Oil traders in Europe are amazingly still addicted to Yahoo instant messenger

Some people have a thing for retro technology. And then there are the commodities traders in Europe who are really stuck in a digital time warp.

Some people have a thing for retro technology. And then there are the commodities traders in Europe who are really stuck in a digital time warp.

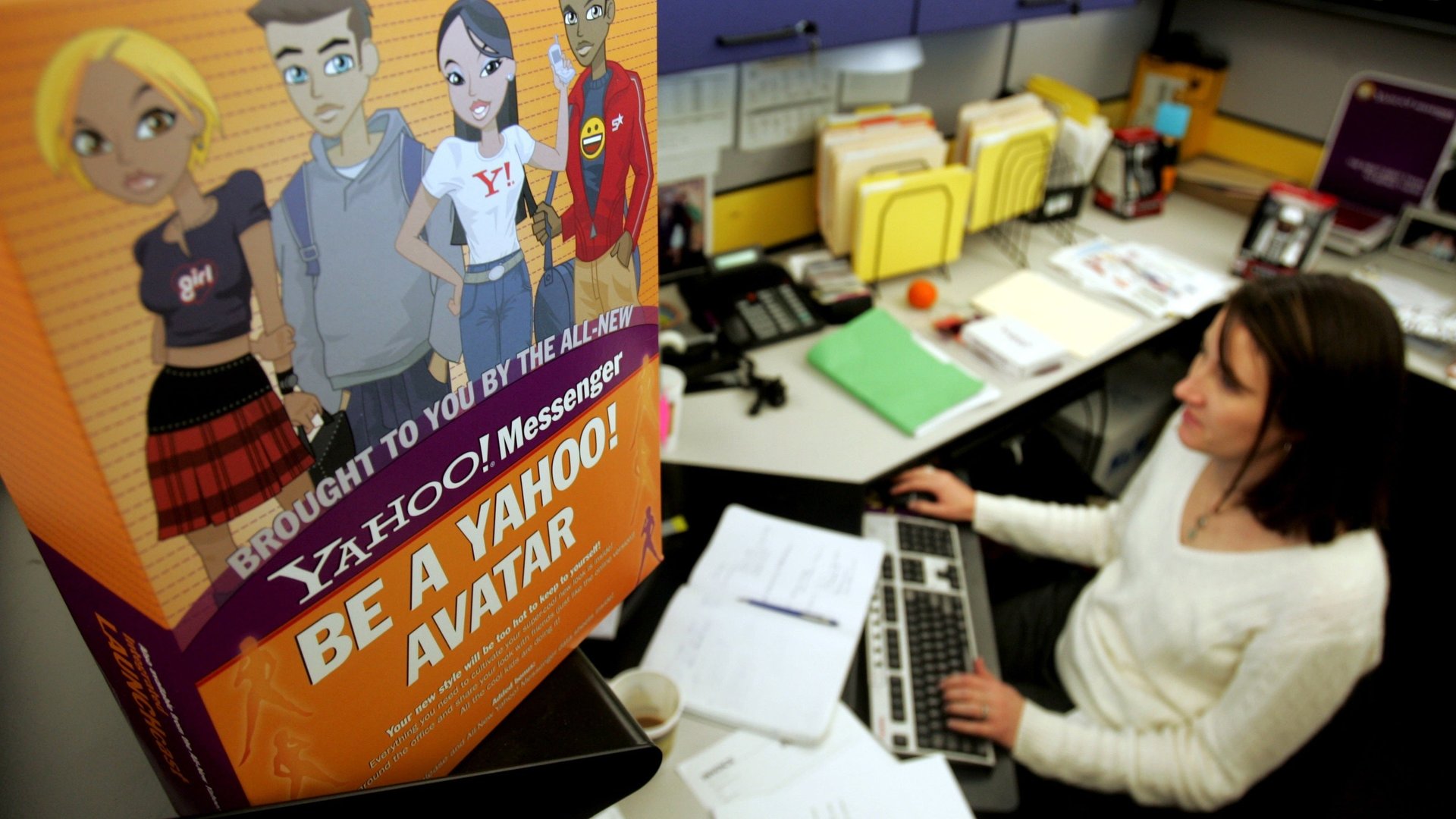

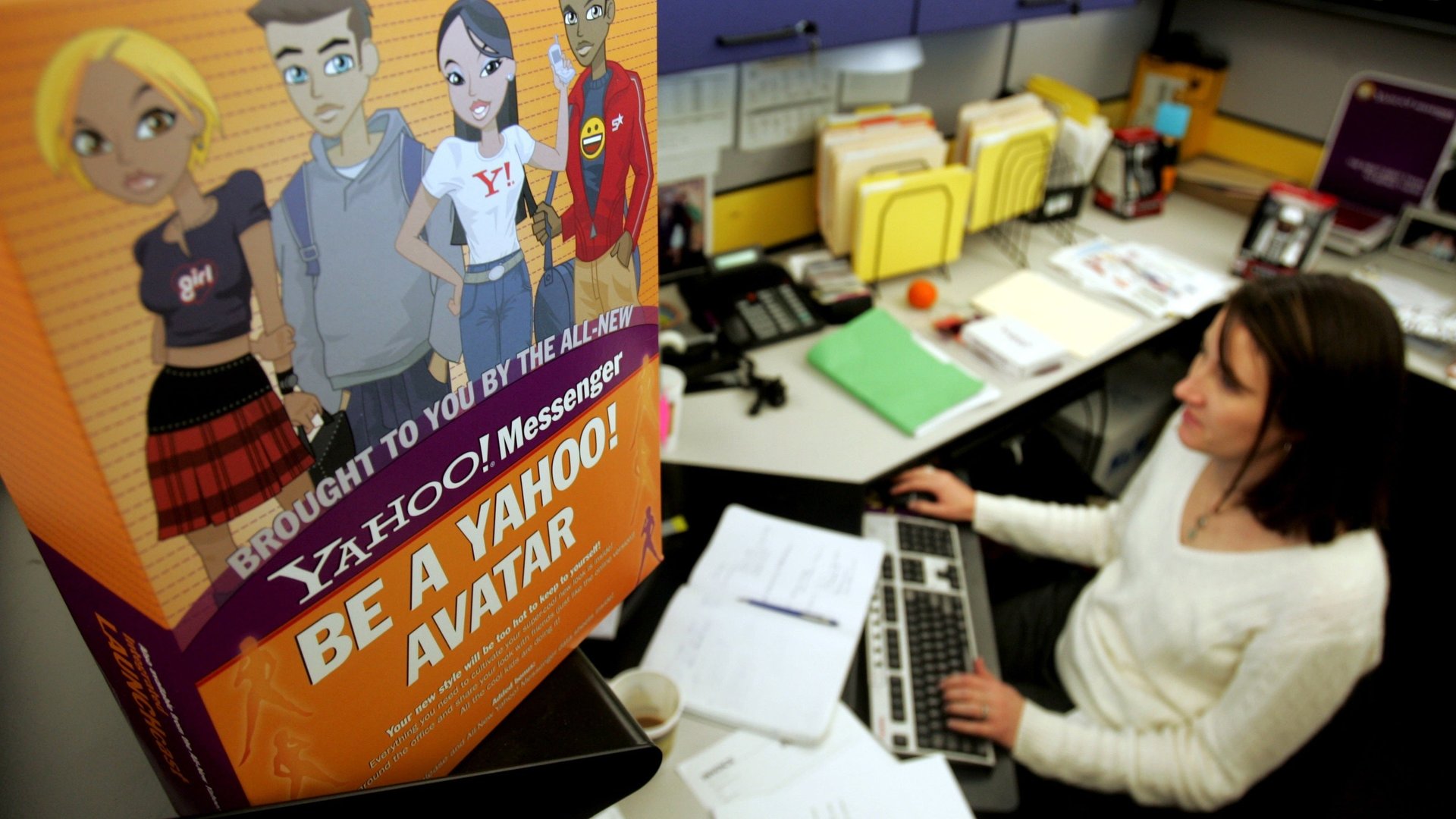

Forget Slack or Skype—these traders use Yahoo Messenger, which launched nearly 20 years ago and has been largely forgotten in the ensuing years. But many traders in oil, gold, and other commodities are so fervent that they sometimes refuse to communicate any other way. Yahoo IDs are still printed on some of their business cards.

Because Yahoo’s service is perfect for the job of exchanging information about prices, market rumors, and gossip? Perhaps. But mainly they use it because, way back when instant messaging was new, Yahoo was first.

In the early 2000s, modern commodity trading was also a fledgling business, developing rapidly alongside a boom that was brought about by increased demand from developing economies (and only slowed by the subsequent financial crisis.) Some people didn’t yet have an email address, and the phone was king. Traders called each other to swap tips, and rang up brokers for price quotes.

Yahoo had set up a service that allowed users to chat in real time, launching its instant messenger service under the name Yahoo Pager in 1998.

AOL had brought out its chat service, AIM, the year before, but Yahoo was still ahead of the curve. MSN didn’t enter the fray with its Messenger Service, integrated with Hotmail, until 1999, and Skype came on the scene only in 2003. Google released Google Talk, sometimes called Gchat, in 2005. Several other chat services came and went.

Yahoo’s messenger was “the only one really around…[and I] guess it was the easiest to use then,” says one retired trader who was working in oil at the time. Now that everyone’s on the same system, it’s too much hassle to change, he tells Quartz via Yahoo Messenger.

Though the trader recently stopped working for a large oil firm, he didn’t want to be named. Old habits die hard, and traders who communicate with journalists on the Yahoo platform repeatedly request that their names and companies must never be revealed, else they risk losing their jobs.

Brokers and analysts use Yahoo as well. One broker says he sends out price updates to hundreds of contacts and chats to “50-odd daily.”

“Yahoo is ingrained into the financial services sector—everyone who has used it for years and has a big list of contacts…won’t be willing to change,” says an oil analyst, who used to trade. This is despite increasing competition from the messaging services of Bloomberg and Reuters, he says.

Since the mid 2000s, the former trader said, instant messenger accounts have been subject to more scrutiny than when they first came on the scene.

“Most companies monitor the chats and record them,” the trader said, adding that banks were the first to start keeping tabs on their traders’ instant communications, followed by the big energy companies, and now “mostly everyone.” A 2013 scandal surrounding the privacy of chats on Bloomberg’s terminals increased the oversight.

Another oil trader says that he’s seen a move back towards voice, and though phone calls were probably monitored as well, messaging is “likely less secure.” The trader says he still uses Yahoo every day, though.

Traders complain of bugs with Yahoo Messenger. But one reason for switching back to the phone can’t be blamed on technology. “Sometimes you get bored of typing,” the recently retired trader said.