China’s surge in exports sounds more promising than it actually is

China took economists by surprise when it reported February that its exports totaled $169 billion (link in Chinese)—a leap of nearly 50%, versus the same month last year. That’s especially impressive since the strengthening yuan has effectively made goods sold to many countries way more expensive. For a couple of reasons, though, it’s not quite the good news for China’s ailing economy that it might seem.

China took economists by surprise when it reported February that its exports totaled $169 billion (link in Chinese)—a leap of nearly 50%, versus the same month last year. That’s especially impressive since the strengthening yuan has effectively made goods sold to many countries way more expensive. For a couple of reasons, though, it’s not quite the good news for China’s ailing economy that it might seem.

First off, growth wasn’t really that huge—largely thanks to weird distortions from Chinese New Year. Since it’s based on the lunar calendar, the weeklong holiday falls at a different point in the months of January and February each year. In 2015, Chinese New Year fell fairly late (Feb. 18-25), meaning exporters had plenty of time to wrap up their shipments for the month. The previous year, the holiday started on Jan. 31, which meant that exporters spent the first week of February on holiday, and the following weeks catching up with orders.

One way to limit year-on-year comparisons by combining the data for those two months. Here’s what that looks like:

Still, export growth was still respectable, up 15% versus the first two months of 2014. The US and ASEAN were the chief drivers of that growth, rising 21% and 38% (link in Chinese), respectively. And despite ongoing weakness in the EU, China’s second-biggest export market after the US, the People’s Republic sold 13% more goods there than last year.

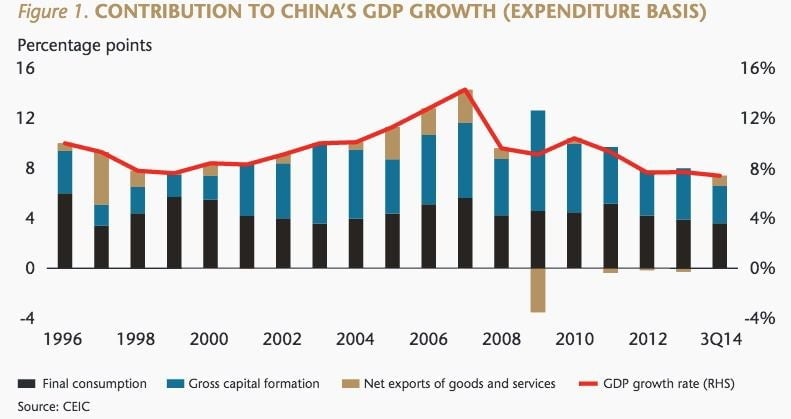

But though export growth is still important for keeping employment up, it doesn’t drive the economy much at all anymore. Though it’s frequently still referred to as having an “export-led growth model,” this hasn’t been true since 2007. The Chinese government knows this.

In fact, after China missed its 2014 export growth target of 7.5%—the government last week set the 2015 goal for a meager 6%.

As you can see, consumption is much more important these days—in fact, it’s the key to the oft-discussed “rebalancing” that economists say China must do to dodge a debt crisis. One indicator of how domestic demand is holding up is imports. And they’re not looking so hot these days.

Part of the reason is the combination of dollar strength—China maintains a soft peg to the greenback—and falling commodity prices. However, the volume of imports (link in Chinese) of refined oil, steel, copper, and many other industrial commodities fell in the first two months of the year, compared with the same period in 2014.

Weakening consumption also might explain some of that import collapse. Growth in spending during this past Chinese New Year, which is often read as a signal of consumer confidence, slowed to 11%, compared with 13% in 2014.