The Google founders’ 2004 IPO letter has imitators even today

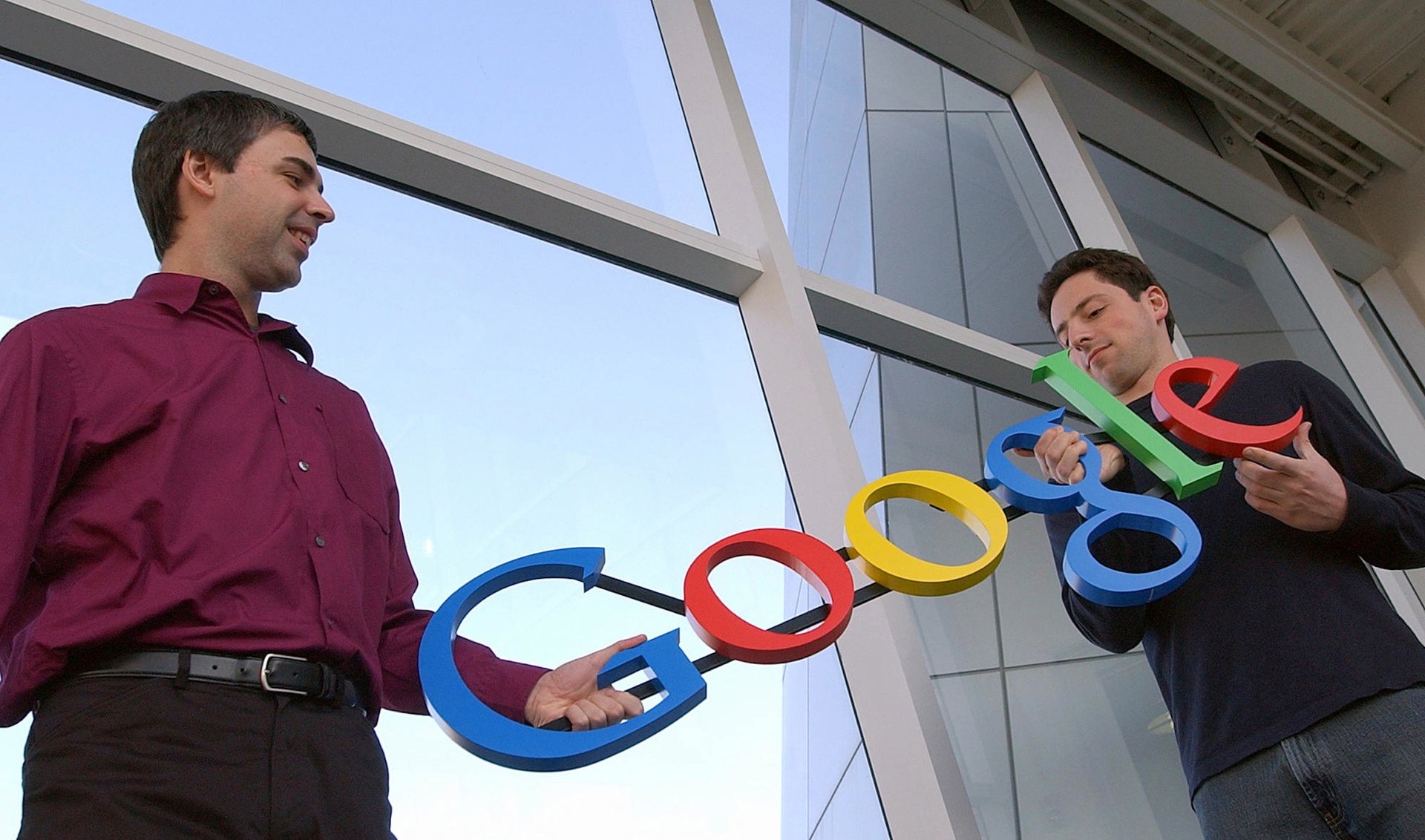

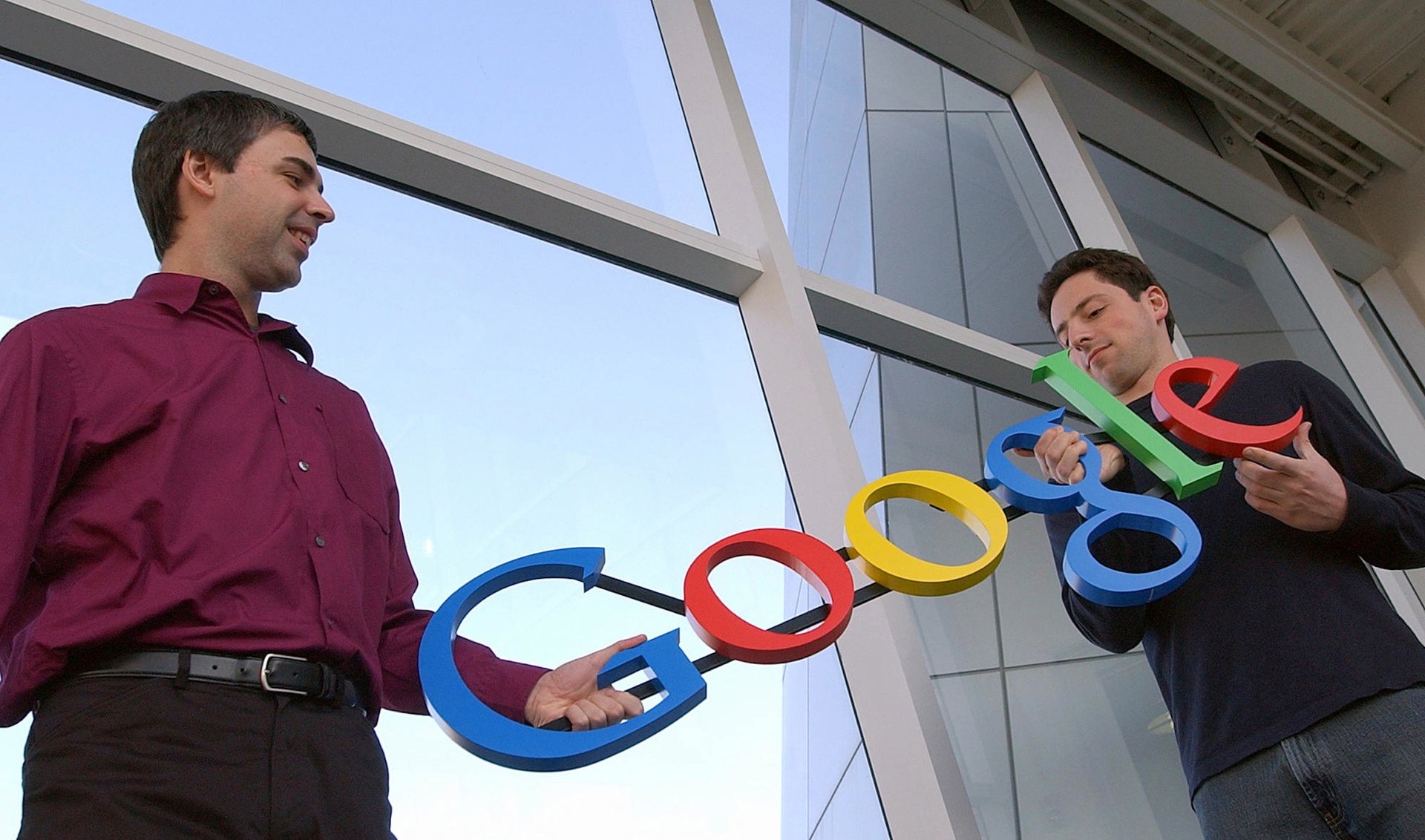

It’s been more than 10 years since Google went public, but the way the company did so is still having an impact. Founders Larry Page and Sergey Brin wrote a long and personal “owner’s manual” for shareholders detailing their hopes and worries about going public, and sharing the company’s ethos.

It’s been more than 10 years since Google went public, but the way the company did so is still having an impact. Founders Larry Page and Sergey Brin wrote a long and personal “owner’s manual” for shareholders detailing their hopes and worries about going public, and sharing the company’s ethos.

Such letters have become standard at tech companies. Facebook CEO Mark Zuckerberg wrote something similar. And today’s letter from craft marketplace Etsy’s CEO Chad Dickerson, included in the company’s S-1 filing for its IPO, echoes it as well.

Etsy followed Google in both form and content. It also used the letter to announce the fact that it won’t be providing regular quarterly financial forecasts to shareholders.

Here are Page and Brin from Google’s 2004 letter:

Although we may discuss long term trends in our business, we do not plan to give earnings guidance in the traditional sense. We are not able to predict our business within a narrow range for each quarter.

We recognize that our duty is to advance our shareholders’ interests, and we believe that artificially creating short term target numbers serves our shareholders poorly. We would prefer not to be asked to make such predictions, and if asked we will respectfully decline. A management team distracted by a series of short term targets is as pointless as a dieter stepping on a scale every half hour.

And here’s Etsy’s Dickerson:

When we’re public, we do not plan to give quarterly or annual earnings guidance. I think providing quantitative earnings guidance is misaligned with Etsy’s mission. For example, the pressure to hit a quarterly financial target could incent us too heavily to seek near-term gains, which could diminish our ability to fulfill our larger mission over the long-term.

We will continue to be transparent with our investors. Instead of providing guidance in the traditional sense, I plan to talk frequently with our investors about our progress, challenges and opportunities. I welcome investors who share our long-term, community-oriented philosophy.

A very non-techy father of this sort of no-guidance philosophy and shareholder letter is even older. Google’s founders credited in a footnote investor Warren Buffett’s 1996 owner’s manual (PDF) for Berkshire Hathaway shareholders and his annual letters with inspiring the overall attitude and long-term focus of their own letter. Buffett may be among the most old school of investors, but he manages to influence the youngest of companies.

From his manual:

In all of our communications, we try to make sure that no single shareholder gets an edge: We do not follow the usual practice of giving earnings “guidance” or other information of value to analysts or large shareholders. Our goal is to have all of our owners updated at the same time.