Nigeria’s currency is taking a beating from low oil prices and political uncertainty

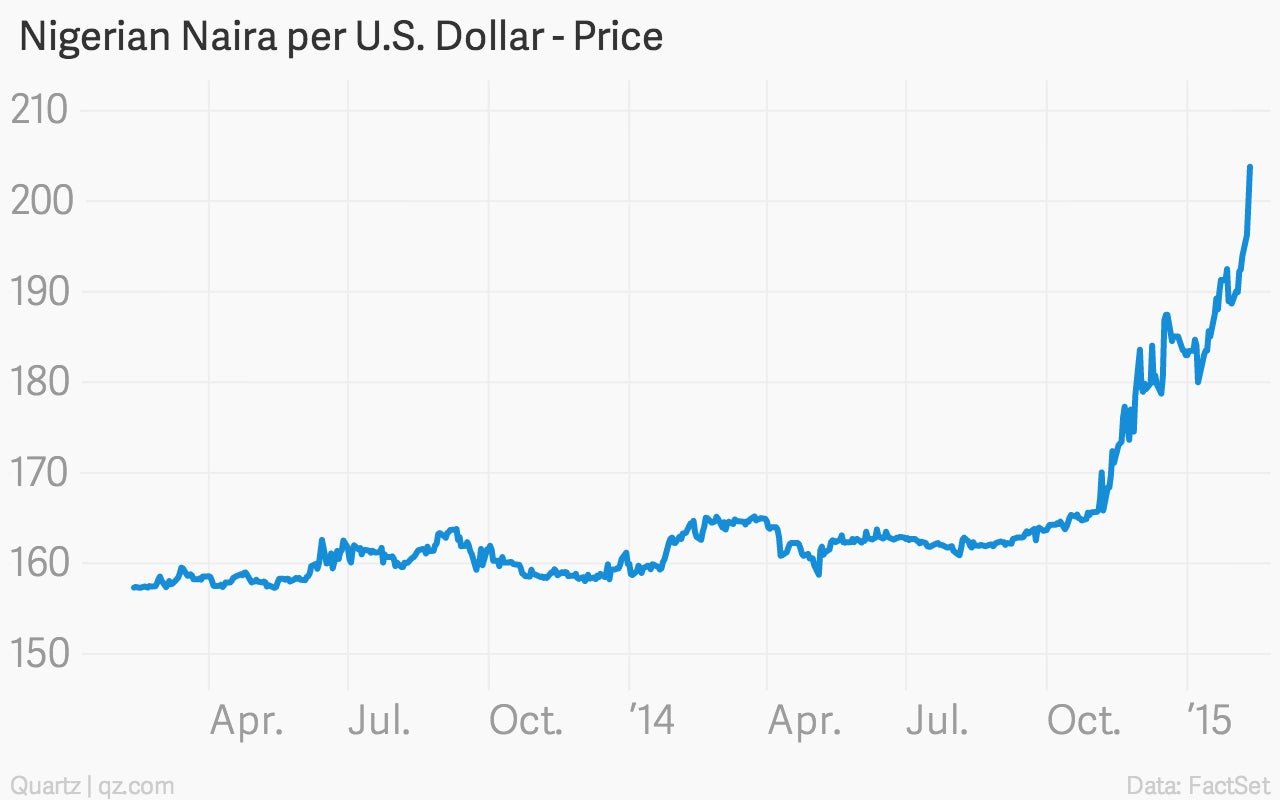

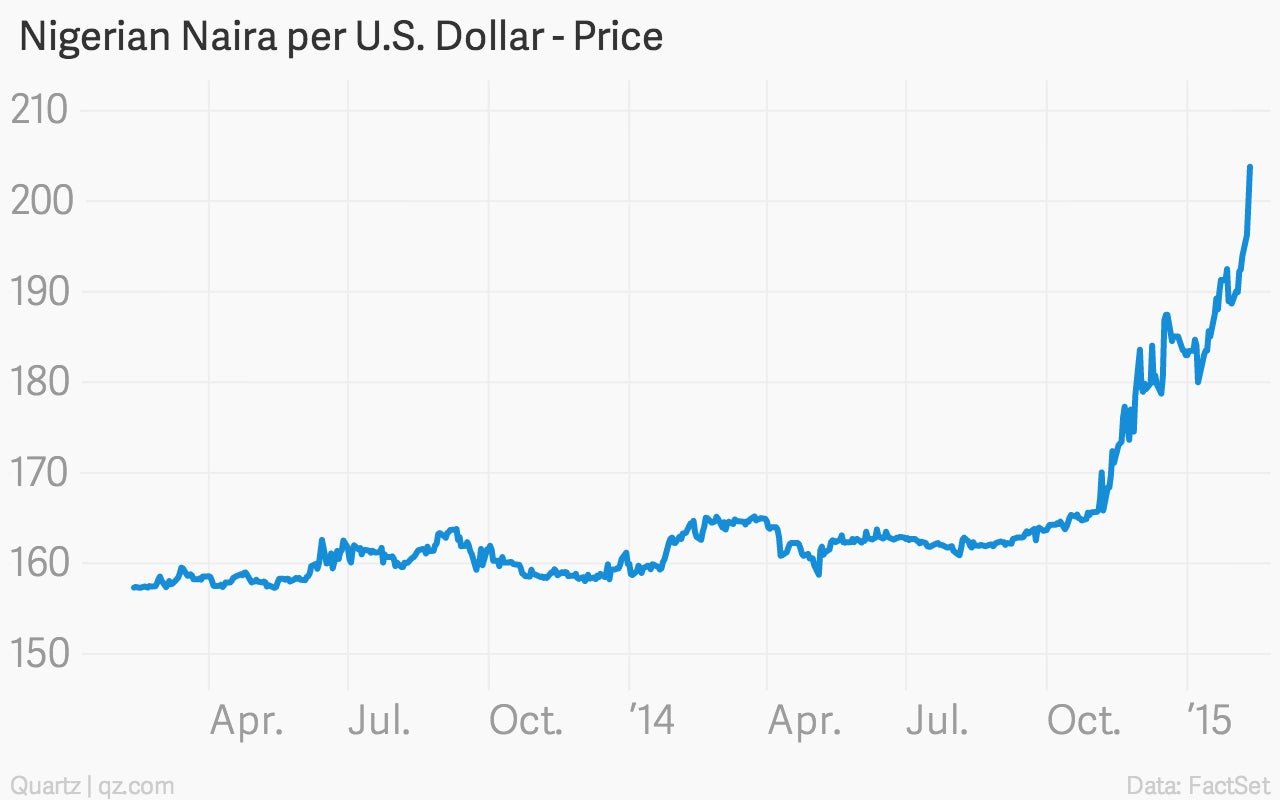

The Nigerian naira has plunged more than 20% since last July—broadly the same trajectory as the price of oil, which has dropped some 50% in the same period. Though Nigeria’s economy is diversifying into telecoms and entertainment, oil still accounts for 90% of its export revenue.

The Nigerian naira has plunged more than 20% since last July—broadly the same trajectory as the price of oil, which has dropped some 50% in the same period. Though Nigeria’s economy is diversifying into telecoms and entertainment, oil still accounts for 90% of its export revenue.

Yesterday, the Naira broke through the psychological level of N200 to the dollar, after hovering around the N190 mark for a few weeks.

Nigerian central bank governor Godwin Emefiele claims there are no plans to fight the naira’s free-fall, though there have been occasional dips into the bank’s reserves—said to total $33.5 billion—to slow the currency’s fall. ”In 2001, 2002, reserves were as low as about $10 billion,” Emefiele told the Wall Street Journal. “If we could survive with $10 billion, I don’t see a reason why we cannot survive with the $33.5 billion that it is today.”

It’s not just lower oil prices affecting the currency. There’s also uncertainty around the country’s political system. Over the weekend, presidential elections due for February 14th were pushed back to March 28. Any more delays could trigger a constitutional impasse, and potentially could encourage the military make a bid for power.

In a television interview broadcast live on Wednesday evening in Nigeria, president Goodluck Jonathan reiterated his intention to hand over the reins of power if he lost the closely fought-election to rival candidate Muhammadu Buhari, a former general.

“I want to assure Nigerians that elections will be conducted in this country, and a government will be inaugurated on the 29th of May this year,” he said.