iPhones are getting bigger but their profit margins are shrinking

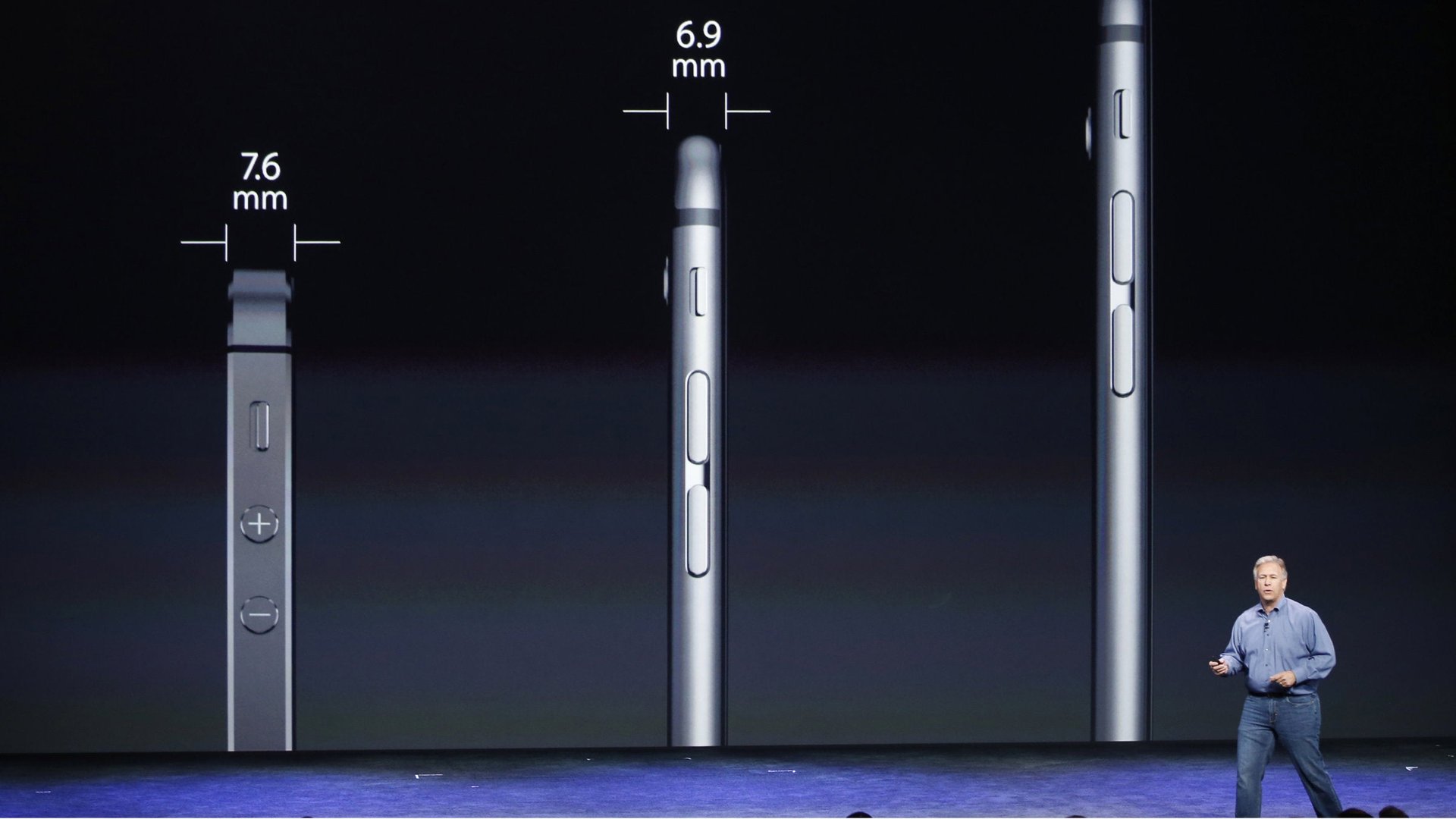

The new phone is bigger. Heck, it’s “bigger than bigger,” boast the marketing folks at Cupertino. They are talking about the size of the device, but they may as well have been talking about the bill Apple must pay to produce the thing. By keeping the off-contract retail price for the base model at $649, but giving customers more iPhone for their money, Apple will make less per unit than on any phone it has produced in the past.

The new phone is bigger. Heck, it’s “bigger than bigger,” boast the marketing folks at Cupertino. They are talking about the size of the device, but they may as well have been talking about the bill Apple must pay to produce the thing. By keeping the off-contract retail price for the base model at $649, but giving customers more iPhone for their money, Apple will make less per unit than on any phone it has produced in the past.

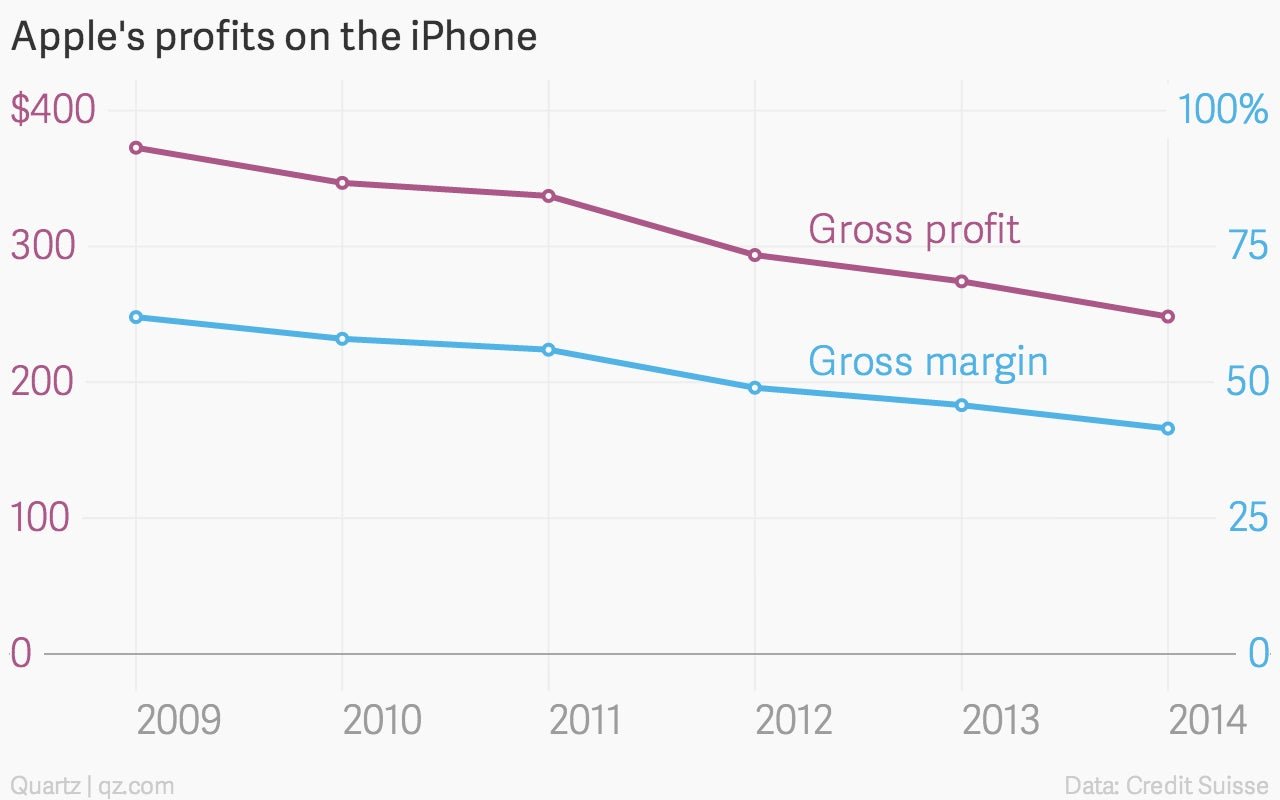

Here’s how the numbers break down, as estimated by analysts at Credit Suisse: The iPhone 6 costs Apple $350.60 to produce, all in. Apple typically receives $599 on the retail price of $649, leaving it with $248.40 in gross profit. That’s 41.5%. Still very healthy, but not at the levels of previous models.

In contrast, the iPhone 5s left Apple with $274.30, giving it a 45.8% margin. The two-year-old iPhone 5 gave Apple $293.70 per unit, or 49%.

The biggest jump in costs comes from the larger display, but the camera, bluetooth, Wi-Fi, and GPS chips also contribute significantly. The biggest iPhone, the “6 plus,” is still more expensive, but the higher price tag makes up the difference, leaving Apple with its highest gross profit per unit since the iPhone 4s, but the same margin as the iPhone 5s.

Don’t shed a tear just yet. Credit Suisse forecasts the highest iPhone sales in four years in 2015, as well as a boost to the average selling price of the devices, giving Apple a 14% year-over-year growth in iPhone revenue.