Wall Street’s favorite burger joint is headed for an IPO

Danny Meyer’s hip New York-based burger joint Shake Shack is about to launch an IPO, Reuters reported. The restaurant chain, which started out as a food cart in Manhattan’s Madison Square Park in 2000, has rapidly transformed into a cult franchise with locations peppered across the globe. It’s that following that the chain–part of Union Square Hospitality Group–is hoping to cash in on.

Danny Meyer’s hip New York-based burger joint Shake Shack is about to launch an IPO, Reuters reported. The restaurant chain, which started out as a food cart in Manhattan’s Madison Square Park in 2000, has rapidly transformed into a cult franchise with locations peppered across the globe. It’s that following that the chain–part of Union Square Hospitality Group–is hoping to cash in on.

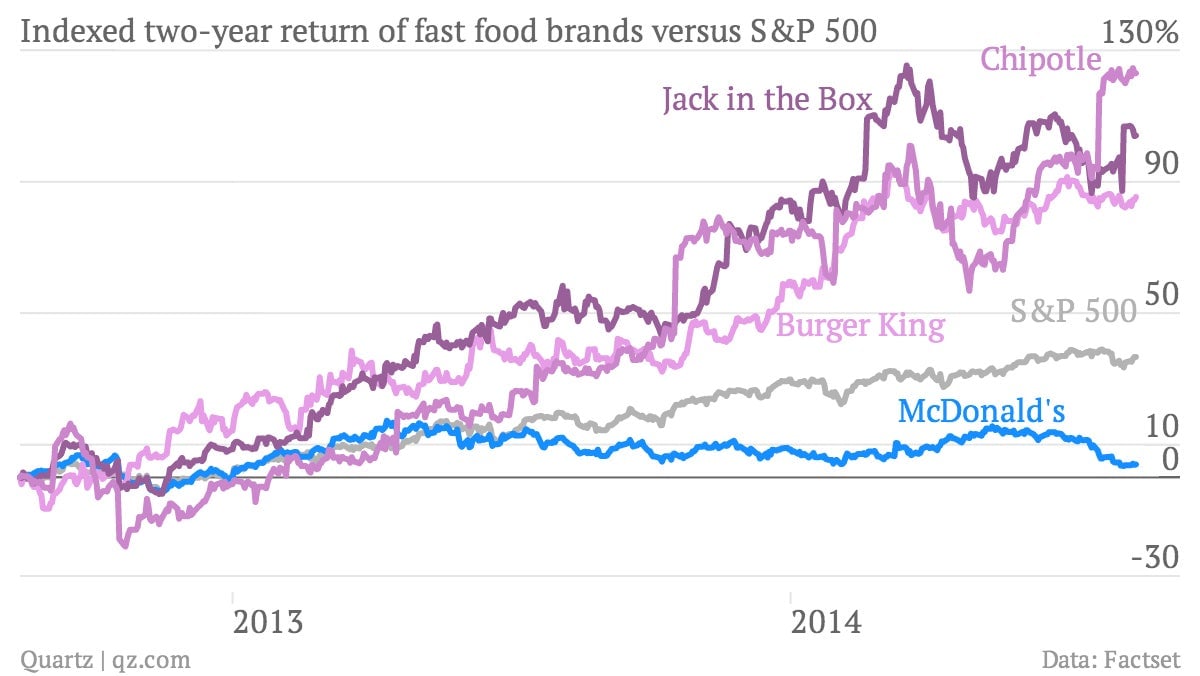

Looking at the stock performance of other popular restaurant chains like Chipotle, Jack in the Box, and Burger King, it’s no wonder why Shake Shack’s owners would try their hand at selling shares in an initial public offering. While McDonald’s has been seeing some of its rivals eat its lunch over the past few years, these other fast-food casual dining venues are doing well, as the chart below illustrates:

In some ways, Shake Shack has always been a Wall Street darling. The restaurant’s first location sat right outside Credit Suisse’s New York headquarters office at 11 Madison Square Park. There are even a few stories of Credit Suisse employees striking deals with Shake Shake staffers to circumvent the oftentimes lengthy queue for grub at the restaurant. Shake Shack opened another location near Goldman Sachs’ lower Manhattan headquarters at 200 West St.

Reuters reports that bankers are being auditioned to handle the IPO. Both Credit Suisse and Goldman may argue they deserve a key role in the offering by virtue of their employees’ loyalty to the chain. This time, however, it’s lucrative fees that are on the menu.