Commercial real estate’s dilemma: Just because you build it, they won’t come

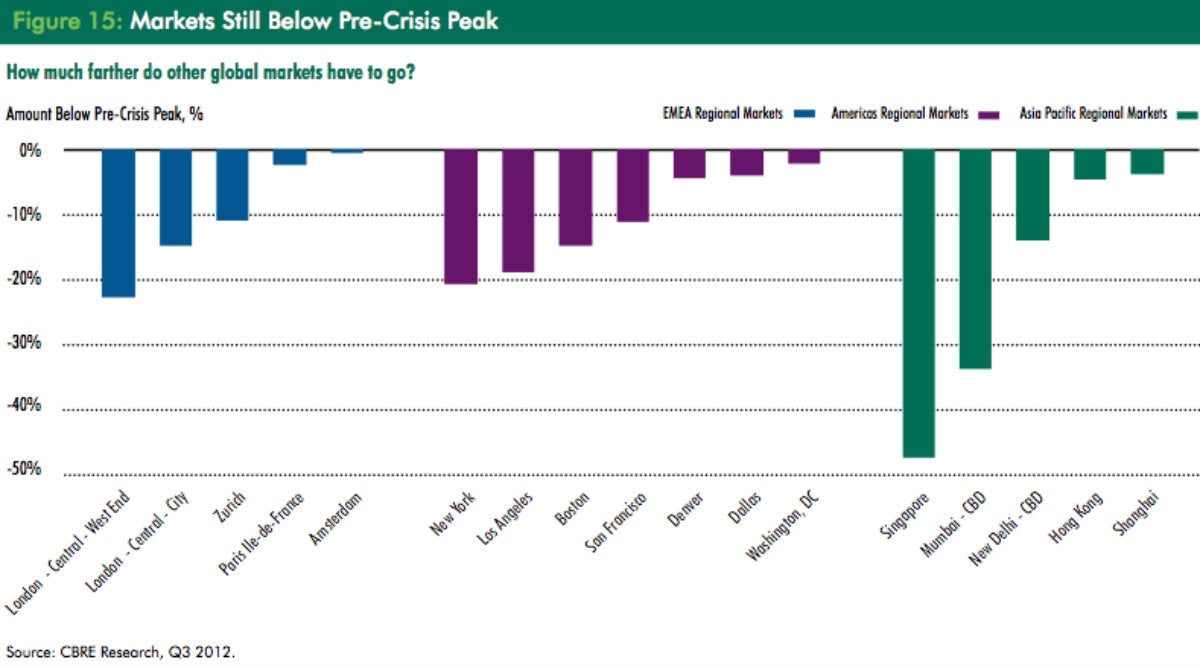

This might be the global property market’s new normal. Here’s a telling chart from a report (pdf) just released by real-estate firm CBRE:

This might be the global property market’s new normal. Here’s a telling chart from a report (pdf) just released by real-estate firm CBRE:

What’s noteworthy is that while some of these markets have been slammed in the financial crisis, others such as Washington and Singapore have fared fairly well. So what’s going on? Blame an oversupply and competition from outlying (and much cheaper) areas. The report notes:

Within regions, performance lacked uniformity across markets. The Makati CBD in Manila, for example, experienced relatively strong rent growth thanks to high occupancies, demand for high-quality space and a minimal amount of new supply. Meanwhile, the central business districts of Mumbai, Bangalore, Adelaide and Shanghai entered the downward portion of their rent cycles due, in part, to the introduction of new supply in decentralized areas which offers more competitive rents…

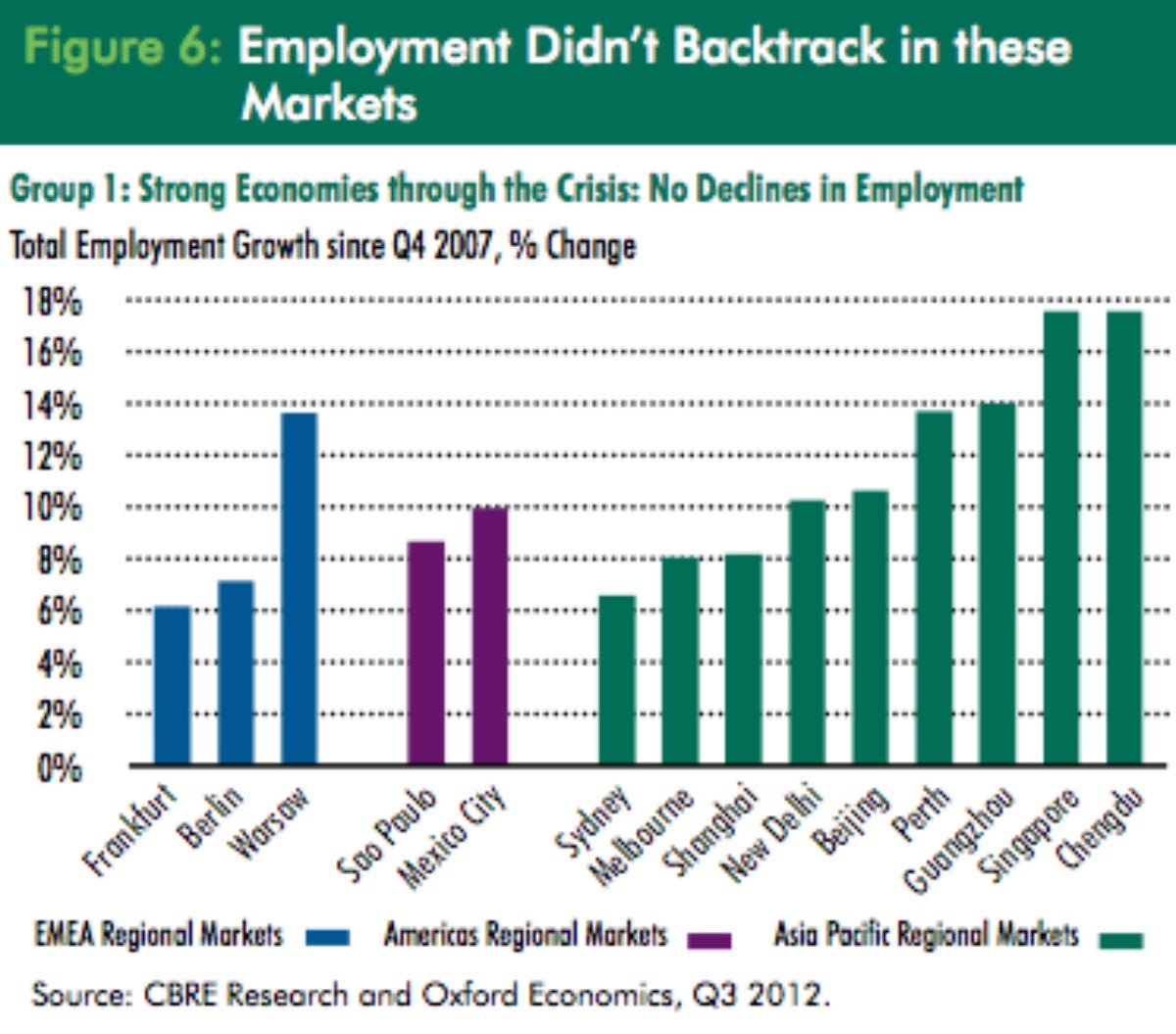

The cost of renting office space in San Francisco soared highest, driven by technology companies. But as the chart above shows, even that city hasn’t returned to pre-crisis levels. Another telling chart:

Note that cities like New Delhi and Shanghai did not suffer a downturn in employment but did in commercial real estate. As long as these cities continue to build (and oversaturate), their rents likely won’t be seeing those peaks anytime soon.