Oil’s luminaries think that we are witnessing merely another historical bust

Four years ago, no one forecast that a freak suicide in Tunisia would rock the Middle East, bring down governments and spread civil unrest. Before last March, no one suggested that a Russian invasion of eastern Ukraine was in the offing. Nor did anyone warn that oil prices were about to halve, and undercut all these governments.

Four years ago, no one forecast that a freak suicide in Tunisia would rock the Middle East, bring down governments and spread civil unrest. Before last March, no one suggested that a Russian invasion of eastern Ukraine was in the offing. Nor did anyone warn that oil prices were about to halve, and undercut all these governments.

In short, no one predicted that many of the presumptions underlying our understanding of basic geopolitics and economics were about to be shaken fundamentally. So, should we now believe some of the oil industry’s main luminaries when they say, as they did at Davos last month, that the price turbulence we are currently witnessing is merely another of history’s usual cyclical busts, and that nothing fundamental is different?

In a piece today, The Wall Street Journal quotes a fear voiced at a December oil-producers meeting by Saudi Arabian oil minister Ali al-Naimi. Quite beyond Saudi’s apprehension over US shale oil, Naimi said, a more ominous dread falls on the consumption side. “Is there a black swan that we don’t know about which will come by 2050 and we will have no [oil] demand?” he said.

As phrased, Naimi’s flourish is far-fetched to say the least. The global economy has grown to more than $75 trillion a year, and hydrocarbons are the flexible fuels that allow it to operate almost regardless of the business at hand—the world is almost wholly outfitted to operate on oil, natural gas and coal. At that scale, you don’t simply transform an economy to operate on another fueling system in a little over three decades.

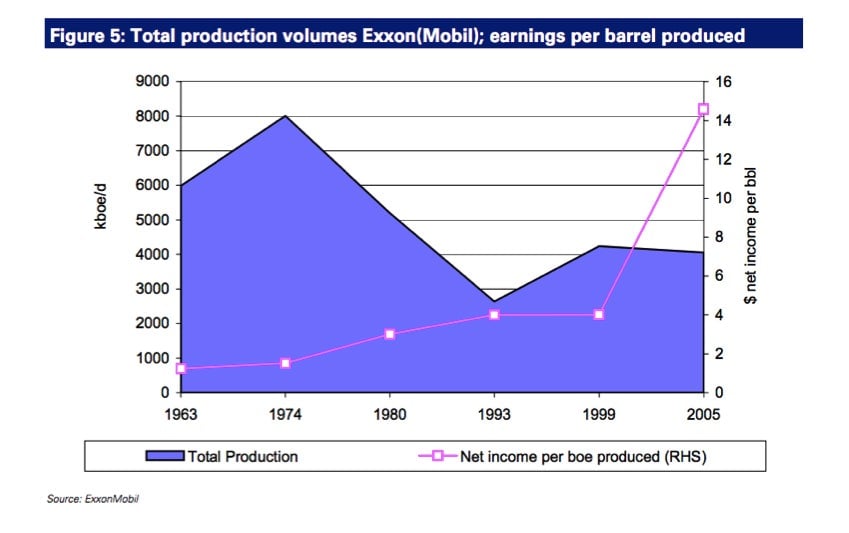

Yet, as just one historical data point to remember, Exxon itself invented the precursor to the current lithium-ion battery. That was the early-to-mid 1970s, when OPEC nationalism eliminated more than 60% of the company’s daily oil production, and it thought that electric cars could be part of its new future.

Exxon changed its mind when its batteries kept blowing up in the lab, and industry sentiment generally turned back to oil. Today, Exxon runs on a base case under which, at least through 2040, oil will continue to dominate transportation at about the same proportion as it does today, meaning at a little over 90% of all fuels. For one thing, Exxon believes that battery researchers will fail to close the gap with combustion and enable the robust adoption of electric cars.

But the episode in the 1970s is emblematic of the speed with which attitudes and reality shift in big energy (another example is the current shale oil boom itself).

The oil luminaries at Davos could be right—we may be in the throes of a blip, with a return coming quickly to the status quo of oil scarcity and high prices. Then again, they didn’t see the blip coming.