How hedge funds—and Mrs Watanabe—plan to profit from the Japanese election

Speculation that Shinzo Abe’s Liberal Democratic Party will win the Japanese election on Dec. 16 is bringing an old and much loved currency gamble back into vogue. It is called the “yen carry trade”. The “carry” involves borrowing money in a weak, low-interest-rate currency and investing it in a higher interest-paying one. Investors profit on the difference. A very popular version of this trade for years has been pairing the weak yen with a stronger, higher paying currency such as the Australian dollar. Hedge fund managers and legions of Japanese retail investors—the fictional “Mrs Watanabe” in market parlance—love the yen carry. Because it is easy.

Speculation that Shinzo Abe’s Liberal Democratic Party will win the Japanese election on Dec. 16 is bringing an old and much loved currency gamble back into vogue. It is called the “yen carry trade”. The “carry” involves borrowing money in a weak, low-interest-rate currency and investing it in a higher interest-paying one. Investors profit on the difference. A very popular version of this trade for years has been pairing the weak yen with a stronger, higher paying currency such as the Australian dollar. Hedge fund managers and legions of Japanese retail investors—the fictional “Mrs Watanabe” in market parlance—love the yen carry. Because it is easy.

The trade has been out of favour for much of this year. The Japanese currency was strengthening because investors viewed it as a “safe haven” (video) against falls in the dollar and the Euro. But it looks set to come back, thanks to Shinzo Abe. As researchers at London consultancy Capital Economics point out in a note, Abe wants to “ease monetary policy aggressively and weaken the yen”. In fact, he has said he wants the Bank of Japan to print unlimited yen. That will increase its attractiveness as a currency to borrow in.

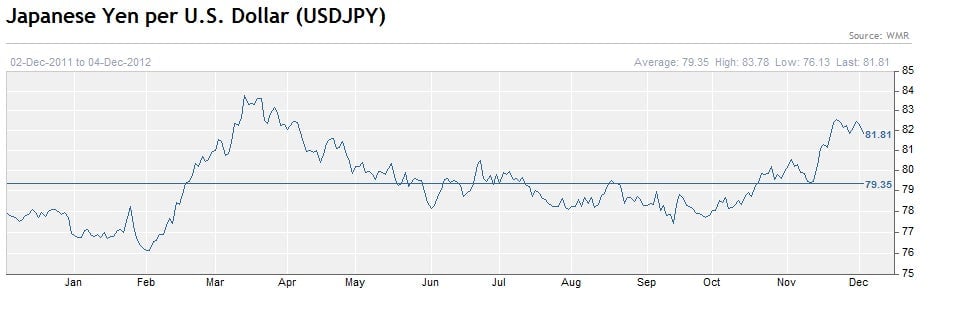

Here is how the yen has been doing against the US dollar recently:

The Financial Times noted on Dec. 3 (paywall) that short positions in the yen—bets that the currency will fall in value—are at a five year high. So the market thinks the yen is bound to weaken, which in turn should stir enthusiasm for the carry. Traders are beside themselves with joy at the thought of making easy money again.

“I think everyone is getting increasingly excited that this could be “it”. The market has been waiting for “the big yen sell-off” for years,” Philippe Bonnefoy, chairman and chief investment officer of fund manager Newscape Capital Group, told the FT.

Last week, Reuters also pointed out that talk of that “old favourite” carry trade involving the yen and the Aussie dollar, was “resurfacing.”

Carry trades are risky. A small appreciation in the funding currency can offset the gains from the higher rate of interest. On the other hand, any fall in the funding currency makes it more profitable.

The excitement about the yen carry could be overdone. The Japanese election could well result in a coalition. Politicians could end up gridlocked and unable to achieve anything, weakening Abe’s power over the Japanese central bank.

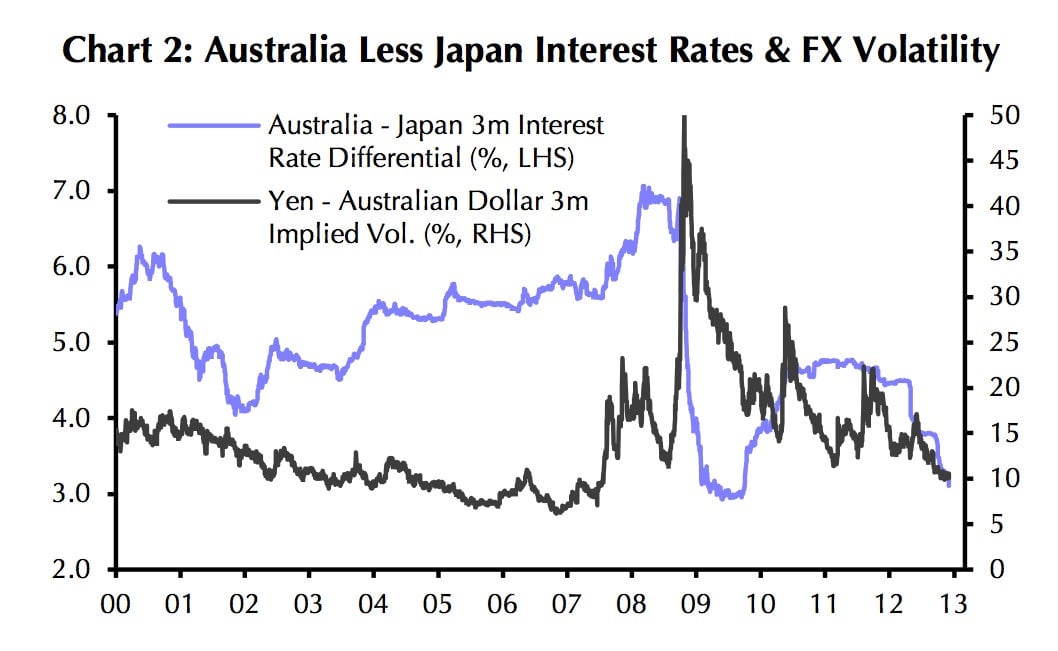

And the yen trade may not be quite as popular as it was a few years ago. There are other weak currencies in the world to borrow in, such as the US dollar. And the interest rate differential between the yen and traditional high-paying currencies is not as big as it once was. Australia’s benchmark interest rate is now 3%, having peaked at 7.25% in 2008. This chart shows the interest rate difference between the yen and the Aussie now, and historically. Clearly the potential for profit is narrowing.