A year old, the Comcast-Time Warner Cable merger plan is precariously poised

Today marks a full year since America’s two biggest cable companies, Comcast and Time Warner Cable, agreed to unite.

Today marks a full year since America’s two biggest cable companies, Comcast and Time Warner Cable, agreed to unite.

At the time, the proposal was quite stunning (paywall). Most people thought the bride (Time Warner Cable) would end up in the arms of another suitor (Charter Communications). One year on, and the couple have still not yet been able (paywall) to consummate their union. But they might not have to wait too much longer before they can finally, formally get together.

OK, enough with the sexual metaphors. Here’s where things actually stand.

This merger deal needs to be approved by three government agencies, but people close to the transaction agree that the most important of those is the US Federal Communications Commission.

The FCC has an informal 180-day “shot clock” on transaction approvals, which expires at the end of March; it only started reviewing this deal last summer, and has already paused the review twice. There is a chance that the review goes beyond this informal deadline.

Before that, the agency is poised to vote on critical “net neutrality” rules supported by President Obama. The big internet companies hate these rules, which basically enforce the principle that all traffic on the internet should be treated equally. But some people think that if the vote gets through it could actually maker it easier for the Comcast-Time Warner deal to gain approval.

Remember, Time Warner Cable and Comcast don’t actually directly compete with each other at the moment. Their customers are in different locations. They argue this means the merger won’t reduce competition.

(The cable industry in the US is basically a collection of regional pseudo-monopolies. This unusual fragmentation is a legacy of the way licenses were doled out in the 1960’s and 70’s).

But others are worried that Comcast would become too powerful if it were to gain Time Warner Cable’s customers in key markets like Los Angeles and New York City. Senator Al Franken, a Democrat from Minnesota, and streaming video operator Netflix have been among the more vociferous opponents of the merger.

It is not terribly unusual for a deal approval to take this long. It took more than a year for the FCC to approve Comcast’s purchase of NBC Universal for example, and also for AOL’s (disastrous) merger with Time Warner Inc to get the green light.

But arguably, neither of those deals was as politically sensitive as this one. And neither was the outcome of those deals as hard to predict.

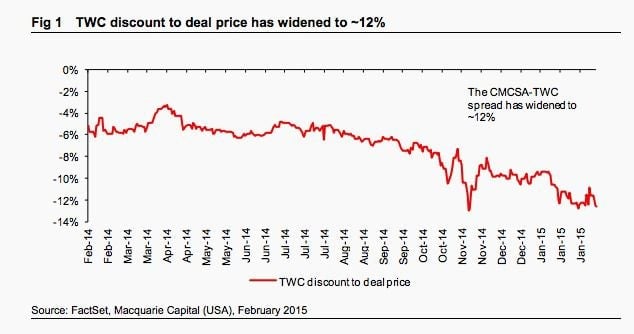

Doubt certainly appears to be creeping into the minds of investors.

Time Warner Cable shares have been trading well below Comcast’s bid price, suggesting uncertainty about whether the deal will get over the line.

Get set for an interesting few weeks.