Business bosses are griping about regulation in record numbers, and that’s a good sign

Jamie Dimon, the boss of JPMorgan, recently complained that his bank, and others like it, were “under assault” by an army of regulators. He would know—JPMorgan has paid more than $25 billion in fines for wrongdoing over the past few years. And while some suggest that this pain is largely self-inflicted, Dimon (pictured above) still felt the point was worth making.

Jamie Dimon, the boss of JPMorgan, recently complained that his bank, and others like it, were “under assault” by an army of regulators. He would know—JPMorgan has paid more than $25 billion in fines for wrongdoing over the past few years. And while some suggest that this pain is largely self-inflicted, Dimon (pictured above) still felt the point was worth making.

When any group of executives is quizzed about their biggest fears, you can guarantee that the evils of regulation will eventually come up. It’s not that bosses necessarily object to playing by the rules, it’s just that if there was less red tape, lower taxes, and lighter official oversight of their companies, they could really, really flourish.

This is one of the conclusions to draw from the latest edition of a long-running global survey of CEOs by PricewaterhouseCoopers. The report was released today at the start of the annual World Economic Forum in Davos, where company bosses and their relevant regulators, heads of state, and other policymakers meet to exchange pleasantries in person—and gripe about each other when backs are turned.

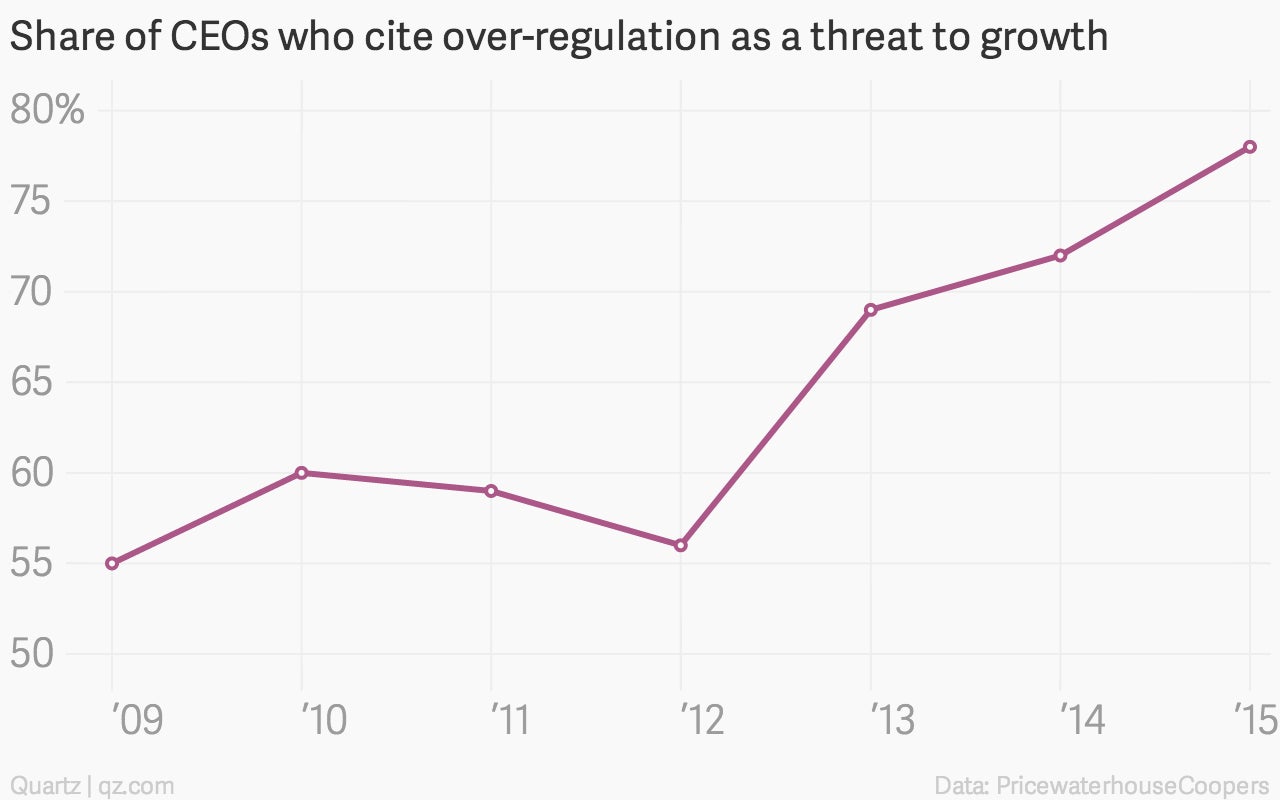

For the second year running, over-regulation topped the CEOs’ list of worries. In fact, more chief execs cited this as a pressing threat to growth prospects than ever before in the 18-year history of the survey, according to PwC.

This is an encouraging sign. In years past, economic volatility, unstable capital markets, and daunting public deficits were CEOs’ biggest fears. When big banks were failing, the euro zone threatened to break apart, and other era-defining risks seemed suddenly plausible, fretting about things like marginal tax rates and accounting standards was a luxury few could afford.

Amid a renewed bout of gloom about global growth, the viability of the euro zone, and market stability, it is comforting, in a way, that business bigwigs are comfortable getting back to what they do best—moaning about unfair rules—instead of fearing more immediate, and dangerous, disruptions.