American banks are safer, but don’t forget about the shadow banks

The US Federal Reserve has issued its yearly report card on the strength of the financial system and for the most part, the news is good.

The US Federal Reserve has issued its yearly report card on the strength of the financial system and for the most part, the news is good.

True, the Fed rejected the capital plans of the US units of two large European banks. The central bank made the decision after its annual ‘stress tests’ of the 31 largest banks. The tests measure whether the institutions have enough capital to withstand another severe economic and financial downturn. The Fed said Deutsche Bank and Santander failed to adequately predict risks and potential losses.

And Bank of America only received conditional approval to increase dividends or return cash to shareholders once it has satisfied the Fed’s concerns over BofA’s ability to measure its losses and revenue and then resubmit its capital plans.

But Goldman Sachs, JP Morgan Chase, and Morgan Stanley, ended up meeting minimum capital requirements after revising and resubmitting their capital plans. Meanwhile, Citigroup was finally able to gain approval of its capital plans after failing the tests twice over the last three years. Banks including Goldman Sachs, Wells Fargo, Morgan Stanley, and JP Morgan wasted no time in announcing plans to increase their dividends—a welcome sign to bank shareholders.

At the heart of this annual exercise is the Fed’s effort to induce banks to operate using less borrowed money and rely more on their own capital. If given their druthers, banks prefer to use borrowed money—leverage—to invest, as it has the power to amplify positive returns. Unfortunately, leverage also amplifies losses. And excessive leverage was a major factor in the financial crisis, helping to create the need for a US government bailout of, effectively, the entire financial sector.

There are signs the system is safer today. Metrics show bank capital levels are much higher than they were before the crisis.

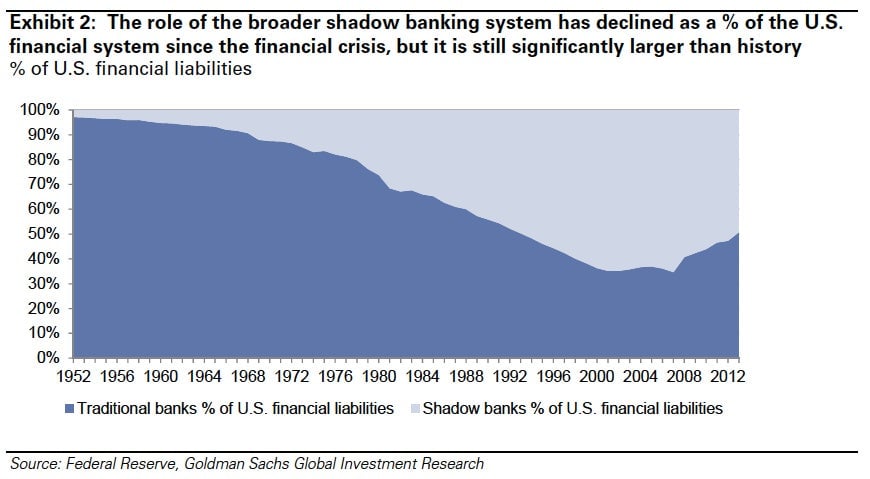

And while a safer banking system is undoubtedly good. That’s not the end of the story. Some argue that the very regulation that is improving the safety of banks is also pushing risky behavior out of the regulated system altogether. Such so-called “shadow banking” was also a source of financial instability during the crisis. And it remains quite a large part of the financial system, according to a recent report from Goldman Sachs analysts.

In other words, safer banks are a good thing. But don’t forget about the financial wizards pursuing new—and potentially risky—alchemical experiments outside of the regulated banking system.