How old-fashioned, broadcast radio is avoiding internet disruption

It’s often said that all politics is local. The same might be said of the radio business.

It’s often said that all politics is local. The same might be said of the radio business.

Broadcast radio hasn’t captivated the imagination the way streaming music has, but the medium has proven surprisingly resilient in terms of its ability to retain and attract listeners.

More than 90% of Americans surveyed by Pew Research last year said they listened to radio at least once a week, which probably is a byproduct of America’s love affair with the automobile. (About 44% of all radio listening takes place in the car, where 80% of people are tuned into broadcast radio—it’s still far more popular than internet or satellite radio).

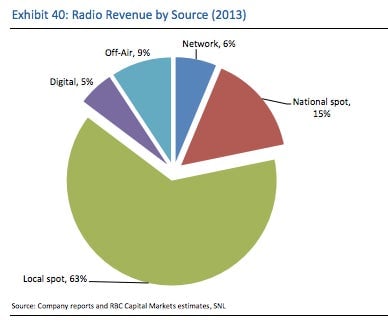

And as the chart below from RBC Capital Markets shows, the overwhelming bulk of radio industry revenue in the US comes from local advertising: businesses (often small ones) buying ads on local radio stations rather nationally.

The are more than 15,000 radio stations in the US, according to the FCC, making it one of the most effective (and few remaining) ways for businesses to target customers in specific locations. Lewis Dickey, the CEO of Cumulus Media, America’s second-largest owner and operator of broadcast radio stations, told Quartz in a recent interview: “Video has really gone national, online is national, print is gone. This [broadcast radio] is really the last great local medium for connectivity. We believe in the power of broadcast radio.”

There are signs, of course, that in certain markets, and in certain demographics, listeners are shifting to internet radio. (Cumulus’ hedge against this threat has been to invest in Rdio, the streaming service run by the founders of Skype.) Pandora, the biggest internet radio service, with about 75 million active users, already is alert to the local opportunity and has been engaged in a massive local advertising push.

Pandora doesn’t have on-air personalities and local content that can endear broadcast radio to audiences, but its proprietary technology, which arguably can be even more targeted than a spot on a local radio station, seems to be appealing to advertisers. Last quarter, Pandora’s local advertising revenue grew 230% from a year earlier, and within two years has grown from zero to account for 20% of the company’s total ad revenue, according to analysis by Cowen & Co.