OPEC expects to run US shale out of the market by the end of the year

As weak prices make oil production an increasingly less attractive business, OPEC seems confident that its battle plan against US shale producers—to simply outlast them—will force a surrender by the end of the year.

As weak prices make oil production an increasingly less attractive business, OPEC seems confident that its battle plan against US shale producers—to simply outlast them—will force a surrender by the end of the year.

But the numbers so far indicate that the brinksmanship will last much longer than that.

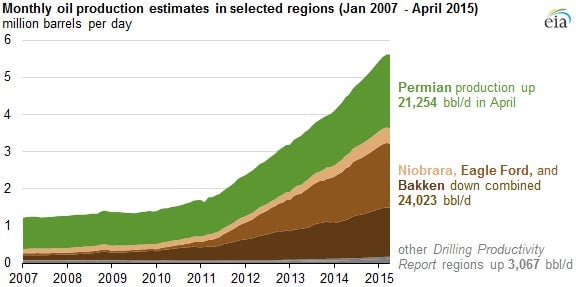

In a new report (pdf), OPEC cites a plunge in the number of rigs drilling in the US shale patch as evidence that American oil production will fall “possibly by late 2015.” It notes that the US rig count has fallen for 13 straight weeks (p. 53), to the lowest number since December 2009. However, recent figures from the US Energy Information Administration indicate that US oil production has actually risen this month despite the lower rig count. Look at this chart.

The Saudis may ultimately be right about US production levels. But there is reason to question their logic. As the Financial Times reports, US shale gas production has continued to rise despite a plummet in the number of rigs drilling for it (268, down from 1,606 in 2008). The precise same method is used to drill for shale oil as for shale gas, so why shouldn’t oil production stay similarly buoyant?

Saudi Arabia has been successful so far in persuading its OPEC partners to maintain the flow of crude into a glutted market in order to squeeze out higher-cost producers, especially US shale. That glut has sent oil prices lower since last June, including a further plunge today.

The Saudis have calculated that the financial pain will be worth it—that they can run much of the US shale industry out of the market—if they can only hold out until the end of the year. In other words, a single year of financial suffering, followed by a return to OPEC’s accustomed perch as oil king.

Production levels, however, suggest that OPEC’s misery won’t end so quickly.