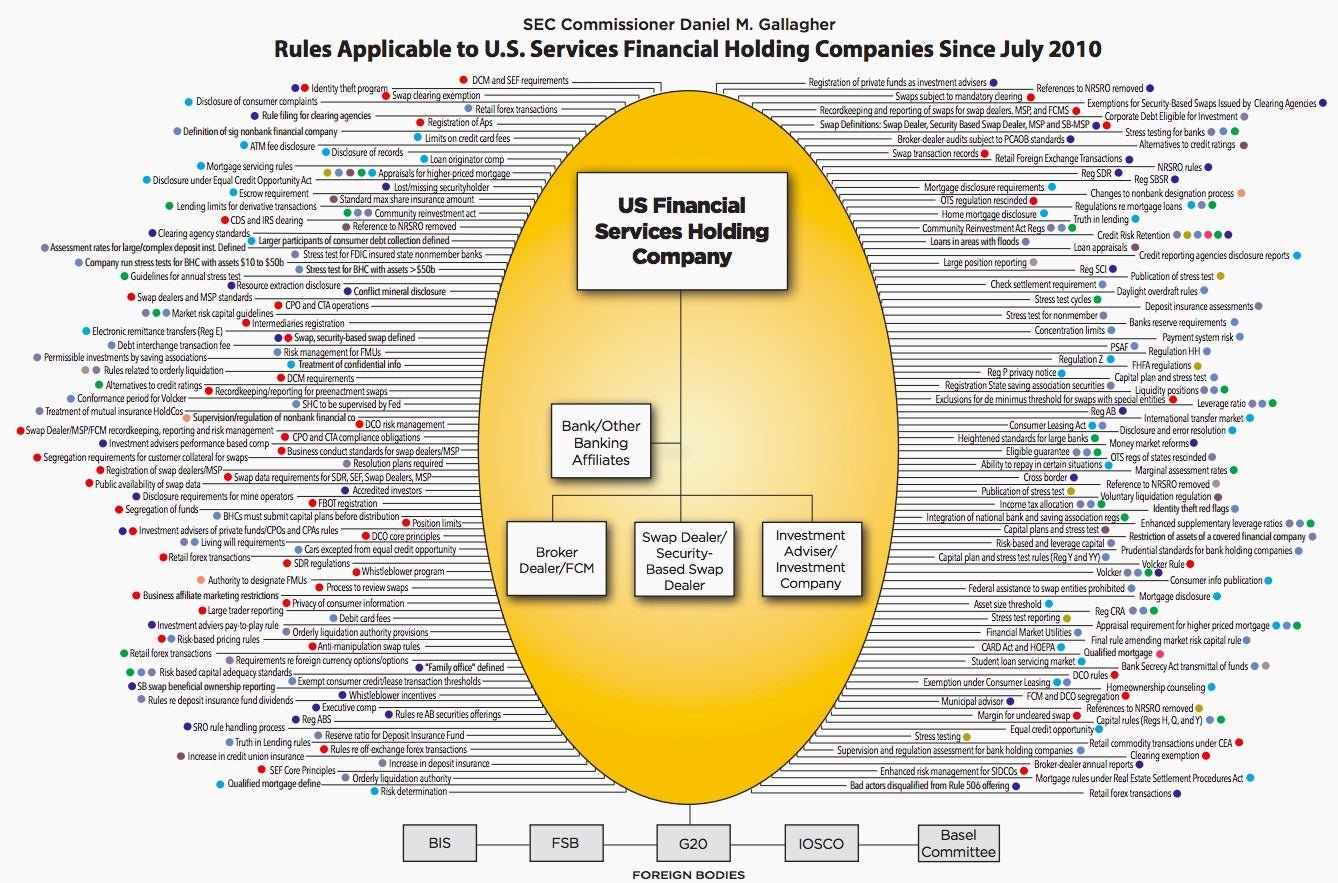

The one chart you need to understand why US bank regulation can’t be understood

It’s getting hard to keep track of all the government regulations that stemmed from the last financial crisis and are still working their way through banks and other financial institutions.

It’s getting hard to keep track of all the government regulations that stemmed from the last financial crisis and are still working their way through banks and other financial institutions.

So Republican SEC Commissioner Daniel Gallagher charted it.

“We as regulators are, when it comes to the possibility that our rules are causing death by a thousand cuts, the proverbial ostrich—head firmly entrenched in the sand,” Gallagher wrote in a statement this week that accompanied an intricate chart he presented at an annual bankers conference. “I hope this stark depiction can spark a much-needed debate about the regulatory burden that has been placed on our financial services industry.”

Gallagher is arguing that the regulatory burdens are driving capital away out of the economy, creating bigger barriers for new financial services companies to start up and further entrenching the mega banks.

Everyone can agree the onslaught of Wall Street regulations are overwhelming. But as lawsuits, market manipulation scandals and government investigations continue, it remains to be seen if the regulations are working to make the banks safer.