Insider traders, drug dealers—the language is much the same

A group of high-school buddies accused of making more than $1.4 million in an insider-trading ring were obviously fans of The Wire or some other drug crime drama. According to a complaint filed yesterday by the US, the traders, including three health-care executives, used elaborate code to discuss their illicit trades:

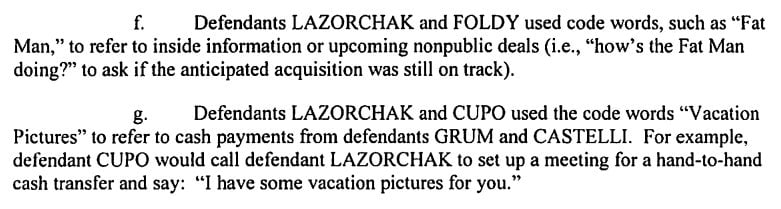

A group of high-school buddies accused of making more than $1.4 million in an insider-trading ring were obviously fans of The Wire or some other drug crime drama. According to a complaint filed yesterday by the US, the traders, including three health-care executives, used elaborate code to discuss their illicit trades:

But as we learned on The Wire, even the most cryptic crime talk can be damning when caught on a wiretap:

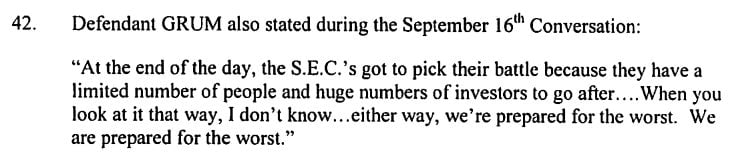

The alleged scheme is unusual both for its size and its length: the government says that the group of five began trading based on inside information in 2007 and were boasting about evading the notice of authorities as recently as September:

The Securities and Exchange Commission probably included that last bit in the complaint because the agency has been criticized for not aggressively pursuing insider-trading cases in the past. The defendants in this case surrendered to the Federal Bureau of Investigation but haven’t entered a plea yet.