Amazon is building the retail world’s most unbreachable “moat”—and it’s called Prime

Amazon is a company that has divided investors for years. Its relentlessly fast-growing revenues typically translate into relatively diminutive profits because the company reinvests most of its enormous cash-flow into expanding its infrastructure and maintaining low prices—the idea being that at some point in the future, it can turn the profit screws on and reap enormous financial rewards.

Amazon is a company that has divided investors for years. Its relentlessly fast-growing revenues typically translate into relatively diminutive profits because the company reinvests most of its enormous cash-flow into expanding its infrastructure and maintaining low prices—the idea being that at some point in the future, it can turn the profit screws on and reap enormous financial rewards.

This philosophy has actually served shareholders in the company extremely well—stock in Amazon has been a staggeringly good investment over most timeframes—although some skepticism over the Amazon model is creeping into the minds of investors in 2014, with shares down 10% so far this year.

We’ll get a clearer sense for how Amazon is traveling when it releases earnings on Thursday, but according to the Deutsche Bank analyst Ross Sandler, the future for the e-commerce giant is bright. And its ability to turn on the profit screws might not be that far off, either. That’s mainly because through Prime, Amazon’s premium home delivery service, the company is building an army of tremendously loyal and (more importantly) profitable customers.

“Amazon has built the biggest competitive moat in e-commerce in the Western world,” Sandler declared in a note this week—using ”moat” in the Warren Buffet sense, to describe a business advantage that allows a company to keep its competitors at bay for extended periods.

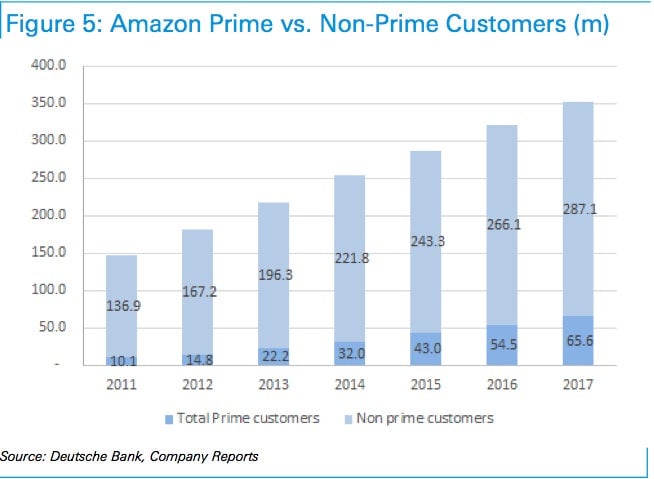

As Quartz’s Dan Frommer pointed out earlier this year, Prime customers spend twice as much as non-Prime customers. Yet they are still a tiny proportion of Amazon’s total customer base, meaning there is plenty of room for growth.

And that’s what Sandler expects to happen. By 2017, Deutsche forecasts that Prime subscribers will account for 19% of Amazon’s customer base, (up from about 13% today) and about half its retail profits (compared to about 31% currently)

The genius, according to Deutsche Bank, is that while the average Prime customer generates $1,000 in profit (through product purchases) over the lifetime of their relationship with the e-commerce giant, new Prime customers cost virtually nothing to acquire: Amazon spends very little on advertising these days, because the value of the Prime program is enough to draw new people in. (The real costs are in free add-ons, such as the Prime Instant Video service, but the costs of running that service, including content, don’t get bigger as Prime adds subscribers.)

Finally, it would be extremely difficult for any competitor to build a viable competing service to Prime—the required investment would be massive, and Prime is just too big to compete with now, and offering too many products. In other words, it’s becoming a moat for Amazon.

By 2020, Sandler reckons Amazon could have 100 million Prime subscribers, one of the biggest membership clubs of any industry, and worth a cumulative $70 billion. In this light, Amazon’s market cap of about $165 billion (which looks ridiculous when compared to last year’s profit of just $274 million) starts to look justifiable.