With tech startups, Wall Street goes where Silicon Valley leads

The cliquish, insular world of Wall Street is converging with the even more clubby enclave of Silicon Valley venture capitalists.

The cliquish, insular world of Wall Street is converging with the even more clubby enclave of Silicon Valley venture capitalists.

The New York Times recently wrote about how Americans’ retirement funds are increasingly made up of tech startup stocks (paywall) such as Uber and Airbnb. Money managers don’t want to miss out on the rocketing growth in private companies that are racking up billion-dollar valuations at an unprecedented pace.

But what the story left out was how Wall Street firms are choosing these investments. They aren’t just going after any tech startups. They’re primarily piling onto investments only after a select group of VC funds have already given their blessing, according to data from CB Insights.

The firm found that the odds of a big money manager such as Fidelity or BlackRock investing in a tech startup increases dramatically once a young company receives money from one of these 11 VC firms: Greylock Partners, Andreessen Horowitz, Sequoia Capital, Benchmark Capital, Norwest Venture Partners, Accel Partners, Kleiner Perkins Caufield & Byers, DAG Ventures, Union Square Ventures, New Enterprise Associates, and Bessemer Venture Partners.

There’s good reason to follow these venture capital bigwigs. They have a track record of making major, successful bets on companies such as Facebook and LinkedIn.

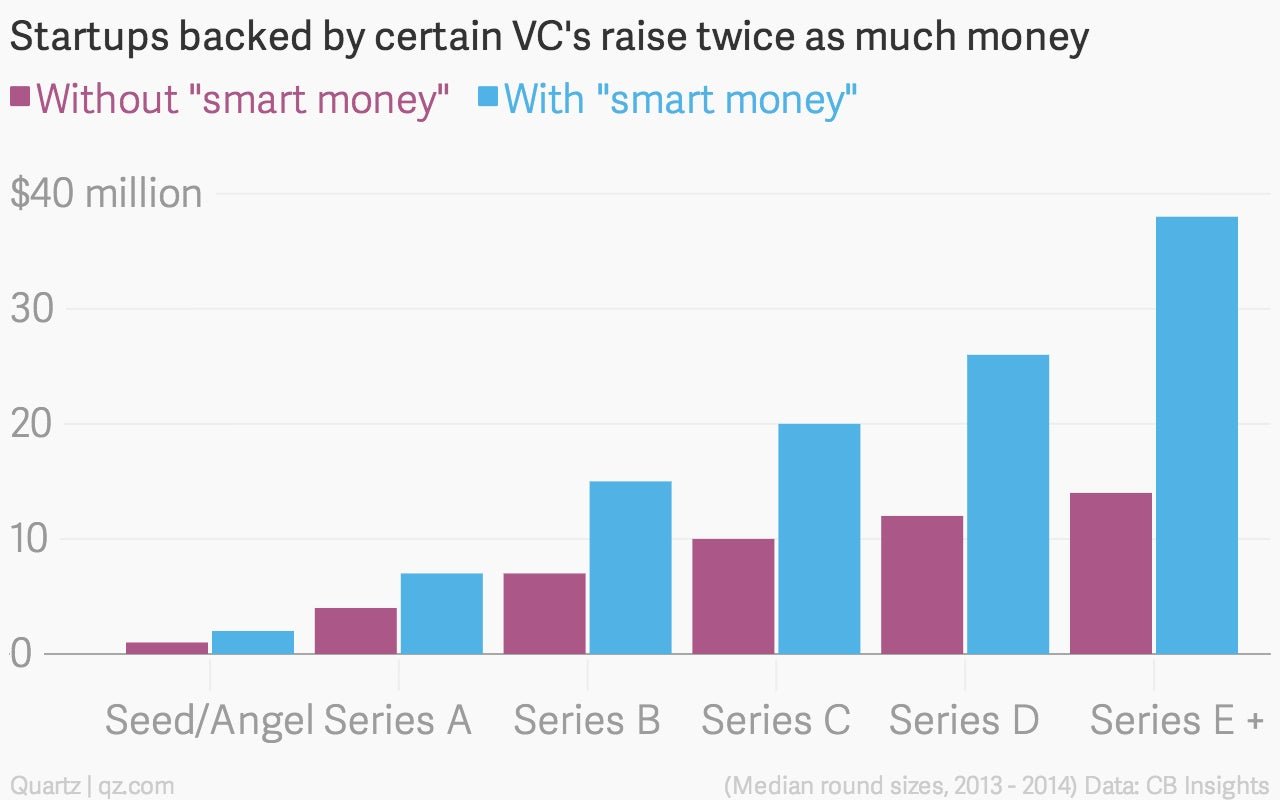

And their mark of approval tends to fuel more funding: Startups that raise money from what CB Insights deems “smart money” VCs end up raising at least twice as much money than those without backing from the Silicon Valley darlings.

Here’s the breakdown by funding stage of the tech startups in the past two years that CB Insights looked at: