Jobless, homeless, suicidal: Spain’s government can only blame itself for this crisis

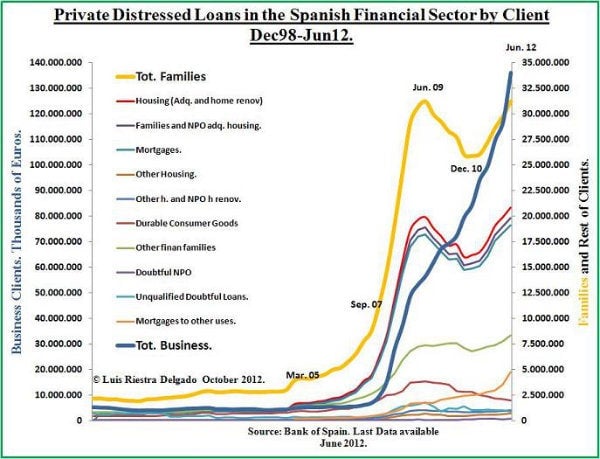

The recent spate of suicides in Spain after police tried to enforce judicial orders of evictions has changed Spain’s entire perspective on the euro crisis. Caused by the burst of the real estate bubble and the ruin, literally, of a large part of the Spanish population, more than 1 million families have all members of the family unemployed.

The recent spate of suicides in Spain after police tried to enforce judicial orders of evictions has changed Spain’s entire perspective on the euro crisis. Caused by the burst of the real estate bubble and the ruin, literally, of a large part of the Spanish population, more than 1 million families have all members of the family unemployed.

The mortgage law is a conundrum

Since 2008, courts have had close to 180,000 cases for dishonored mortgages and a large number of them are close to judicial resolution meaning that a tsunami of evictions will come to a term soon with the clear alarm of all sectors involved.

The banking sector decided a temporary moratorium on evictions for special causes under dramatic circumstances. The government, in conjunction with the Spanish Socialist Workers Party, is working on changing the law, favorable to lenders, to attend special cases. But it raises all kind of questions in matters related to rule of law and security on other mercantile contracts and also brings to the table the matter of transparency and possible “mafias” in auctions over assets submitted to evictions. In this country you could pay €100,000 over a mortgage of €200,000, then become insolvent and suffer eviction while the bank sells in auction that asset for €125,000 and you still ought €100,000 plus interest to the bank for the rest of your life, or until you pay it off.

Austerity, poverty and the insolvency spiral

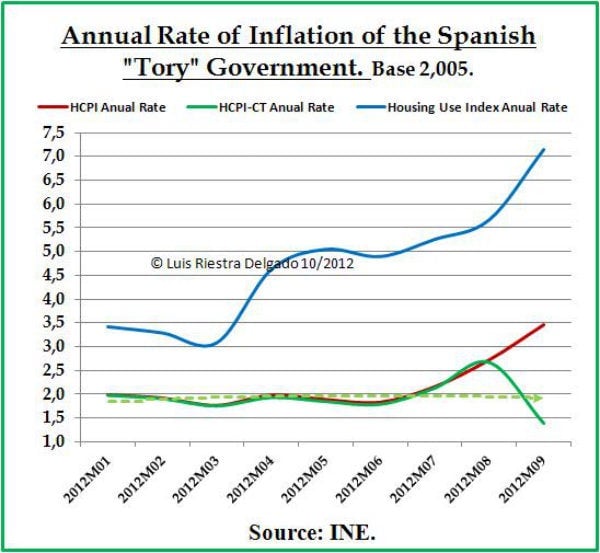

As a result of the austerity policies to balance the budget (after income crashed with the burst of the real estate bubble and social expenses exploded as unemployment jump from close to 9% to over 25% of the workforce), more and more regressive higher taxes are making it so that most families can hardly pay their debts even when they are lucky enough to have a job. The component cost of “inhabiting” a house raised almost 20% in family budgets as the price of utilities rise, especially electricity, with its dark political interests in “green” energy seem to grow ad infinitum.

HCPI-CT: Harmonized Consumer Price Index at Constant Taxes.

And all goes back to the banking sector

Higher unemployment, less tax revenues, higher unemployment expenses, more austerity, more taxes, less aggregate demand, and worse job expectations, more insolvent loans and the vicious cycle goes on and on.

Traditionally, this problem was mainly dealt with by our cajas (house of savings), through their own charity trusts. These institutions were working very well until corrupt politicians ruined many of them under the inaction of the Bank of Spain, our central bank.

Don’t be surprised then if this drama ends in riots and a major political crises of a ruling class that is highly corrupt, clearly dysfunctional and given a new name by the people: “La Casta,” or the Caste.