Small US colleges are swallowing more tuition costs, but still struggling to attract students

College tuition in the US continues to increase. A number of small private colleges, though, are offsetting some of these increases by covering a larger share of student tuition and fees.

College tuition in the US continues to increase. A number of small private colleges, though, are offsetting some of these increases by covering a larger share of student tuition and fees.

That practice is measured with the “tuition discount rate”—that is, the share of the total tuition and fees charged that a university absorbs, rather than collecting from parents and students. Many private universities use money from the school’s endowment to give institutional grants to students based on need or merit.

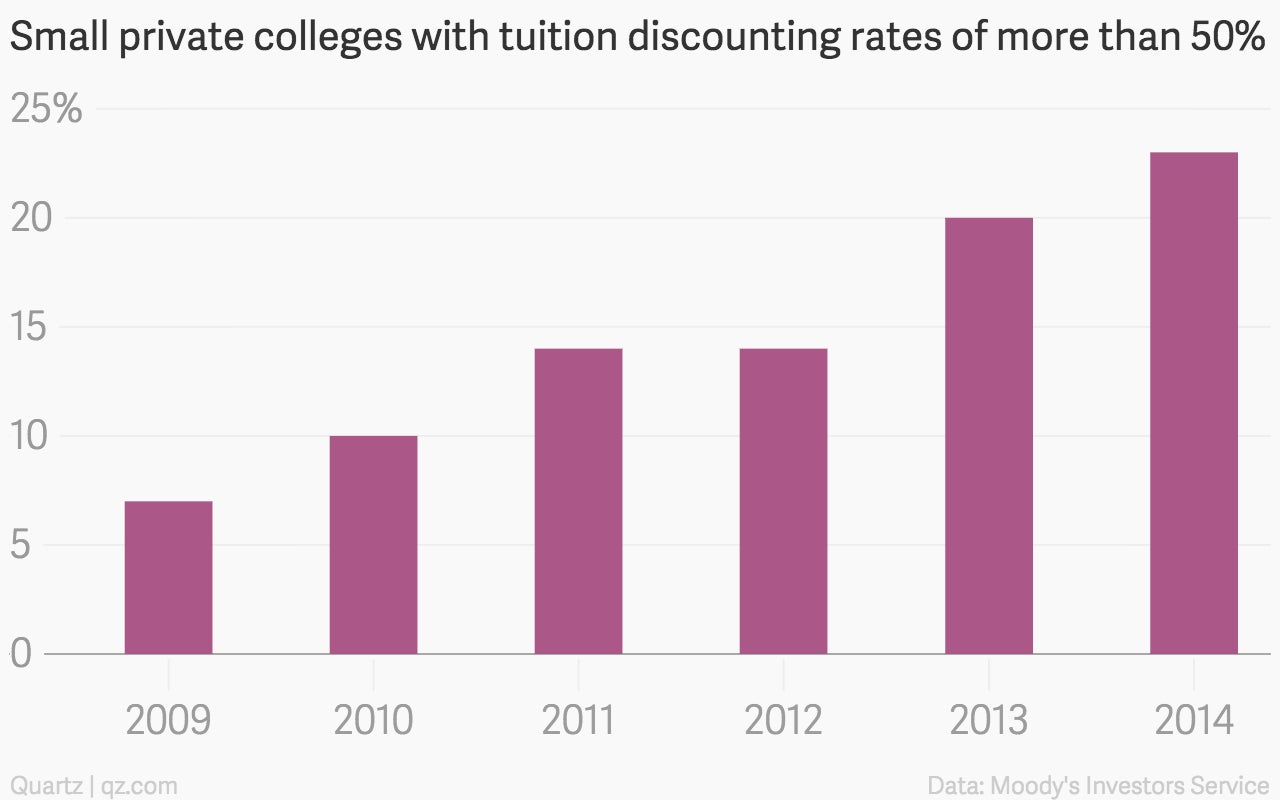

Since 2009, the number of small private colleges in the US in which students overall pay less than half of the set tuition is rising, according to a Moody’s credit outlook report (login required). Moody’s looked at 83 private colleges and universities with less than $100 million in operating revenue, and almost a quarter—23%—were swallowing more than half of the tuition they charged.

In 28 of the colleges, tuition discount rates reached 40-50% in 2014, according to data Moody’s provided to Quartz.

These colleges are facing what some have called a “death spiral”: Often in remote areas, they’re having a hard time attracting students who don’t see the value of racking up mounds of debt to live far from a city for four years, and attend a school with little name-recognition. So the schools are offering steep tuition discounts to attract more students.

But the strategy may be backfiring: Tuition is a primary revenue source for most of these universities, so the discounts are having a negative effect on the schools’ operations, the Moody’s report notes. These colleges don’t have billions in endowments that can help absorb the cost of discounts, as Harvard or Texas A&M do, so some have faced difficult decisions such as layoffs or closing whole departments. Others have chosen to merge with other small schools, or be absorbed by larger institutions.

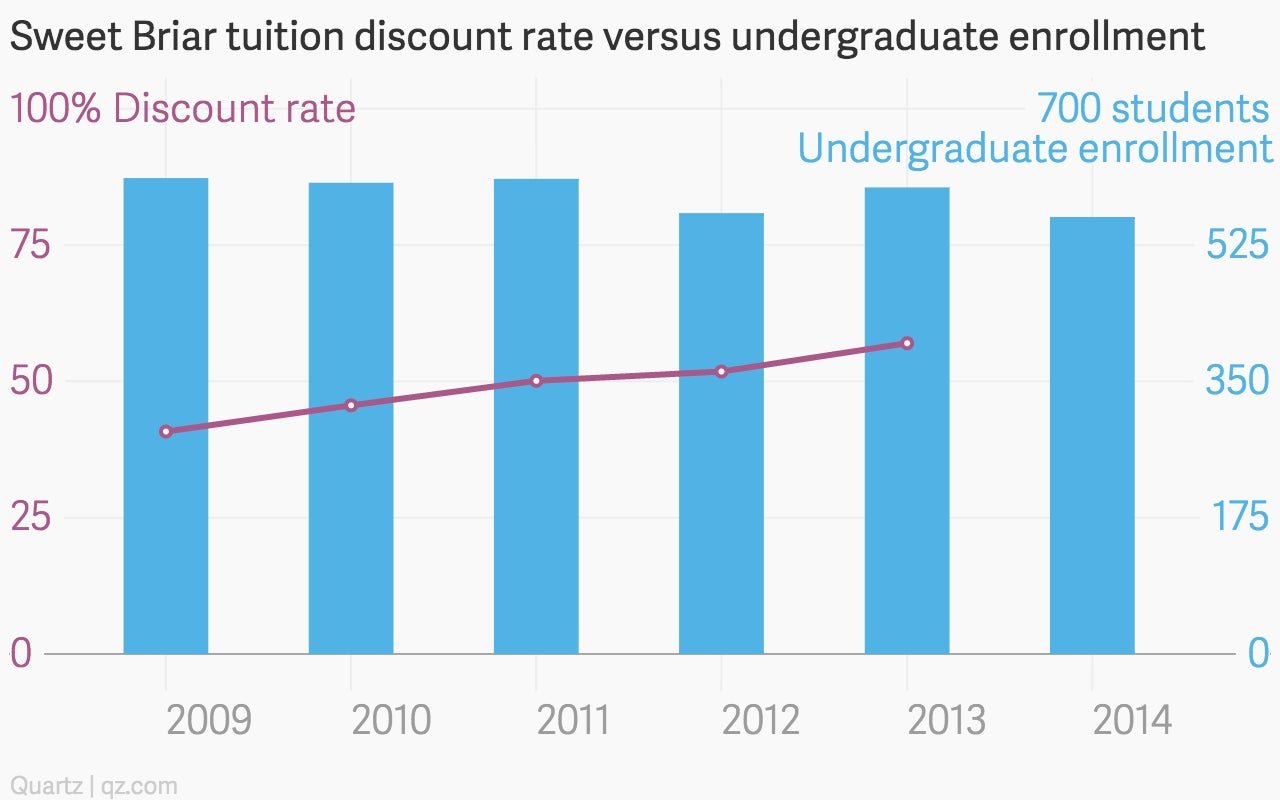

One all-women college in rural Virginia, Sweet Briar, announced its closure in February. The college’s discount rate has increased steadily in recent years, even as enrollment has declined, according to data Sweet Briar gave Inside Higher Ed (and confirmed with Quartz).

Private colleges throughout the US, not just small ones, are facing increasing discount rates. In 2012, the average discount rate was 40.2% for a US private college undergraduate student, according to an analysis of 401 institutions.

So, does this mean an education at these colleges with high discount rates is a cheap deal?

Not necessarily. Discount rate increases often happen in tandem with tuition increases, Inside Higher Ed notes, so students might still find themselves stuck with a heftier bill. (At Sweet Briar, for example, tuition jumped 4% from last school year to the current one.)

It’s also important to know that discount rates are calculated based on the whole student body, and are not applied uniformly. Colleges grant tuition breaks based on need or merit, so some students might be paying very little, while others pay full price.