Fashion’s most volatile stock is getting more and more unstable

The numbers: British online retailer ASOS said that total sales rose to £246 million ($385 million) in the three months to Nov. 30; that’s up 8% from the same period last year. The company’s UK sales jumped by 24% while US revenue rose by 9%, which was enough to offset a 1% decline in the rest of Europe and 6% drop in the “rest of world” unit that covers countries like Australia, Russia, and China.

The numbers: British online retailer ASOS said that total sales rose to £246 million ($385 million) in the three months to Nov. 30; that’s up 8% from the same period last year. The company’s UK sales jumped by 24% while US revenue rose by 9%, which was enough to offset a 1% decline in the rest of Europe and 6% drop in the “rest of world” unit that covers countries like Australia, Russia, and China.

The takeaway: ASOS warned, ominously, that “international trading conditions remain challenging” and its shares took a 6% hit as a result. It is the latest retailer to admit people outside of the US and UK aren’t in much of a shopping mood. Things are worse at high-end outlets like Prada and Burberry, whereas ASOS’s mix of own-brand clothes and cheaper brands aimed at millennials has protected it somewhat. But it’s still not faring as well as more British consumer-focused rivals.

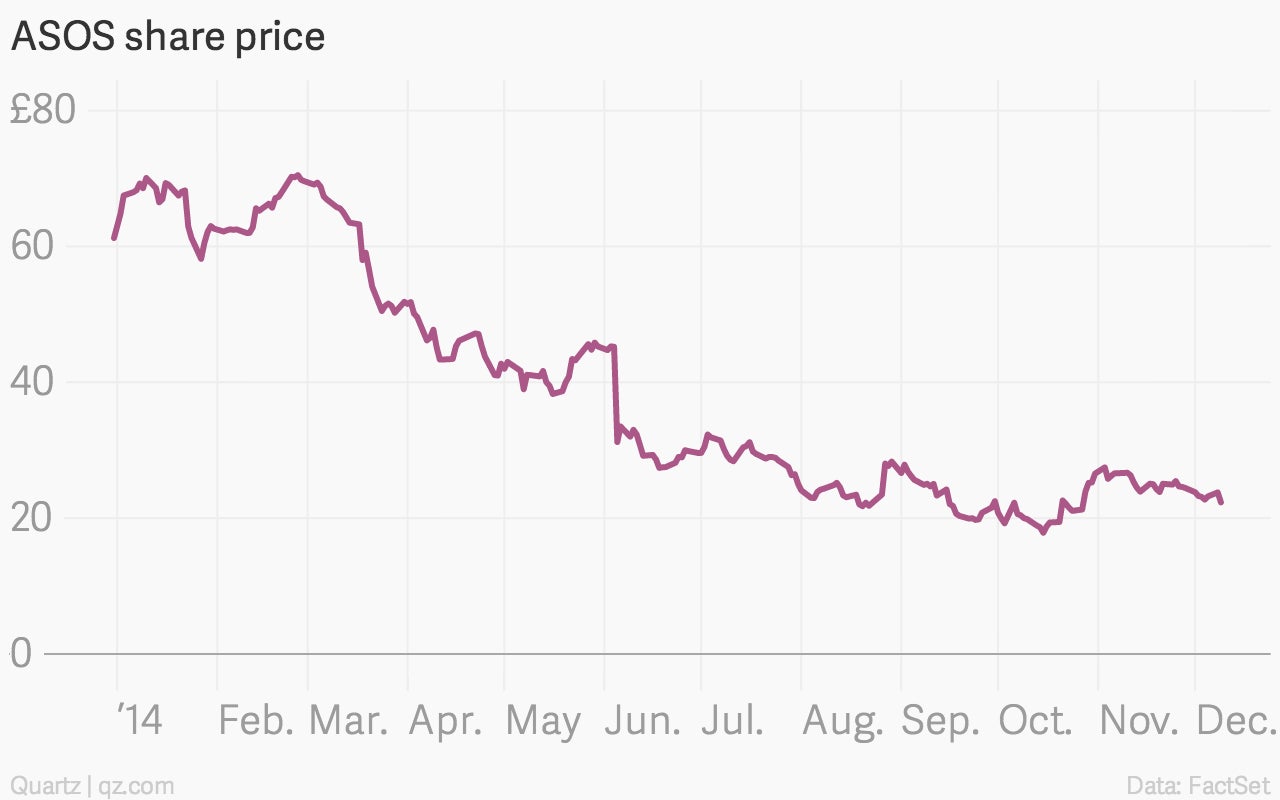

What’s interesting: Investors in ASOS have been on a bit of a rollercoaster. Shares of the company debuted in London in 2001 at £0.20 and soared to more than £70 towards the end of last year as it expanded into China. But the share price has fallen by more than 60% this year—even before today’s drop—on the back of three profit warnings, including one induced by a warehouse fire. The retailer’s chairman admits that launching in China last year was ”too much too soon.” Burnt overseas, ASOS now wants to focus more on its roots, boosting its share of the UK fashion market from 3% to 10%.