Will it take 30 years or 300 years for poor countries to catch up to rich ones?

If there’s one trend you can count on without fail, it’s that emerging markets out-grow wealthy ones—they’ve got more people, lower labor costs and, thanks to global knowledge and capital flows, access to the expertise and investment needed to drive up productivity to incredible levels. The results have included China’s growth miracle (and a commensurate plunge in extreme poverty), and the BRICS investment craze—as well as plenty of nervous collar-pulling in the wealthy West’s capitals.

If there’s one trend you can count on without fail, it’s that emerging markets out-grow wealthy ones—they’ve got more people, lower labor costs and, thanks to global knowledge and capital flows, access to the expertise and investment needed to drive up productivity to incredible levels. The results have included China’s growth miracle (and a commensurate plunge in extreme poverty), and the BRICS investment craze—as well as plenty of nervous collar-pulling in the wealthy West’s capitals.

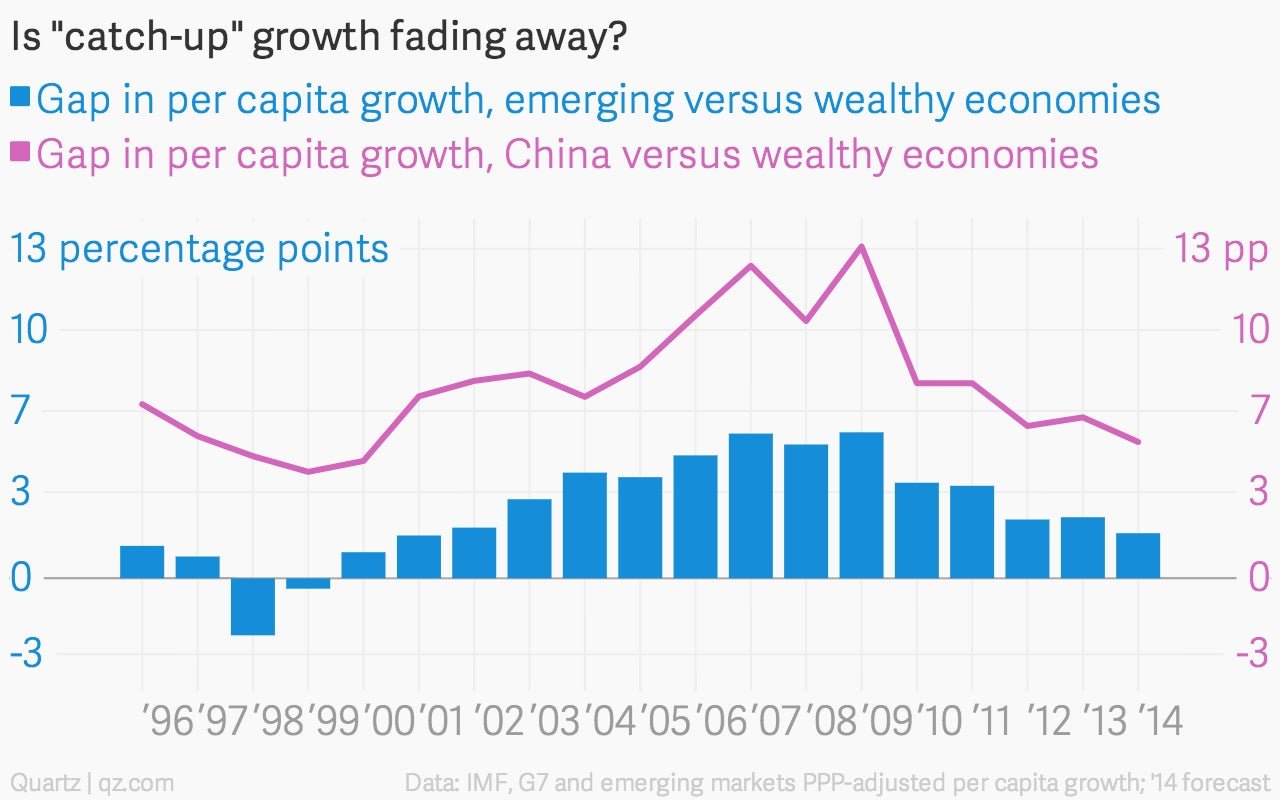

But is the most important economic trend of the past decade coming to an end? The chart above shows that the catch-up growth gap between wealthy countries and emerging markets has been shrinking in recent years. The trend is explored this week by the Economist’s Ryan Avent, who used the latest calculations of each country’s relative buying power from the World Bank to directly compare emerging market economic growth to that in wealthy economies.

When those calculations were released last spring, they were widely touted for finding that China’s overall economy will surpass the US as the world’s largest sooner than expected. But Avent recognizes that the more important social indicator is national income per person—and China and the rest of the emerging markets still have far to go to catch up to the world’s wealthy countries on that score: The average G7 economy’s per capita income is $45,246, while the average emerging market’s is $7,676. (In China, it’s $11,525.)

The “glorious 15” years of catch-up growth Avent identifies come largely from two trends: Manufacturing-driven trade and a commodities boom. And China has been at the center of both. In fact, the commodities boom largely rested on China’s capacity to consume raw materials for its manufacturing explosion. But as the limits of manufacturing as a permanent strategy are becoming clear and China’s growth is slowing, that commodities boom has slowed as well. Now, many of the emerging markets are hitting the “hard part” of the development cycle, where political reform is needed and higher-skilled workers, expensive infrastructure, and a services sector must be developed. China, assuming it can avoid calamity, is positioned to maintain its growth advantage, but its fellow emerging markets are facing stronger headwinds.

Where this matters most is global inequality: It’s fashionable to note that, despite the crunch on the middle classes of the wealthy world, overall global inequality has fallen dramatically thanks to the rise of the bottom billion up the income scale. But the fall-off in catch-up growth spells trouble for those hoping that trend will continue: Avent calculates that if the catch-up growth gap stays at 4.5 percentage points (which it did from 2006 to 2009) it would take the emerging markets just 30 years to catch up to US levels of income. At 2013 levels, it will take 50 years—which is still an astonishingly fast pathway to prosperity.

But if you take China out of the equation, it will take 115 years for the rest of the emerging markets to catch up to the US. And it’s the forecasts that are the scariest: At the 2014 levels expected by the IMF, emerging markets other than China will take 300 years to catch up to US income levels. Which, for all intents and purposes, is never.