Credit Suisse strikes a deal to give Fidelity’s moms and pops a taste of the exuberant IPO market

Credit Suisse has a struck a deal to give clients of Fidelity’s retail brokerage arm a taste of the newly-minted IPOs that the investment bank underwrites in the United States. Gaining access to a big roster of potential investors—Fidelity’s brokerage has some 15 million retail accounts—could be a boon for Credit Suisse as it tries to bolster its IPO franchise.

Credit Suisse has a struck a deal to give clients of Fidelity’s retail brokerage arm a taste of the newly-minted IPOs that the investment bank underwrites in the United States. Gaining access to a big roster of potential investors—Fidelity’s brokerage has some 15 million retail accounts—could be a boon for Credit Suisse as it tries to bolster its IPO franchise.

Ordinarily, retail investors don’t get a shot at buying buzzy IPOs unless a company like Facebook specifically dictates that it wants average folk to get involved. What’s more common is that IPO shares are initially parceled out to prized institutional clientele. But companies like Fidelity still represent a lot of untapped investor potential. For Credit Suisse, having a big retail pipeline at the ready can be a significant source of untapped potential investors and a selling point to clients considering selecting the bank to handle IPOs.

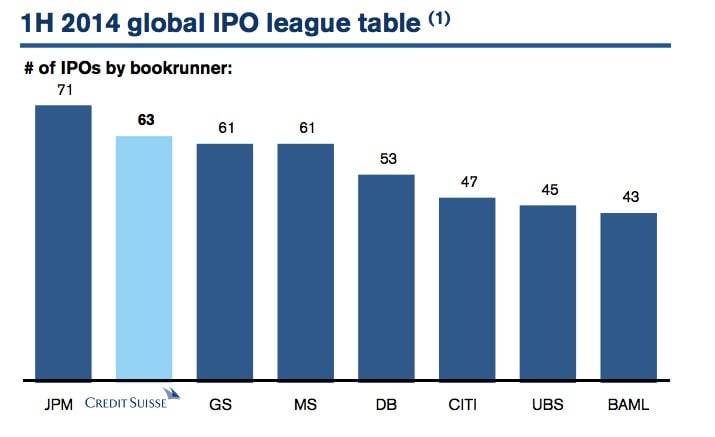

The Credit Suisse/Fidelity deal comes as the overall IPO market is seeing a lot of exuberance. “The IPO market has been very strong as of late and we think that of some 2,500 clients we surveyed, greater than 50% are looking to participate in IPOs,” Brian Conroy, president of Fidelity Capital Markets, explained to Quartz. Here’s part of a presentation that Credit Suisse has been using to highlight its IPO prowess to clients:

Highlights of Credit Suisse’s IPO activity of late include scoring a lead role (along with Morgan Stanley, Goldman Sachs, JPMorgan Chase, and others) on the $20-billion-plus blockbuster listing of Chinese e-commerce company Alibaba that’s set to kick off sometime in September. The Swiss bank also has served as lead on splashy tech deals like China’s version of Twitter, Weibo.

Fidelity’s Credit Suisse partnership runs for three years. Fidelity had maintained a similar underwriting arrangement with Deutsche Bank struck back in 2009 but it expired this year, Conroy notes. Fidelity also has an stock arrangement with private equity firm KKR but that deal is specific to privately-held companies KKR wants to take public.

To be sure, not all Fidelity’s retail brokerage clients can get access. In order to be eligible, Fidelity clients need to have at least $500,000 worth of assets and have completed at least 36 trades during a rolling 12-month period.