The world’s third-largest smartphone maker is weirdly cagey about its progress outside of China

Huawei has leveraged its position as the world’s biggest telecom equipment maker to quickly grab market share in the brutally competitive smartphone industry. It currently ranks third—albeit a distant third—behind Samsung and Apple, and at the head of the pack of up-and-coming Chinese smartphone makers, including Xiaomi, Lenovo, and XTE.

Huawei has leveraged its position as the world’s biggest telecom equipment maker to quickly grab market share in the brutally competitive smartphone industry. It currently ranks third—albeit a distant third—behind Samsung and Apple, and at the head of the pack of up-and-coming Chinese smartphone makers, including Xiaomi, Lenovo, and XTE.

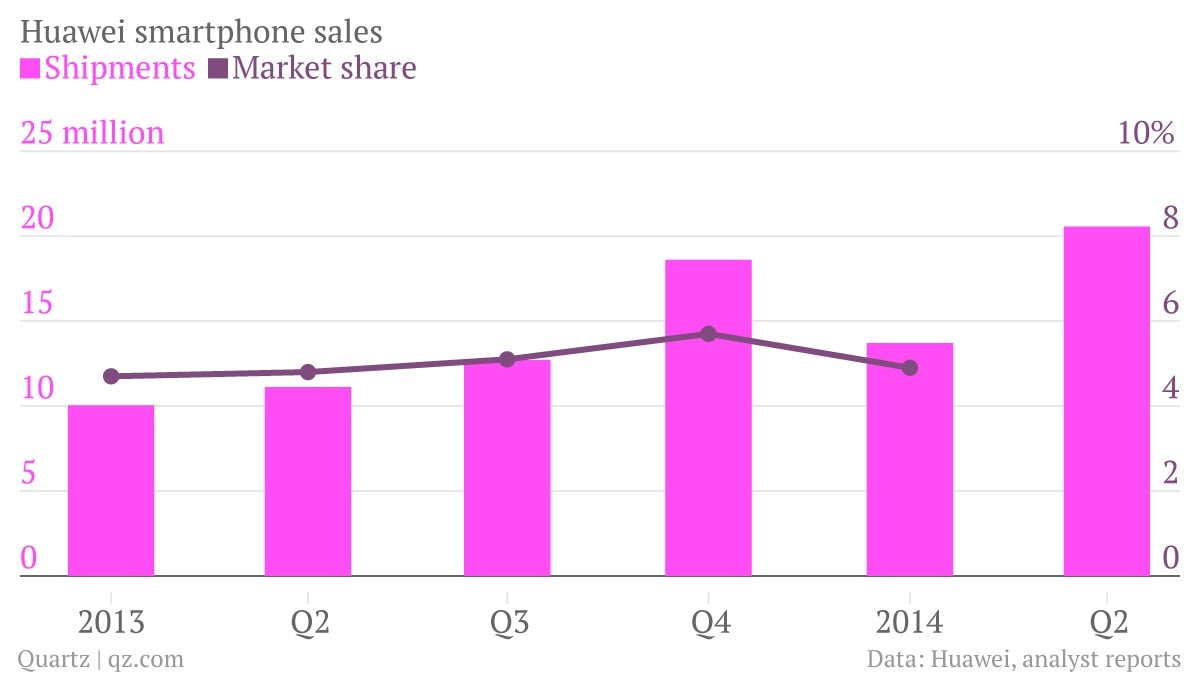

The privately-held company released a new batch of data today, and Huawei’s winning streak has continued: The company sold 34 million smartphones in the first half of 2014, up 62% from the same period last year, with growth accelerating in the second quarter.

But how is the company doing outside of its core smartphone market in China? The picture is not as clear.

“Huawei’s performance over the past six months was fueled largely by the tremendous growth in overseas markets where Huawei intensified global marketing initiatives,” the company said in a press release. It touted growth of “550% in the Middle East and Africa, 275% in Latin America, 180% in Asia-Pacific and 120% in Europe.”

But what does that actually mean? Without absolute sales numbers outside of China, it’s hard to tell where the company is actually making a dent. In an interview with Reuters, a company spokesman “declined to reveal how many smartphones it had shipped in China in the first half,” which would have made it possible to calculate its non-China sales. Huawei also said it “held majority smartphone market share in selected markets in Asia and Latin America.” Which markets? It declined to say.

There is some independent analysis of Huawei’s progress abroad. According to research firm Kantar Worldpanel ComTech, Huawei has a 3% smartphone market share in Europe, including 5% in both the German and Spanish markets. And its market share is effectively zero in the United States, the world’s second-largest smartphone market after China, due to opposition from government officials who claim that Huawei’s equipment represents a national security risk.