ExxonMobil, the world’s biggest oil company, has turned slightly more optimistic about electric cars

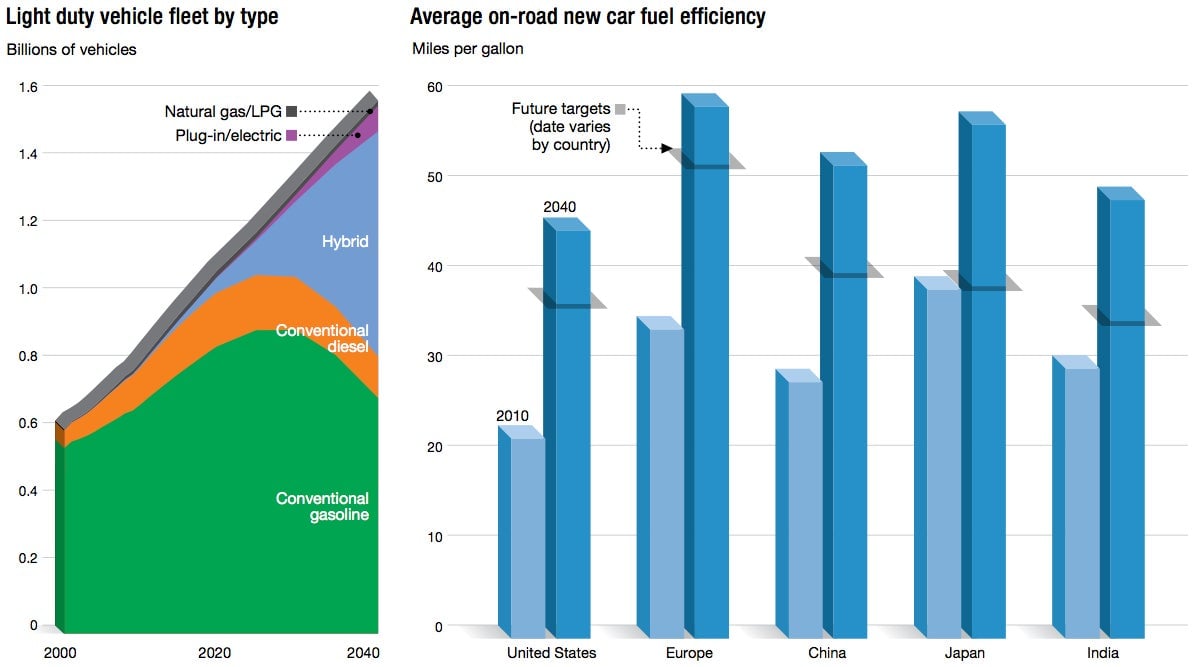

Last year, ExxonMobil, in its annual long-term forecast, delivered an unsentimental message to the nascent electric-car industry: For at least the next three decades, not only electric cars, but plug-in hybrids such as the GM Volt, were destined to be a decidedly niche play. Together with far-out vehicles burning liquefied petroleum gas (LPG) and compressed natural gas (CNG), these cars would make up just 5% of the global fleet by 2040 (pdf, p. 20), although ordinary hybrids—gasoline-propelled vehicles like the Prius with a modest added battery drive—would be about 40% of it.

Last year, ExxonMobil, in its annual long-term forecast, delivered an unsentimental message to the nascent electric-car industry: For at least the next three decades, not only electric cars, but plug-in hybrids such as the GM Volt, were destined to be a decidedly niche play. Together with far-out vehicles burning liquefied petroleum gas (LPG) and compressed natural gas (CNG), these cars would make up just 5% of the global fleet by 2040 (pdf, p. 20), although ordinary hybrids—gasoline-propelled vehicles like the Prius with a modest added battery drive—would be about 40% of it.

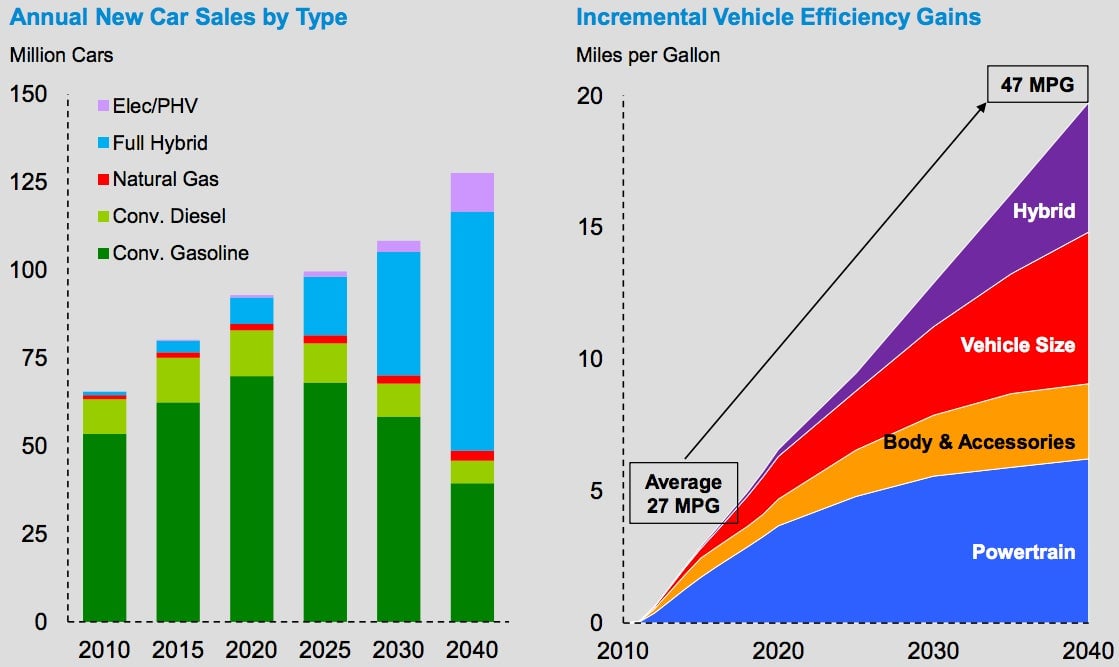

But in Exxon’s latest 2040 forecast, unveiled Dec. 11, there is a subtle difference. The category of electric cars and plug-in hybrids no longer includes LPG and CNG vehicles, but stands on its own. And in 2040, they alone comprise 5% of the market, and 10% of all sales.

That is not a sea-change. Exxon executives continue to bet that scientists will fail to make the breakthrough that quadruples or quintuples battery life, a pre-requisite for electric vehicles to become serious contenders. Exxon itself told me that there is no change. “Our 2013 Outlook for electric cars/plug-in hybrids is very similar to the last year’s report,” the company said.

Yet the fact that electrics are no longer in the “miscellaneous” category, and hold more of the market, does seem to reflect a nuanced and important change of attitude on Exxon’s part. Perhaps it reflects more respect for carmakers such as Nissan—whose new models include an electric Infiniti—that are betting on a future in which electrics play a larger role.