Here’s what Stanford MBAs think about the tech bubble

Rumblings of the next tech bubble have been omnipresent throughout Silicon Valley and the media.

Rumblings of the next tech bubble have been omnipresent throughout Silicon Valley and the media.

So we surveyed approximately 30 MBA students at one of the Valley’s epicenters, Stanford Graduate School of Business, as well as nearly 30 alumni from classes of 1995 to 1999, to compare sentiments and expectations across different tenures.

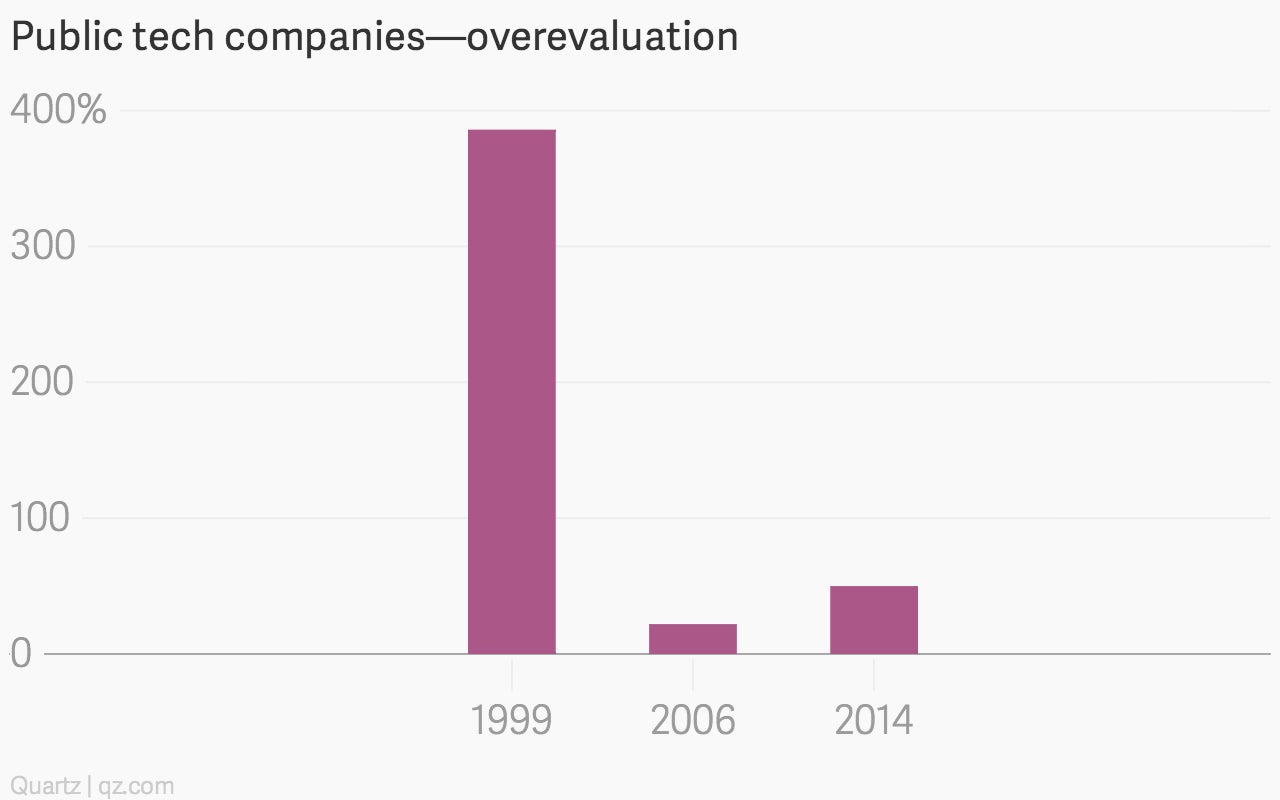

The alumni, all currently working in the technology industry, on average felt that public tech companies are 50% overvalued today versus 22% and 386% in 2006 and 1999, respectively.

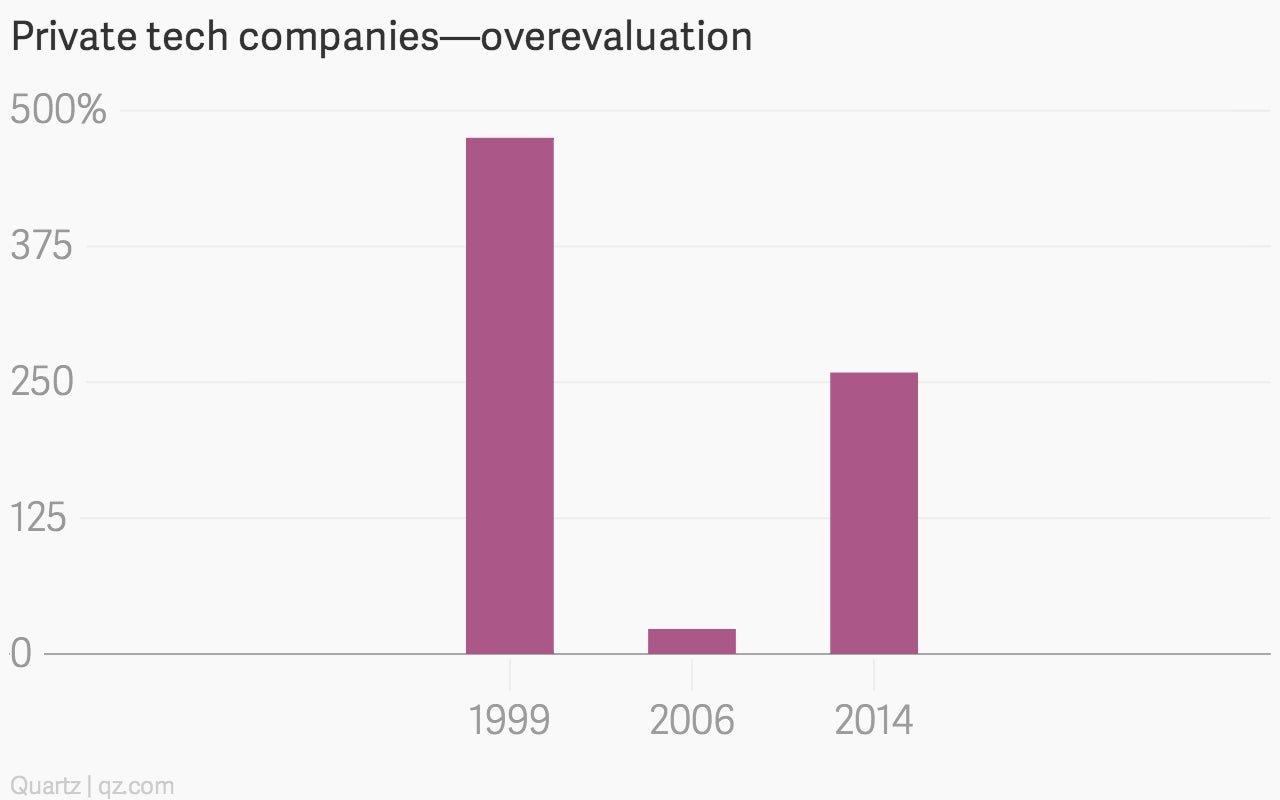

Responses from our Stanford alumni suggest they think privately held companies are more overvalued than public companies, by an average of 259% (or about 3.5 times their fair value).

Obviously a wide range of factors and complexity could underlie this difference. On one hand we see that many high-quality, market-leading businesses are being financed at valuations in the three or four times forward revenue range, which is not far from historical averages. On the other hand, we see late-stage investors taking outsized capital risks by investing at seemingly excessive valuations. Recent funding rounds by Uber at $18 billion, Airbnb at $10 billion and Square at $5 billion come to mind.

Our survey of GSB alumni identified large valuations of zero-revenue businesses as the most concerning observation in the tech sector today. Perhaps these concerns stem from scars caused by the dotcom bust that these alumni lived through shortly after graduating; when companies went bankrupt in flocks as funding dried up and negligible revenues had no chance of supporting hefty operating costs.

The tech sector has had a remarkable run in the last 14 years. Nearly every business leader and investor we interviewed anticipates some kind of correction in the next 2 to 3 years, if for no reason other than commodity and stock valuations have always been cyclical. However, the exact timing of when this correction will occur is up for debate.

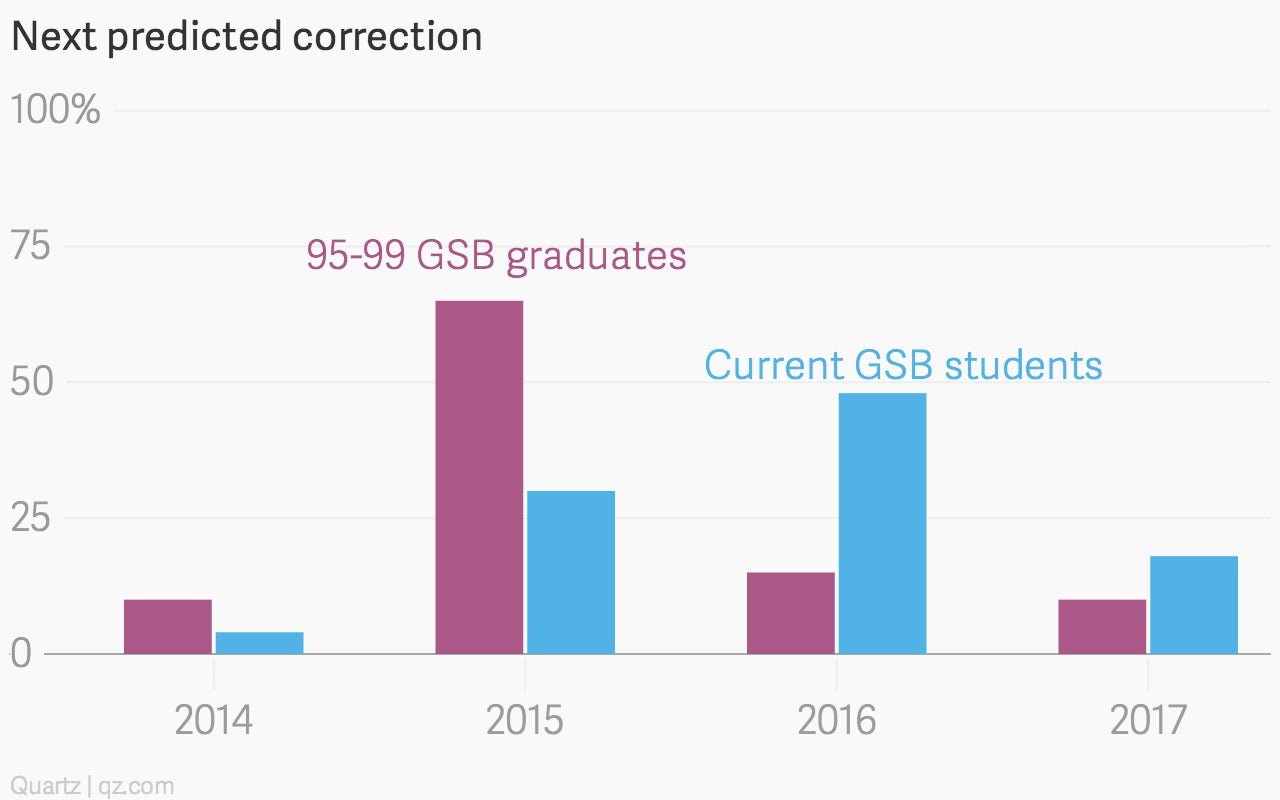

Perhaps unsurprisingly, graduates of the GSB classes of 1995 to 1999 foresee a spring 2015 correction while current GSB students anticipate a fall 2016 correction on average (a full 18 months later). Those who lived and worked through the “dotcom” bubble appear to be more skeptical of how long the momentum can last.