Twentysomethings: Barely saving, but surprisingly confident

There are differing opinions about whether overconfidence is good for humanity. Some say that believing that you’re better than you really are is a self-fulfilling prophecy that’s good for ambition and swift decision making. Overconfidence can lead to boosts in social status, and overconfident populations have been shown to be more evolutionarily stable. Others argue that overconfidence leads to hubris, self-deception, and blind spots in decision making.

There are differing opinions about whether overconfidence is good for humanity. Some say that believing that you’re better than you really are is a self-fulfilling prophecy that’s good for ambition and swift decision making. Overconfidence can lead to boosts in social status, and overconfident populations have been shown to be more evolutionarily stable. Others argue that overconfidence leads to hubris, self-deception, and blind spots in decision making.

In behavioral finance, overconfidence for traders can lead to risky stock picks and overtrading. (Malcolm Gladwell wrote about overconfidence as one of the psychological flaws of Wall Street leading to the crash.) But what about personal finance? Do individuals take on the same attitudes as stock traders when dealing with their own money, where losses can hurt their own bank accounts?

The online startup LearnVest, which aims to bring financial planning to the masses, looked into this question of how confidence affects financial behavior. It’s been documented in the past that overconfidence can hurt retirement savings, but LearnVest took a more detailed look drawing on survey responses from their dataset of over 100,000 users.

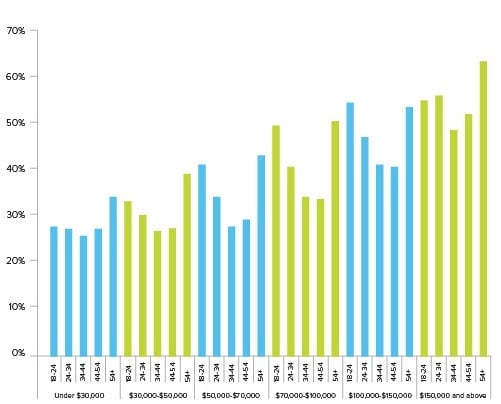

The report found that financial confidence fluctuates at different ages. While those under 25 felt confident about their financial future and potential earnings, 30- and 40-somethings were less confident—saddled with the burdens of debts and, for some, children (who are expensive). After 55, that confidence ticks up again.

“What we saw in our data is that people in their twenties feel like they have a better grasp on their finances than they do and it’s because of an enormous financial literacy problem,” said Alexa von Tobel, founder and CEO of LearnVest. “They enter their 20s thinking juggling a daily budget is what financial planning is about. In their instincts, they feel that the way to solve financial problems is to earn more.”

And that seems intuitive, with incomes rising rapidly in one’s twenties. But as earnings grow, so do financial responsibilities, including starting retirement savings. Even at high income levels, LearnVest found that thirty- and fortysomethings in their dataset had lower confidence about their financial future.

“You see that at every income level, this confidence dips,” says von Tobel.

Confidence by age and income bracket

The issue of stagnant income and savings for Millennials has been widely covered. A recent report from the St. Louis Fed suggests that while their net worths are lower, they’re not doing much worse financially than their predecessors. However, a report from the Employee Benefit Research Institute found that the percentage of workers who feel confident about retirement savings were at record lows in 2009 and 2013.

Von Tobel argues that extended lifespans, combined with an increased ability to borrow multiples of their income and spend it, puts this generation apart from past generations in terms of potential financial burdens. In other words, even though Millennials are not saving less than previous generations, they might consider opting to be safe rather than sorry.

“That this trend in twentysomethings’ low savings rate is not unique to this generation implies that the confidence U-curve is perhaps a longstanding trend as well. It also suggests that better financial literacy could help inspire younger generations to save earlier when time (and compounding interest) are on their side,” says von Tobel.

With more than half of Americans worrying about not having enough retirement savings, earning more is only part of solving the problem for twentysomethings. Experts recommend starting to save—even if just a little bit—for retirement at age 25. Another proven way to save is not opting out of automatic deductions and not withdrawing from retirement accounts. All of this is old wisdom that’s been around for years, perhaps the members of the generation that came of age in the Great Recession are looking to save money as soon as they make enough to pay their rent.