Nigeria is celebrating its first peaceful transition of power with a big market rally

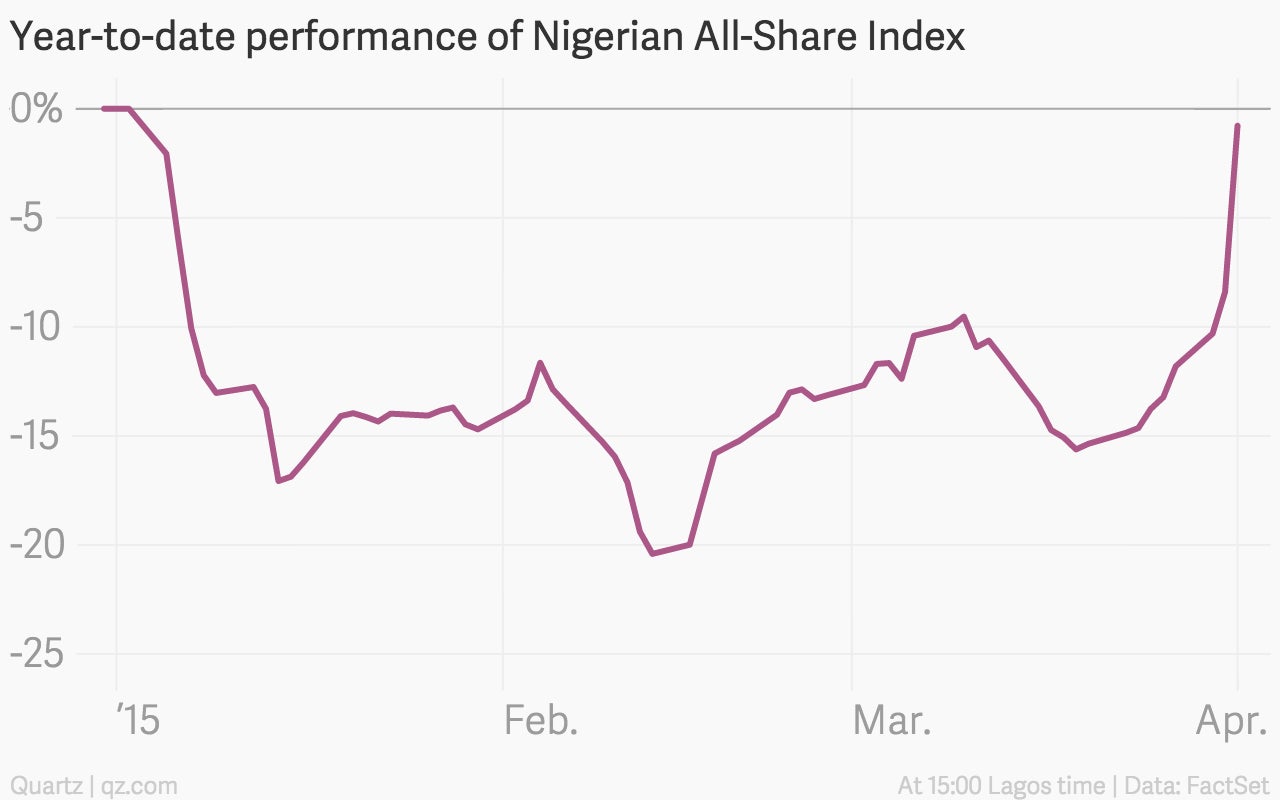

There is such a thing as a “democracy dividend.” In Nigeria, it’s worth an 8% gain on the stock market.

There is such a thing as a “democracy dividend.” In Nigeria, it’s worth an 8% gain on the stock market.

This is perhaps a flippant way to look at the country’s first peaceful transition of power since 1960. But it’s hard to ignore that a wide range of Nigerian assets are rising sharply today, after incumbent president Goodluck Jonathan conceded defeat to challenger Muhammadu Buhari after a hard-fought but reportedly mostly fair election.

Nigerian stocks are topping the world rankings today, extending a nine-day rally that has regained almost all of the ground lost during pre-election jitters earlier in the year:

Even the battered naira is showing some signs of life, after a severe and prolonged slide over the past six months, dragged down by falling oil prices. And despite recent cuts to its credit rating, Nigerian government bonds have also been rallying hard.

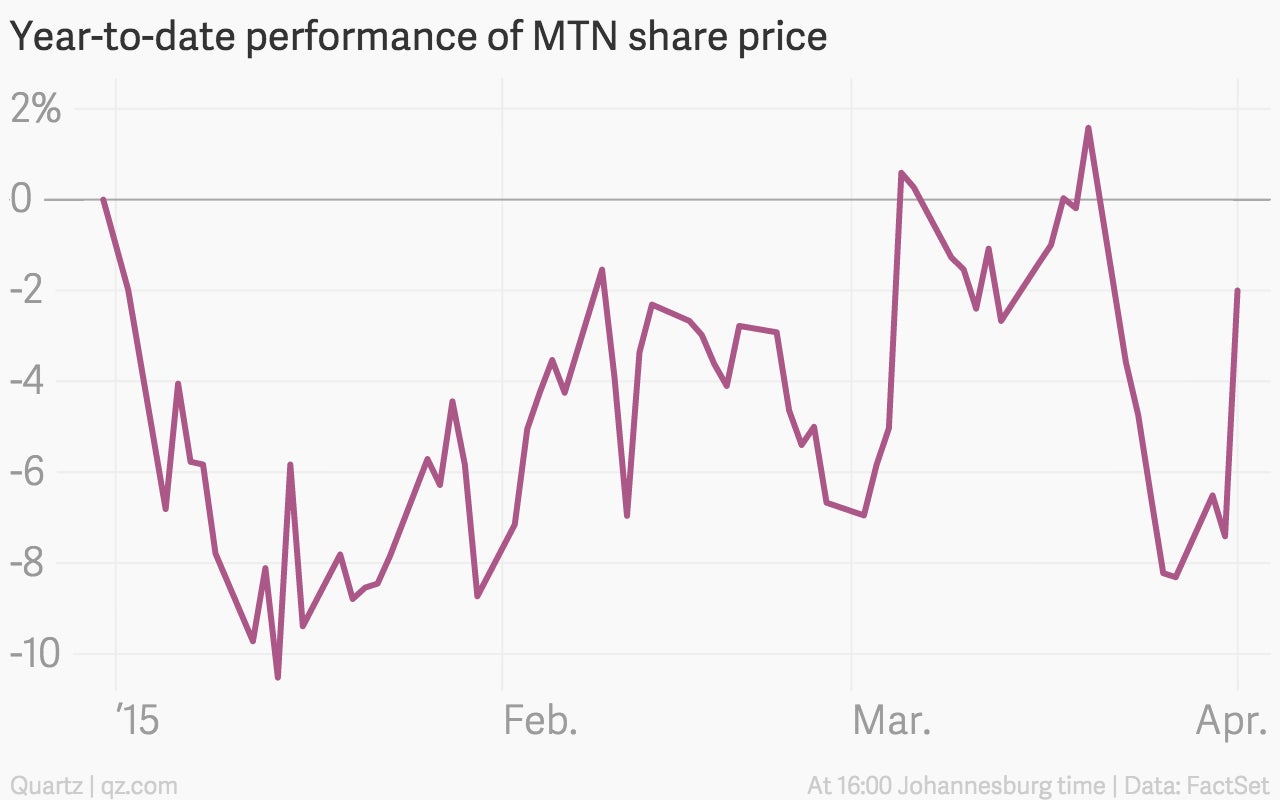

The euphoria is not confined to Nigeria—the ripple effects from Africa’s largest country can be seen across the continent. Shares of the South Africa-based mobile operator MTN, which runs a large division in Nigeria, saw a big one-day gain during Johannesburg trading:

To be sure, Buhari, a former military dictator, comes with plenty of baggage. But for investors used to instability and unpredictability in Nigeria, the nature of his return to power is something to cheer. For now.