If the tiniest US banks have such bad prospects, why are their stocks doing so well this year?

While global institutions like HSBC have found much to complain about regarding financial reform, US community banks were the ones expected to suffer most—with many in the industry arguing that scale matters and that $1 billion would become the minimum asset threshold for survival.

While global institutions like HSBC have found much to complain about regarding financial reform, US community banks were the ones expected to suffer most—with many in the industry arguing that scale matters and that $1 billion would become the minimum asset threshold for survival.

Did someone forget to tell investors?

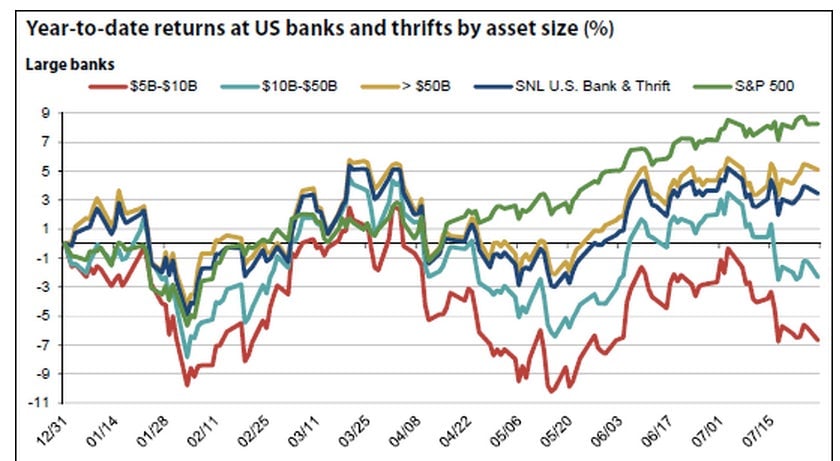

Based on returns for US bank stocks through July, it has been better to be a small bank than a large bank, and even better to be a tiny bank than a small one. The data contrasts sharply with the predicted effects of the new regulatory order.

According to a report from SNL Financial, institutions with less than $500 million in assets have done even better this year than banks in the $500 million to $1 billion bracket, not to mention those with $1 billion to $5 billion in assets. Lately, the smallest of the small banks have been the only group to come close to tracking with the S&P 500.

Meanwhile, none of the different size categories for banks with assets of $5 billion or more has kept pace with the S&P 500 since the end of April.

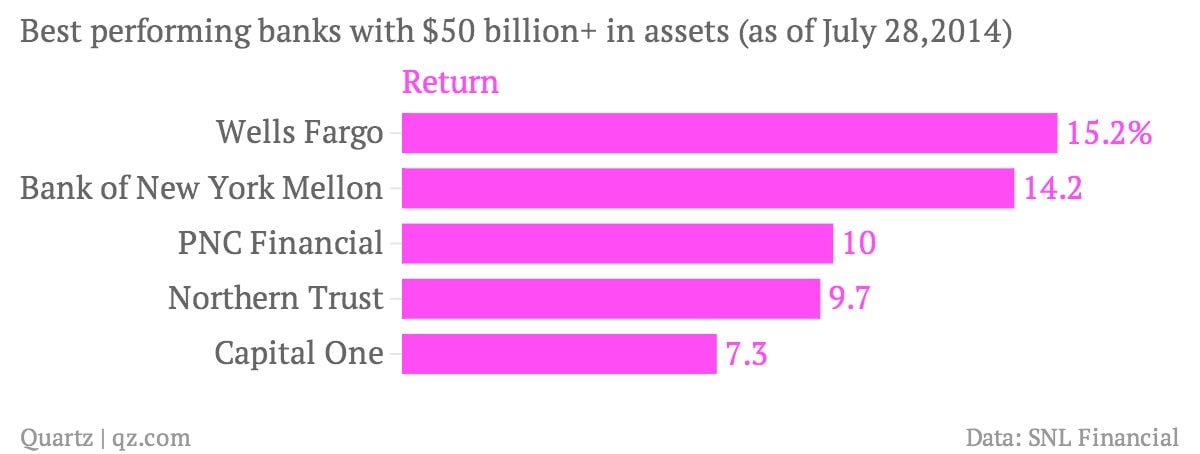

Some large banks, like Wells Fargo, are producing returns higher than SNL’s average. Here’s a look at the returns for the top performers with assets greater than $50 billion:

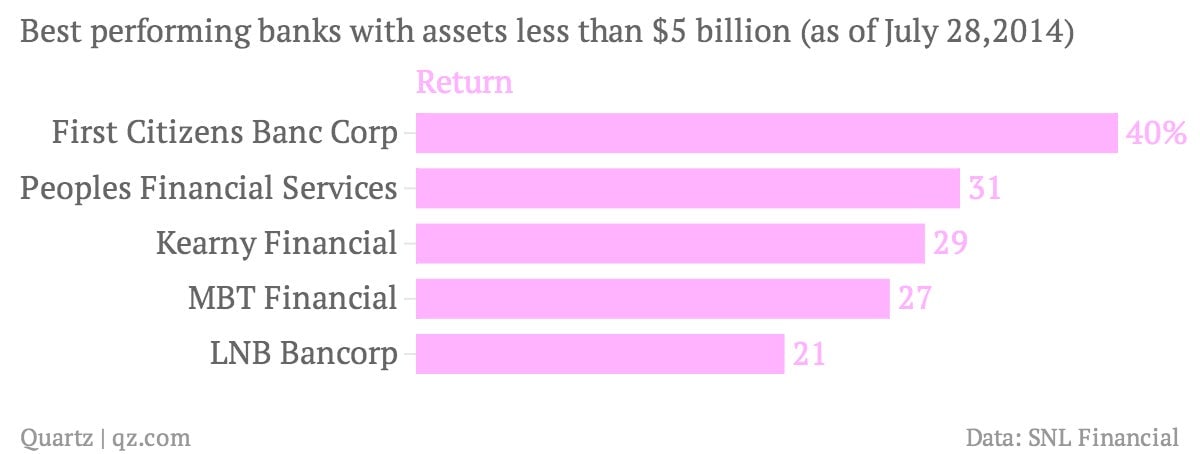

But even these companies would be envious of the returns of smaller banks, which have avoided the degree of regulatory scrutiny, not to mention the legal risks and reputation damage, bedeviling the big banks. Here’s a look at the companies with the highest returns among banks with assets of less than $5 billion:

The FDIC’s most recent quarterly profile on banks offers a handful of clues as to why community banks surprisingly have been so resilient. (The agency has a long, technical definition of what constitutes a community bank, but broadly speaking it includes banks with a business model primarily built on local lending and local decision making on loans.) These banks have done a good job keeping costs in check, relative to total assets. They also are enjoying healthier net interest margins, which measure the difference between the interest earned on assets (like loans) and the interest paid to depositors, divided by assets. Community banks had an average net interest margin of 3.57% in the first quarter, compared with a 3.17% industry average—a significant difference to a banker.

“Small community banks have really been keeping a good handle on expenses,” says Chris Cole, an executive vice president with the Independent Community Bankers of America. “I think that the solid performance of small community banks also debunks the notion that those with more than $1 billion in assets can’t survive now.”

Mergers between smaller banks that are nonetheless seeking scale may be helping on the expense front (and perhaps in the market, where speculators have been known to place bets on suspected takeover targets).

It’s still far-fetched to think that the small shall inherit the banking world—while community banks account for 93% of all FDIC-insured institutions, their assets represent only 14% of the industry total. But smaller banks (and their shareholders) should enjoy the winning streak while bigger banks deal with their own distractions.