Oil prices are low, but are they low enough to compel Iran to climb down?

Oil prices have undercut Iran’s current and expected earnings by billions of dollars, and there are signs that the hit could get worse—Saudi Arabia expects (paywall) prices to drop another $10 a barrel, and some traders are betting on an additional $30 plunge (paywall), to just $40 a barrel.

Oil prices have undercut Iran’s current and expected earnings by billions of dollars, and there are signs that the hit could get worse—Saudi Arabia expects (paywall) prices to drop another $10 a barrel, and some traders are betting on an additional $30 plunge (paywall), to just $40 a barrel.

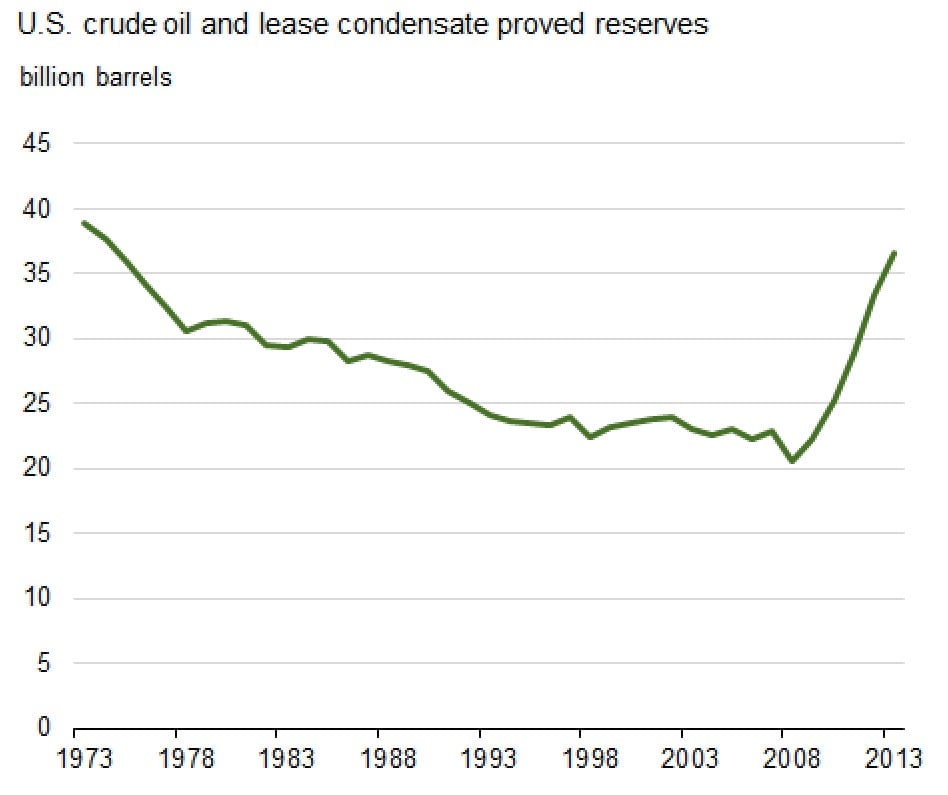

As if to vindicate those bears, prices fell again today after the Saudis sharply cut what they charge their customers, and the release of a new report that US crude oil reserves are at their highest level in 39 years.

But a debate is under way in Washington on whether this oil bludgeon is sufficient, in combination with existing sanctions, to drive Iran to make steep concessions in its nuclear program. Obama administration officials say that, depending on how the debate is settled, the US Congress could “blow up” extended talks attempting to strike a deal with Iran by July 1.

At the heart of the debate is persistent uncertainty about Iran’s calculus in participating in the talks: Is it motivated by a desire to cultivate better relations with the world, and to juice its economy? Or is its concern existential—based on a conviction that, without a nuclear deal, Iran’s economy could implode and threaten the regime’s hold on power?

One view: no mortal threat, no deal

A substantial bloc of power in the US Congress argues that it is the latter and that, therefore, unless you economically threaten to wreck the economy, Iranian leader Ali Khamenei won’t adequately reduce his demands. This bloc is pushing for a vote for additional sanctions after the new year, hoping for a large enough margin of victory to defeat any veto by president Barack Obama.

The main idea is additional financial penalties if the talks don’t succeed over the coming seven months, the extension made when the two sides failed to reach agreement by Nov. 24. For instance, the US could close a loophole that has inadvertently allowed Iran to export a special type of crude called condensate, and to unexpectedly boost its income, says Robert McNally of the Rapidan Group, a Washington consulting firm. Without a deal by July 1, buyers of Iranian crude could again be required to reduce their purchases, and broader sanctions could be directed at assets owned by the Revolutionary Guards.

But Obama fears this will ruin the talks

The Obama administration says sanctions are already sufficient, and that applying any additional force will fracture the international consensus that is pressing Iran—the so-called P5+1 that includes Russia, China and Germany and the other three members of the UN Security Council.

White House advisers say that the plunge in oil prices, in combination with sanctions, has restored the economic pressure relieved a year ago when Tehran won $700 million a month in concessions in exchange for pulling back its nuclear activity, in addition to about $500 million a month in the condensate sales.

Here is the math: At current oil prices, Iran is earning $1 billion a month less than it was under average prices prior to the plunge. This has almost canceled out both the concessions and the condensate dividend, and come close to the pain threshold that experts say pushed Tehran to the negotiating table when sanctions were imposed in July 2013.

In addition, if the Saudis are right that prices will stabilize at $60 a barrel, Tehran’s loss will be about $1.4 billion a month, even more pain than the original hit.

Almost certainly the hawks are right about Iran’s motivations in the talks: Khamenei is operating under the “staying in power” rule, and not just trying to get along better with the outside world. Foremost on his mind are the 2009 Green Revolution and the dynamics behind Hassan Rouhani’s election as president last year.

In terms of holding together the coalition, there is something to the Obama administration’s concerns, especially if it wants to keep Russian president Vladimir Putin aboard. But the P5+1 consensus won’t collapse for domestic economic reasons, suggests a new report by Secure America’s Future Energy, an energy security think tank. Except for Russia, none of the P5+1 countries has much to lose: With oil prices so low and supplies so plentiful, the US and Europe can mete out new sanctions while suffering no pain at all at home.