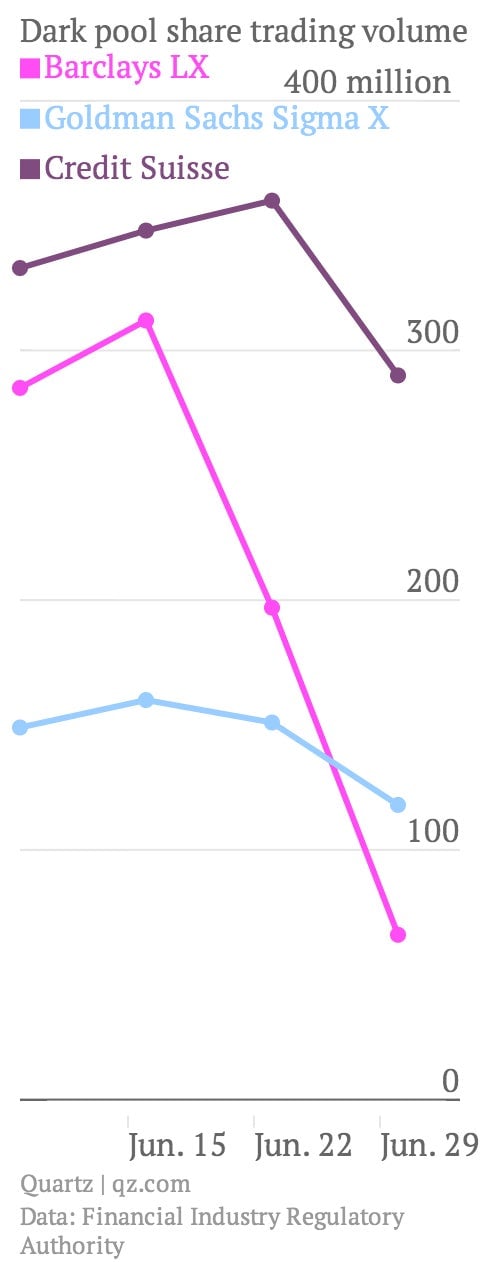

In late June, New York attorney general Eric Schneiderman filed a lawsuit against Barclays alleging that the firm misled clients with its dark pools–used primarily to discreetly match buyers’ and sellers’ securities orders. Since then, trading volume at Barclays’ dark pool is down 66% at 66 million shares during the week of June 30, from 197 million shares in the prior week, according to data from the Financial Industry Regulatory Authority (FINRA). The plunge in trading volume is an even steeper 78% since the beginning of June, FINRA data shows.

FINRA began releasing weekly trading volumes on these so-called dark pool trading platforms, also known as alternative trading systems, at the end of May, in an effort to provide greater transparency in this murky sector.

Underpinning specific concerns about Barclays’ LX dark pool are allegations that it encouraged sophisticated high-frequency traders, which use lightening-fast computers, to prey upon other Barclays trading clients. Indeed, Schneiderman said, contrary to its promise to protect clients from predatory high-frequency traders, Barclays’ dark pool was set up to favor high-frequency traders.

“Barclays demonstrated a disturbing disregard for its investors in a systematic pattern of fraud and deceit,” Schneiderman said of his suit. “Barclays grew its dark pool by telling investors they were diving into safe waters. According to the lawsuit, Barclays’ dark pool was full of predators–there at Barclays’ invitation.”

The allegations have delivered a major blow to the bank’s trading operations and stoked further worries about the secretive dark pools in general. Ranked second in trading volume as recently as the week of June 16, Barclays’ LX dark pool has fallen to 12th among large dark pool operators, according to FINRA data.

Meanwhile, the rival dark pool at Goldman, Sigma X, saw a 22% drop in volume, and Credit Suisse experienced a nearly 20% drop in dark-pool volume at the end of June, compared with the prior week. That said, none of those drops were as precipitous as Barclays’.

The dark pool trading slide also follows growing concerns throughout the financial industry about whether these platforms are beneficial to the market.

According to a Bloomberg survey, about half the industry professionals polled maintain a negative view about the anonymous trading venues.

For Barclays’ part, the bank says it is cooperating with investigators and that it has launched its own internal probe into dark pool trading. But ultimately, the big UK bank may have to shell out millions to settle regulators’ charges.