In the global economy of 2060, China and India will be the biggest, but still not the richest

If you’re reading Quartz, you probably already know that China and India are set to overtake the US and other developed economies, driven by the inevitability of huge populations and the amount of catch-up growth they can harness as their economies industrialize.

If you’re reading Quartz, you probably already know that China and India are set to overtake the US and other developed economies, driven by the inevitability of huge populations and the amount of catch-up growth they can harness as their economies industrialize.

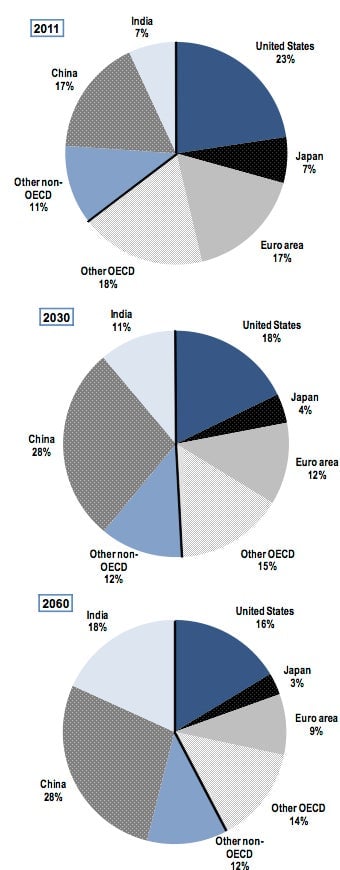

A new report from the OECD, the club of developed-world nations, on the coming decades offers a picture of what that’s going to look like; these pie charts (from page 23 of the report) show the relative distribution of wealth in the world between now and 2060. The world as a whole is forecast to grow at about 3% each year with advanced economies simmering along around 2% each year and emerging markets growing at a rolling boil of 7% that will gradually decelerate.

Two intriguing points here. First is that China’s GDP as a share of the world’s stabilizes by 2030. In the subsequent three decades it’s India that takes on an expanding slice of the pie; by 2060, India’s GDP overtakes that of the United States.

Second, while this growth is sure to affect the geopolitical balance in 2060—China and India’s economies together will be larger than those of all 34 states in the OECD combined—the difference in standards of living shrinks less than you might imagine. Though emerging markets will quadruple their per capita income, and China and India might septuple it, the ranking of countries by that measure isn’t expected to change, with countries like the US (potential 2060 per capita GDP of $136,611) still at the top of the table.

Still, the potential improvement of living conditions in today’s poor countries would represent a huge step in the fight against poverty, and progress toward a more equal world. Which sounds amazing, and is why the OECD uses this report and its somewhat outlandish fifty-year forecast to harass policymakers about doing their jobs. This rosy future entails good behavior on the part of all involved, with countries carefully tending their fiscal gardens and investing in education to take advantage of productivity gains. If countries fail to prepare for the future, especially by letting debt get out of control, all this good growth could just be a line on a chart.