The ups and downs of 2014’s 10 most closely watched tech IPOs

Tech investors will remember 2014 as the year of Alibaba, and indeed it’s been the best year for IPOs in general since 2000, according to data from Bloomberg.

Tech investors will remember 2014 as the year of Alibaba, and indeed it’s been the best year for IPOs in general since 2000, according to data from Bloomberg.

But while the technology sector sparked plenty of enthusiasm, not everyone came out on top. Shares of some winners, such as TubeMogul and Zendesk, climbed skyward, while losers, such as Care.com and Coupons.com, struggled to trade above their (overly optimistic) debut prices.

Here’s a look at 10 IPOs that received the most media and investor attention and how they’ve fared in the markets as the year comes to a close.

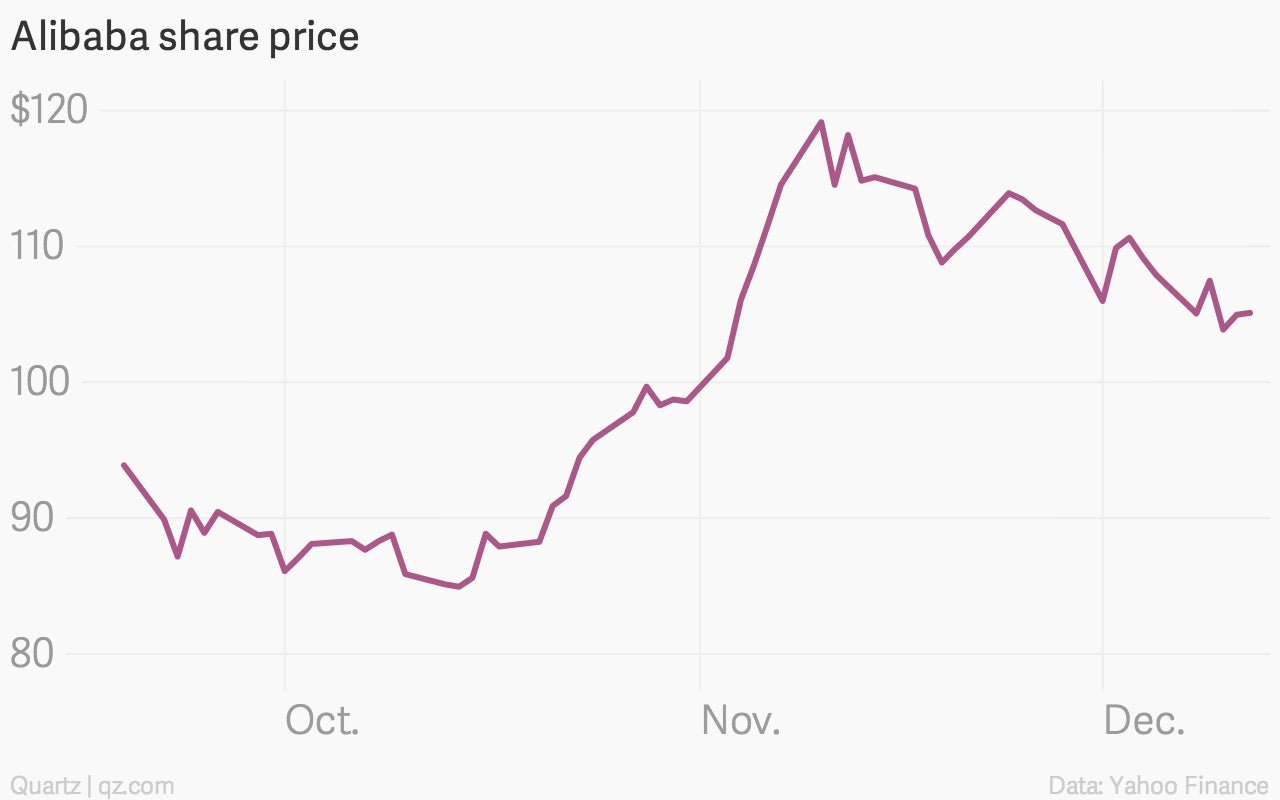

Alibaba

Debut price: $92.70

The Chinese ecommerce giant didn’t just claim the biggest IPO of the year—its gangbuster debut was recorded as the world’s largest in history. Shares skyrocketed after the company raked in $9 billion in online sales on Singles’ Day—a made-up shopping holiday in China (akin to Cyber Monday in the US) created by no other than Alibaba (BABA) itself.

Since debuting on the New York Stock Exchange at $92.70, the stock peaked at about $120 in November and currently hovers above the $100 mark. If the company’s YunOS mobile operating system is successful in eating away at Android’s 90% market share in China, it’s likely Alibaba’s trajectory will continue up, up, up.

King

Debut price: $20.50

From the beginning, investors worried about King (KING). Was the one-hit wonder game Candy Crush, which made up nearly 80% of its sales in 2013, enough to build a public company? Trepidation led to the stock opening at $20.50, less than its already-discounted pricing. Since mid-July, shares have performed under the IPO price.

In August, on the heels of its earnings, the game maker saw its largest plunge in after-hours trading, falling more than 20% to $13.99. The stock also hit record low in October at $10.68 (closing at $11.25). Though King is increasing revenue from other titles, the number of paying customers is dwindling. Given that, it’s become hard to ignore the company’s roots. Building on the blockbuster success of Candy Crush, King released another addition in November: Candy Crush Soda Saga.

GoPro

Debut price: $28.65

Enthusiasm for GoPro’s (GPRO) tiny action cameras boosted shares about 20% to $28.65 right out the gate. The camera maker has been enjoying steady growth, peaking at $98.47 in October. That month, GoPro raised more capital with a secondary offering, but investors, concerned about the dilution of their ownership, pushed the stock down 5% to $75.

Now investors seem buoyed by recent news that GoPro is developing a line of consumer drones expected to go on sale in late 2015, and a partnership that would outfit Tour de France bicycles with its point-of-view cameras.

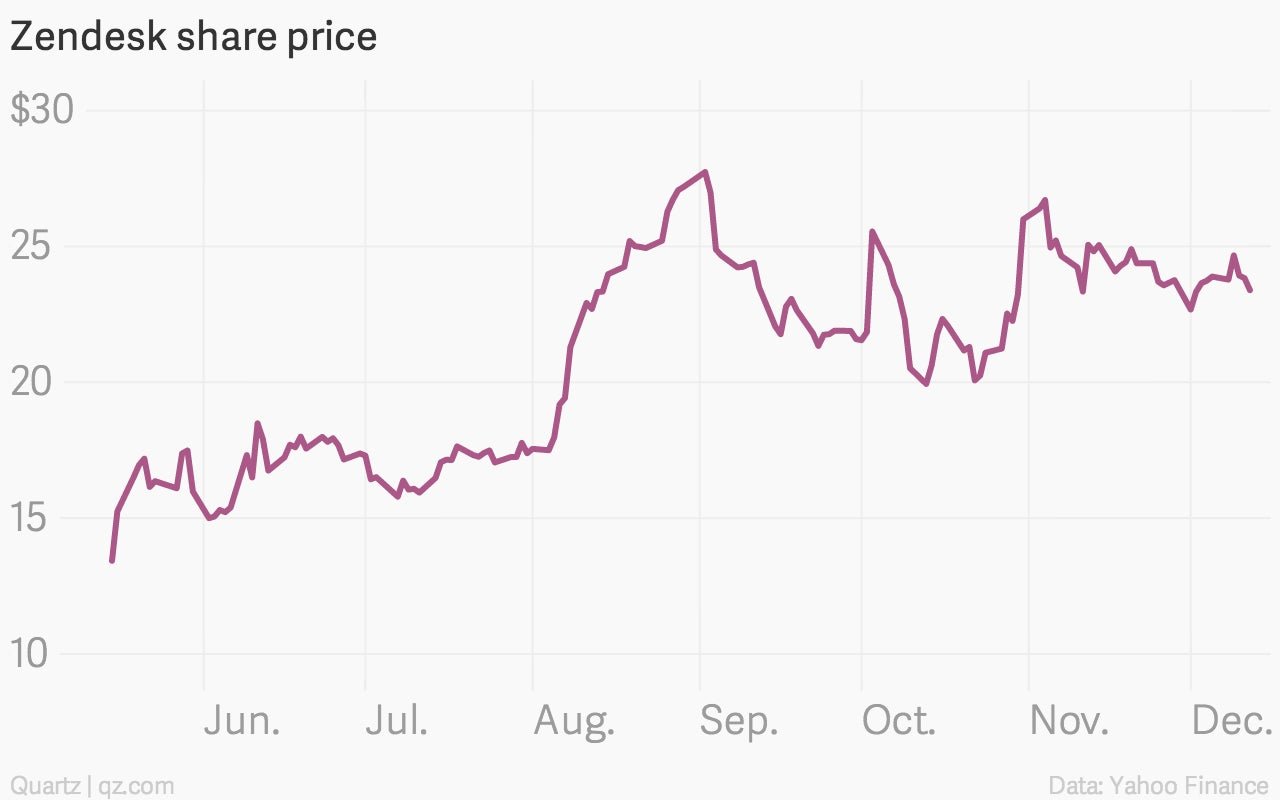

Zendesk

Debut price: $11.40

Investors are clearly pleased with Zendesk (ZEN), a maker of customer service software used by businesses. On its first day of trading, the stock closed 49% higher than its initial pricing at $9 a share. Since then, the company posted strong earnings, and shares are currently hovering in the $20 to $25 range. In December, Zendesk debuted new tools that let clients embed help widgets on mobile, games, and websites.

Grubhub

Debut price: $40

Grubhub’s (GRUB) last earnings report highlighted impressive profit and user growth, but its stock price has wavered since the food-delivery company went public in April. In August, after peaking at $45.80, shares saw an 8% drop amid news the Chicago company planned to sell another 10 million shares in a secondary offering. They dipped below $35 at various points from October to December (not helped by Amazon’s foray into the meal-delivery space)—on par with its performance from the first week of trading.

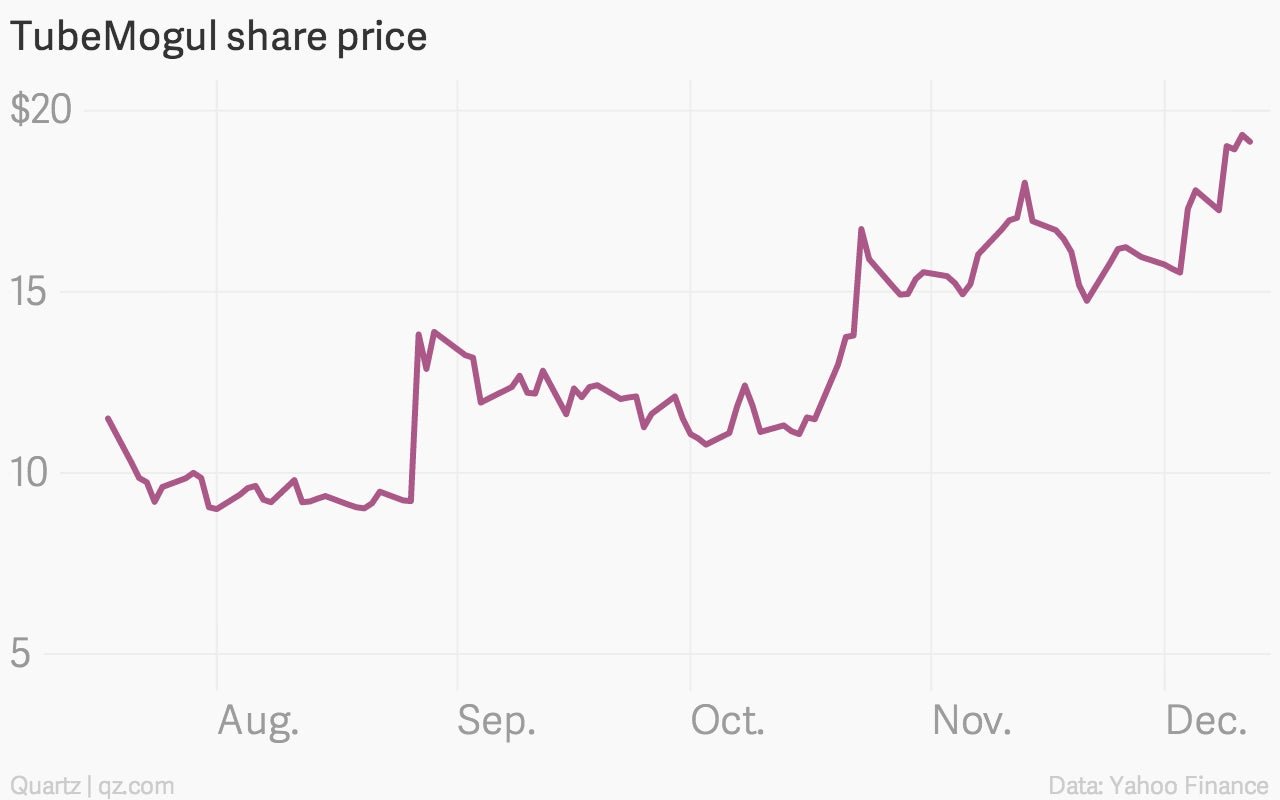

TubeMogul

Debut price: $9

Since going public in July, TubeMogul’s (TUBE) stock has only gone up, soaring from $9 at its debut to $19 in December. The video advertising company enjoyed a rally in late August when it reported strong earnings, sending shares up 13% to $13.82. Analysts are optimistic the stock could hit $25, with a median target of $21.

Care.com

Debut price: $21.21

Talk about a letdown. At about $8 a share in December, the stock price of the babysitting marketplace Care.com (CRCM) is a far cry from February’s, when it hit a high of $29.25. Analysts have downgraded the outlook of its stock after a number of warning signs: disappointing earnings, accelerated spending, and slowing growth.

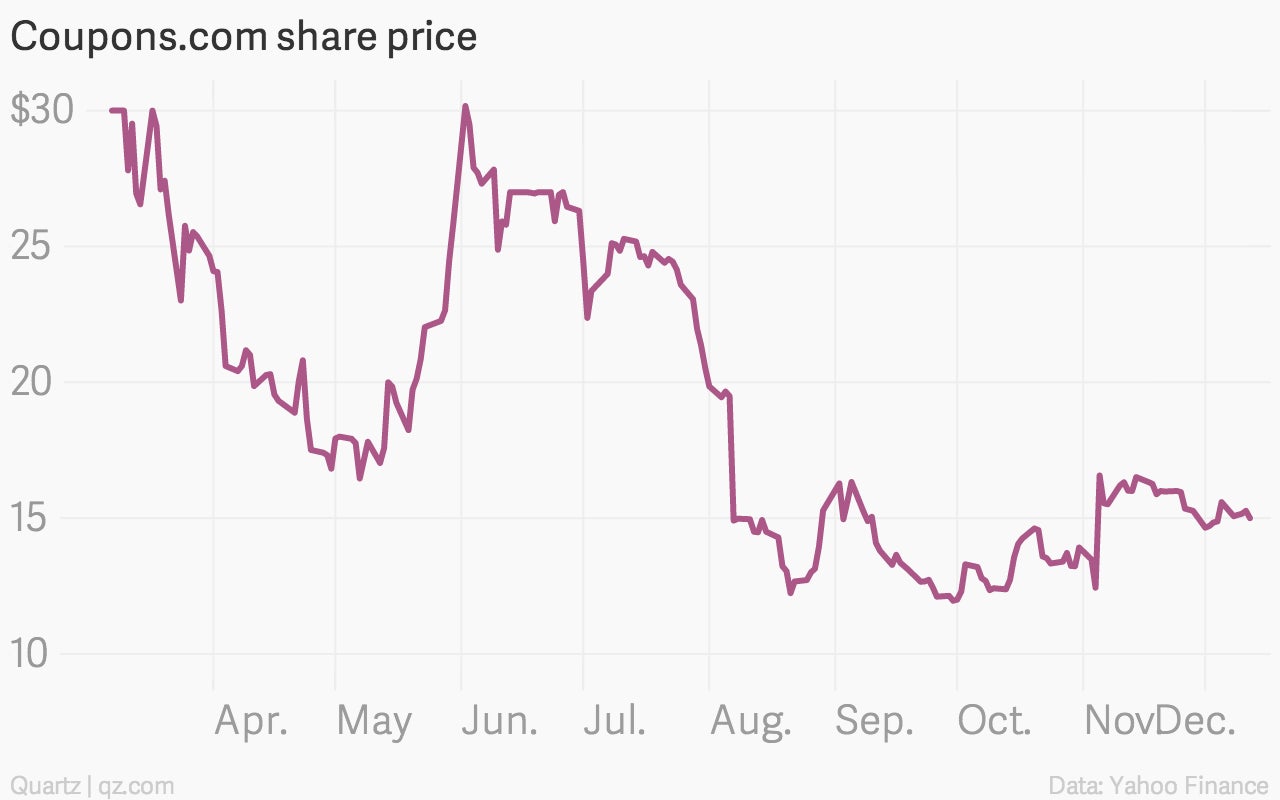

Coupons.com

Debut price: $27.15

Coupons.com (COUP), a Web 2.0 startup that went public 16 years after its founding, saw great enthusiasm on its first day of trading, popping 100% at one point before closing at $30. The stock has lost its luster since. Shares took a dive in June, when Goldman Sachs downgraded its outlook to sell—a move that speaks volumes because it is something investment firms, by nature of their line of work, are hesitant to do. Shares are floating around $15 currently.

TrueCar

Debut price: $9.70

TrueCar (TRUE), a car buying and selling platform, priced its IPO below expectations ($12 to $14) and debuted even lower at $9.70 a share. The stock peaked at $25 in September, but pushed a bit lower in anticipation of the lockup period expiring in November. Trading at about $22 in December, early investors have seen big returns, but analysts downgraded the stock, citing concerns about its business model and inflated valuation.

Tuniu

Debut price: $9

At the midway point of 2014, Chinese travel company Tuniu (TOUR), which went public on the Nasdaq in May, was considered the best performing tech IPO by Renaissance Capital for its 96% jump in share price. The picture at the end of the year, however, is very different. Down from its $24.99 peak, the company’s disappointing earnings and high spending have deterred investors, lowering the stock to about $12 at the end of the year.