Regardless of how their companies do, male executives win and women lose

The gender pay gap in the United States varies by job, but one of the places it’s starkest is at the top of the corporate ladder.

The gender pay gap in the United States varies by job, but one of the places it’s starkest is at the top of the corporate ladder.

It’s not just that there are fewer women in the executive suite, or that there’s a large and persistent pay gap. Women get less incentive pay, and less money for good performance than men. They take substantially bigger pay hits when companies do badly, and get much less of a boost in good years, according to a newly published New York Fed staff report (pdf) highlighted by Bloomberg.

The study controls for the fact that women executives tend to be younger and in less senior positions.

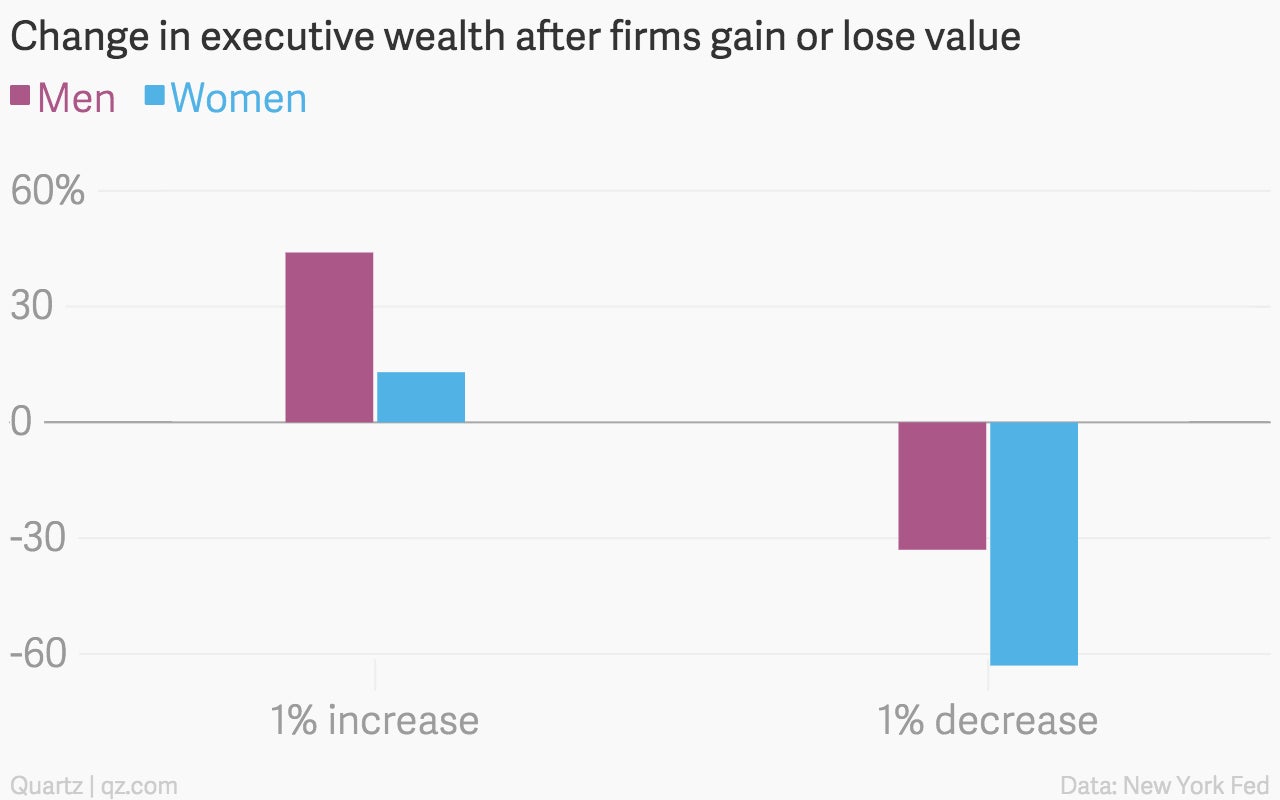

The differences are pretty extraordinary. Here’s how firm-specific wealth (stock options and grants, often the majority of incentive pay) changes for executives of both genders with a 1% gain or loss in a firm’s total value. Male executives do better in good times and suffer less in bad times:

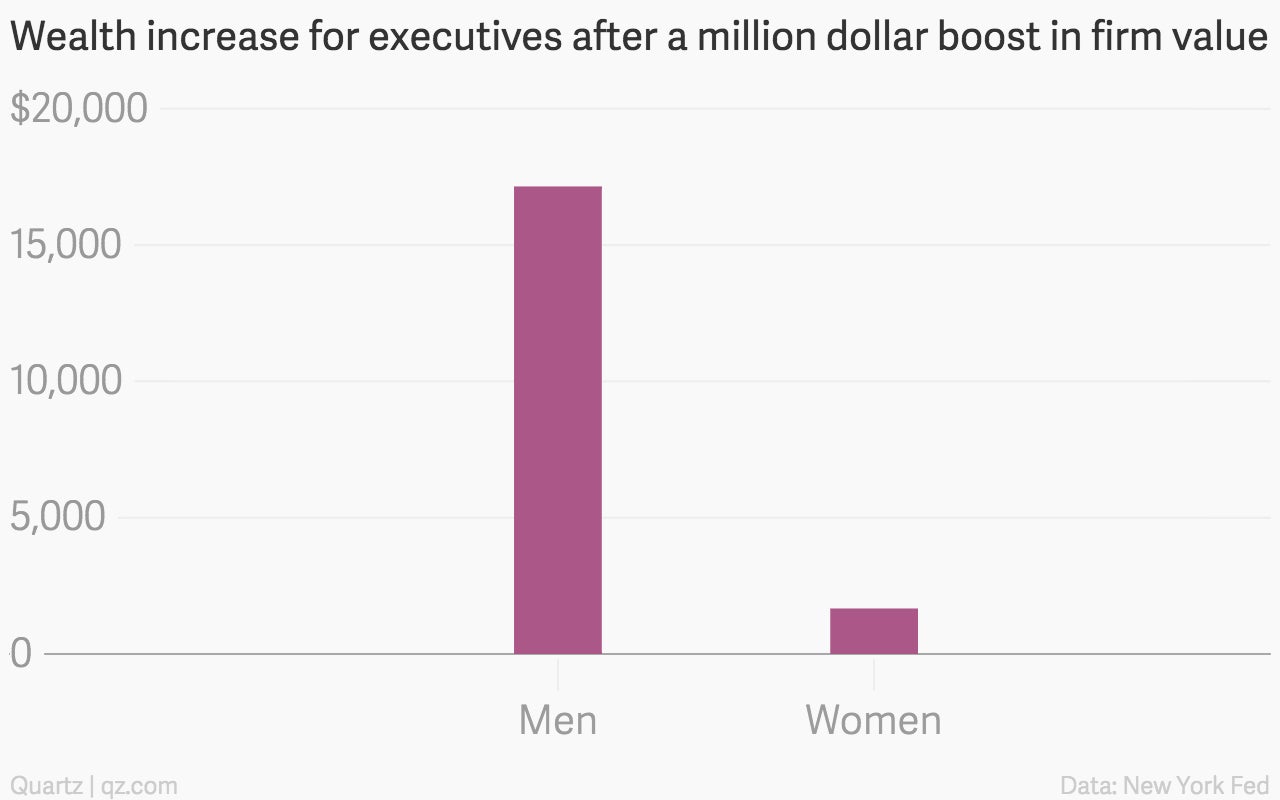

Here’s how executives fare with a million-dollar increase in a firm’s value:

This is a pretty big deal, especially as executives reap billions with stock market gains. Why the huge gap?

One argument is that executive pay is rational and efficient (the “efficient contracting paradigm”), and this is just the result of differences in performance and effort.

Female executives do face a series of barriers that can impact performance. They feel excluded from informal networks, face gender stereotypes, have less access to mentors, and spend more hours managing households and taking care of children than men do.

But the researchers found (PDF) that the gender of executives makes no difference in company performance, which directly contradicts this theory (and other research has shown that companies run by women actually perform better). This theory also completely fails to explain why women gain less when a company does well, and hurt more in bad years.

The researchers suggest instead that the managerial power or “skimming” model, which suggests that executives influence boards (or superiors in general) to increase their pay, is more relevant here.

The vast majority of board members and executives are men. Board members are sensitive to executive pressure because they share informal networks, CEOs can reciprocate favors, and because many board members are current and former executives.

These factors create benefits for entrenched executives with great networks who fit right into common corporate cultures. In other words, men. From the report:

The fact that female top executives perceive limited access to informal networks, gender stereotyping, an inhospitable corporate culture, jointly with their younger age and lower tenure, suggests that they might be considerably less entrenched and exert lower control on their own compensation than their male counterparts on average.

Put bluntly, executive pay is a function of an old-boys network that has made an art of hogging the stock-based compensation. Women have a fraction of the access, and receive a fraction of the benefit.

The fact that these large differences persist in public companies, which are legally required to disclose details of top executive compensation, suggests that things might be even worse elsewhere.