Is that all you got? No respite for the ruble amid a market meltdown

This is no joke.

This is no joke.

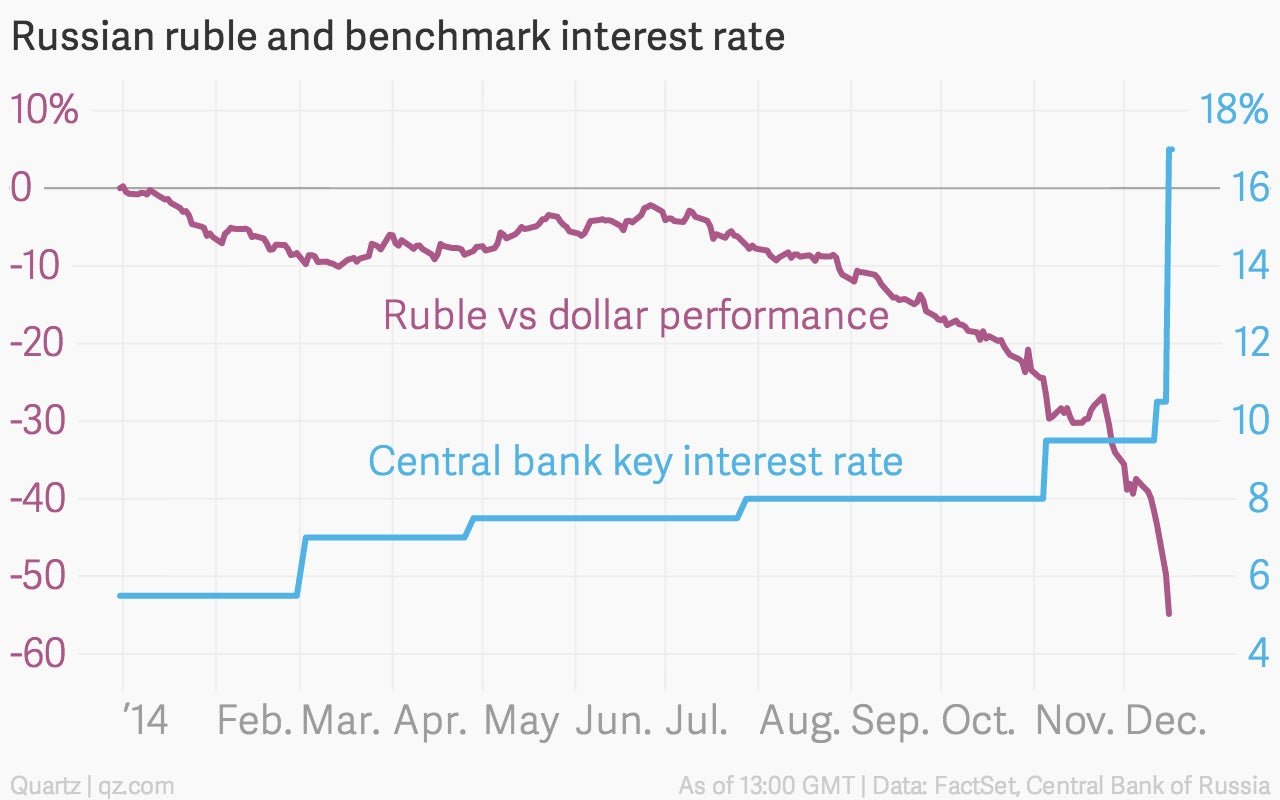

Anxious laughter and black humor yesterday is giving way to a more somber mood in Moscow today, after an aggressive rate hike by the central bank—from 10.5% to 17%—in the wee hours comprehensively failed to stem the currency’s rapid slide.

A brief rally early today quickly fizzled out, with the ruble breaking through previously unthinkable levels with terrifying speed. It briefly broke above 80 to the dollar (versus 33 at the start of the year) and 100 to the euro (versus 45 at the start of the year).

But the central bank mounted a fightback in the afternoon, intervening in the market to push the ruble back towards 70 to the dollar at the time of writing, amid incredibly choppy trading conditions on big volumes.

The ruble has lost around a quarter of its value against the dollar in the past week alone. Russian stocks and bonds are unraveling as well. There are rumors of big layoffs in the works at key state-run firms and banks cutting off new loans to borrowers (link in Russian).

Despite its drastic actions overnight and this afternoon, it’s hard not to conclude that the central bank is losing control:

It is cold comfort for Russians scrambling to swap their rapidly depreciating rubles into hard assets or more stable currencies—heck, even bitcoins don’t look so bad anymore—but things were worse during the country’s last currency crisis, in 1998. In May of that year, the central bank jacked up rates from 50% to 150% at a stroke. Oil prices were also much, much lower back then.

Still, it’s not surprising that people are looking back to 1998 to try to understand what is happening today. The comparisons may not entirely work, but there are enough uncomfortable echoes for market watchers to fear that things could get worse before they get better.

The central bank is coordinating actions with the government to combat the “quite complex” situation, Bank of Russia chief Elvira Nabiullina said today. Analysts say capital controls, debt restructuring, and other measures are likely next steps, provided that policymakers are unable to rein in the ruble.

“The ruble is currently fundamentally undervalued and time will be needed to remedy this,” Nabiullina added. When your institution is charged with maintaining financial stability, a day in which the value of your currency swings by some 30% suggests that time is of the essence. The question now is whether new measures are imminent, or whether the real response will wait for president Vladimir Putin to unveil personally at his annual showpiece press conference on Thursday.

The joke yesterday was that the price of oil, the value of the ruble against the dollar, and Putin’s age were all 62. Now, those who haven’t yet lost their sense of humor are citing a different Russian leader as a gauge for the country’s woes: