Credit Suisse put a brave face on a largely lousy set of results

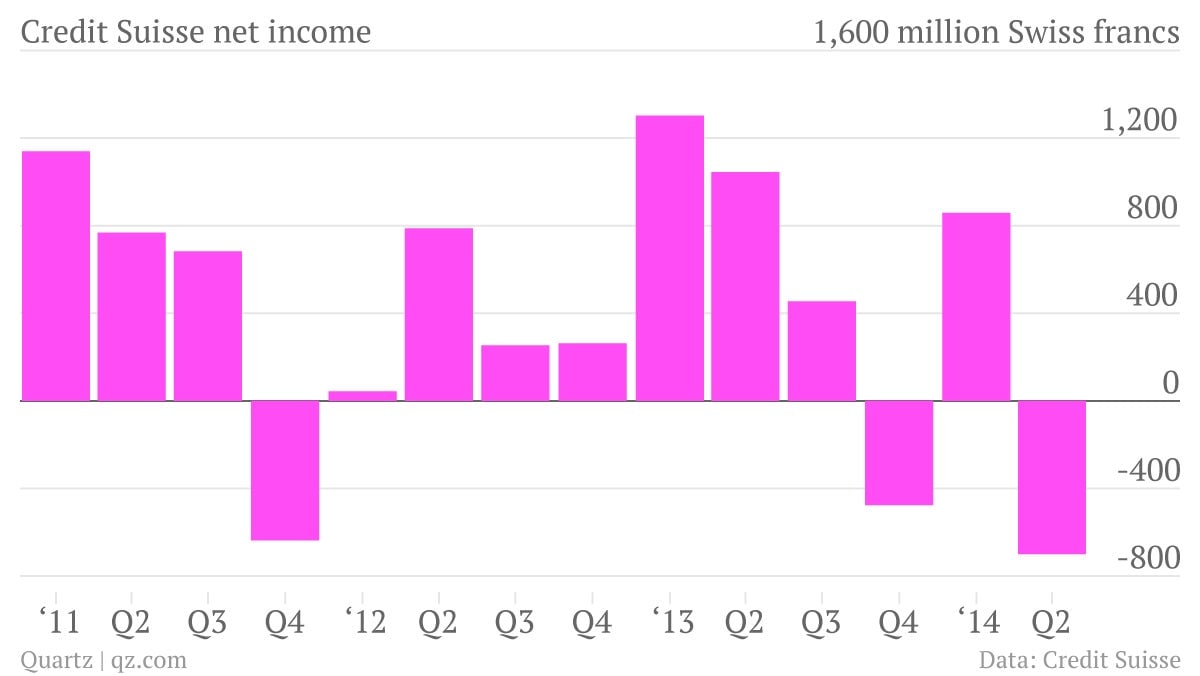

The numbers: Ugly, as expected. Credit Suisse reported a second-quarter loss of 700 million Swiss francs ($779 million), its worst quarterly result since the depths of the financial crisis. The main culprit was a $2.6 billion penalty, agreed with US authorities in May, for helping American clients evade taxes.

The numbers: Ugly, as expected. Credit Suisse reported a second-quarter loss of 700 million Swiss francs ($779 million), its worst quarterly result since the depths of the financial crisis. The main culprit was a $2.6 billion penalty, agreed with US authorities in May, for helping American clients evade taxes.

The takeaway: As usual with Credit Suisse, it can be difficult to discern underlying trends in the business due to accounts that are broken into “core,” “strategic,” and “non-strategic” results. “Our strategic results were solid,” CEO Brady Dougan said, drawing attention away from the carnage elsewhere in its financial statements. That said, there were positive signs in its investment-banking unit, where fixed-income trading revenue grew by 4%, bucking the downtrend seen at most other big banks.

What’s interesting: Worryingly for investors, the bank’s wealth management unit reported a pretty lousy set of results. Although it attracted more than 7 billion Swiss francs in new assets in the quarter, primarily from clients in Asia, the unit’s revenue and profit both fell. The unit’s profit margin also unexpectedly dipped, which doesn’t bode well for the business that Credit Suisse considers its main growth engine in the future.