If you don’t have political-risk insurance yet in Iraq, you may be out of luck

Since the advance of ISIL into northern Iraq two months ago, foreign businesses have scrambled to obtain fresh or added insurance against political risk and violence. But if they had none prior to the current trouble, they are finding it difficult to obtain insurance now, according to a leading insurance provider.

Since the advance of ISIL into northern Iraq two months ago, foreign businesses have scrambled to obtain fresh or added insurance against political risk and violence. But if they had none prior to the current trouble, they are finding it difficult to obtain insurance now, according to a leading insurance provider.

ISIL, the brutal terrorist army in Iraq and Syria, shook up the region with its lightning June 10 conquest of the northern Iraqi city of Mosul. Companies operating in northern Iraq and Baghdad have withdrawn most expat staffers from the country, or shifted them elsewhere within Iraq. By one estimate, the exodus includes 80% of the expat population of Erbil, capital of Iraqi Kurdistan.

In addition, companies have reassessed the exposure of their businesses and assets like buildings and equipment. “When you hear this kind of headline news, the first thing [companies] ask for is political-risk or political-violence insurance,” says Smita Malik of Clements Worldwide, a Washington-based political-risk firm that finds insurance for companies.

But insurance underwriters will take on only a small amount of such coverage because of regulations controlling the level of exposure a firm can assume. “You have clients come with a panic approach to insurance. For them, it may be too late because insurance capacities may be limited. We try to prepare clients and advise them not to wait until the last minute,” Malik tells Quartz.

Clements says its political-risk and kidnapping insurance business is up 20% in Iraq over 2013. Since the advance of ISIL, underwriters have increased premiums by about 10% for existing clients and by 50% for new policies, the firm says.

The situation changes fast. When Quartz spoke to Malik in mid-July, she said that “we haven’t had any difficulty getting insurance” for the oil-rich city of Kirkuk. By last Friday, it became clear in a chat with Clements president Chris Beck that insurance availability for Kirkuk had all-but dried up. “For Kirkuk and Erbil, if you have a multi-million-dollar facility, that is a difficult challenge,” Beck said. The reasons include the ISIL threat to the region and the late date in the year, since underwriters are close to reaching—or have already reached—their limit for high-risk coverage.

When underwriters are willing to provide insurance, they demand a reply to a premium quote almost instantly—a potential client must respond within 24 hours or three days maximum. After that, the underwriter withdraws the quote.

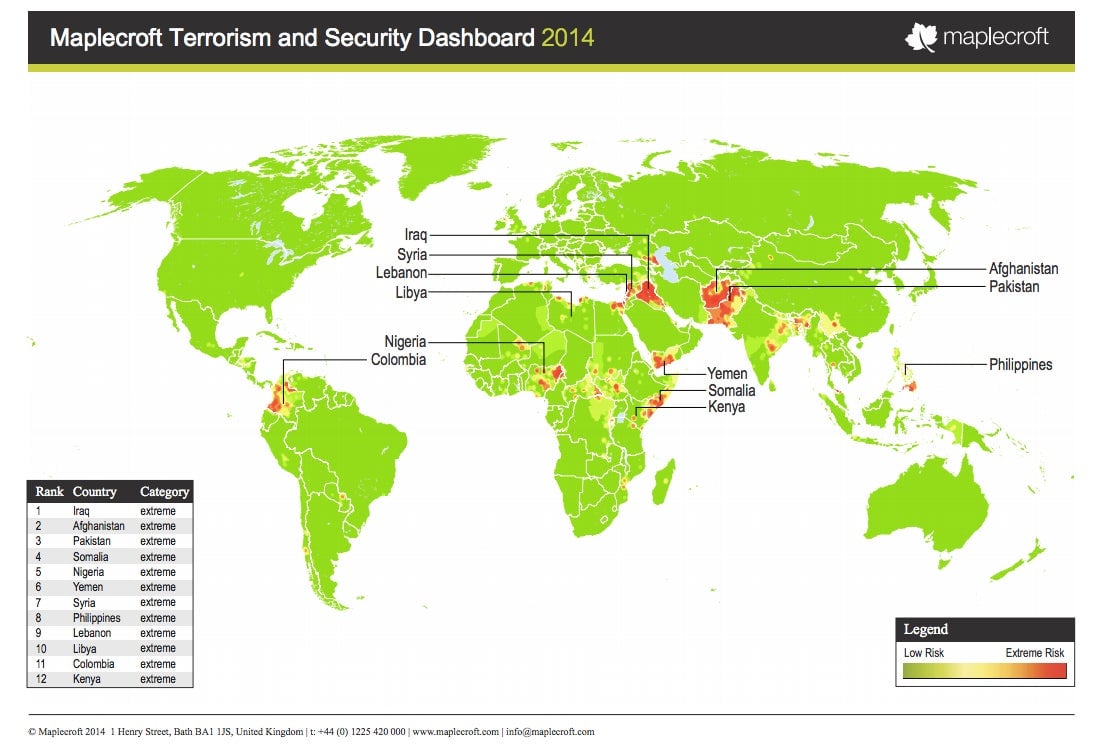

Take a look at this map, which was created by Maplecroft, the political risk firm. The areas of extreme risk are those with the most difficulty to obtain political risk insurance.