Blocking AT&T’s merger with T-Mobile has been great for US consumers, but bad news for operators

Since the US government stopped AT&T from buying rival T-Mobile—a move that would have cemented AT&T as the largest wireless company in the US, and reduced the number of nationwide operators to three from four—the Deutsche Telekom subsidiary has kept the industry on its toes.

Since the US government stopped AT&T from buying rival T-Mobile—a move that would have cemented AT&T as the largest wireless company in the US, and reduced the number of nationwide operators to three from four—the Deutsche Telekom subsidiary has kept the industry on its toes.

Pumped up by CEO John Legere’s leadership, T-Mobile has rebranded itself as an “uncarrier” that doesn’t play by the rules. Sure, some of this is bravado, but the carrier has lowered prices, offered contract-free plans, subsidy-free phones, options to upgrade early, free international data roaming, and even provided free music streaming. Most recently, T-Mobile unveiled a two-line plan with unlimited data for $100 a month. And the company is planning another high-profile reveal Tuesday as well.

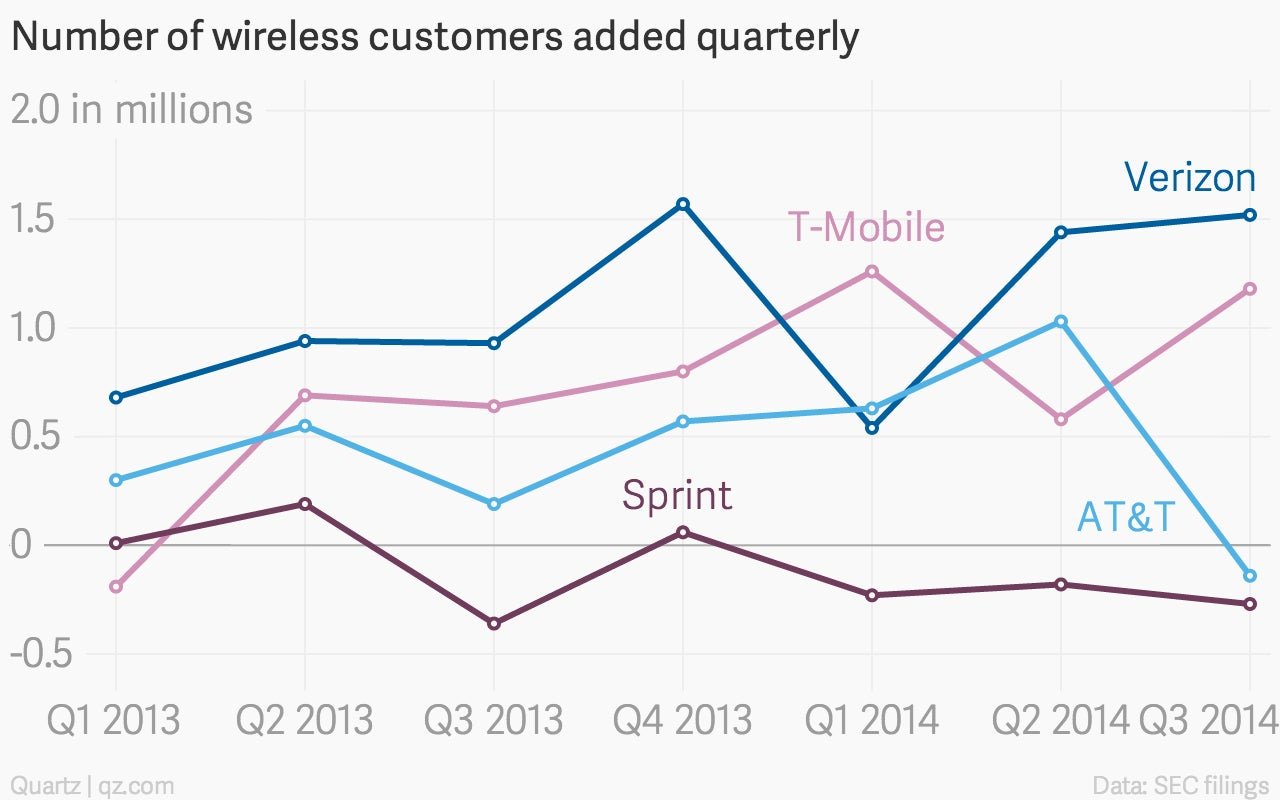

Feeling the pressure to keep up, Verizon, AT&T, and Sprint are hurting as they discount their services–and still, T-Mobile’s tactics are eating away at the number of new customers they are adding. (It even came out on top in the first quarter of 2014.)

For customers, this has meant better deals—which was a main reason for blocking the AT&T deal with T-Mobile.

But the price war also means potentially lower profits and margins for the industry. Collectively, the four major carriers lost $45 billion in market capitalization (paywall) in the last month, in part because of lower pricing. (Stock prices also fell because a recent government airwave auction turned out to be more expensive than initially estimated.) Meanwhile, Verizon warned last week that “promotional offers, together with the strong customer volumes this quarter” is putting “short-term pressure” on wireless profits and margins.

In this case, government intervention has paid off—at least for consumers.