In seven of Africa’s leading economies, nearly a third of mobile users pay with their phones

As many as 30% of cell phone users in Africa report that they participate in mobile banking. A new report from the Pew Research Center shows the transformative power of the cell phone in the world’s fastest-growing market for mobile technology.

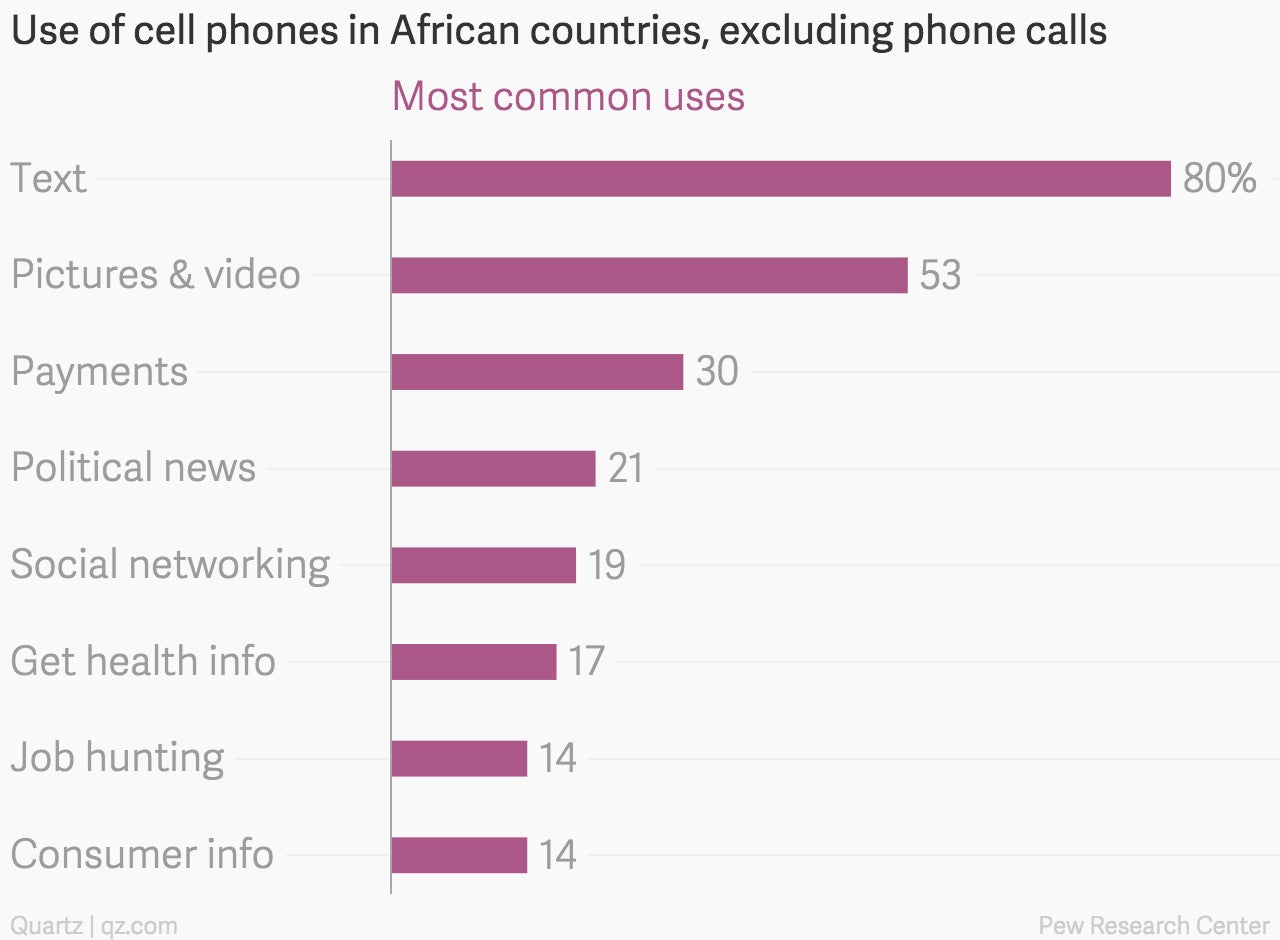

As many as 30% of cell phone users in Africa report that they participate in mobile banking. A new report from the Pew Research Center shows the transformative power of the cell phone in the world’s fastest-growing market for mobile technology.

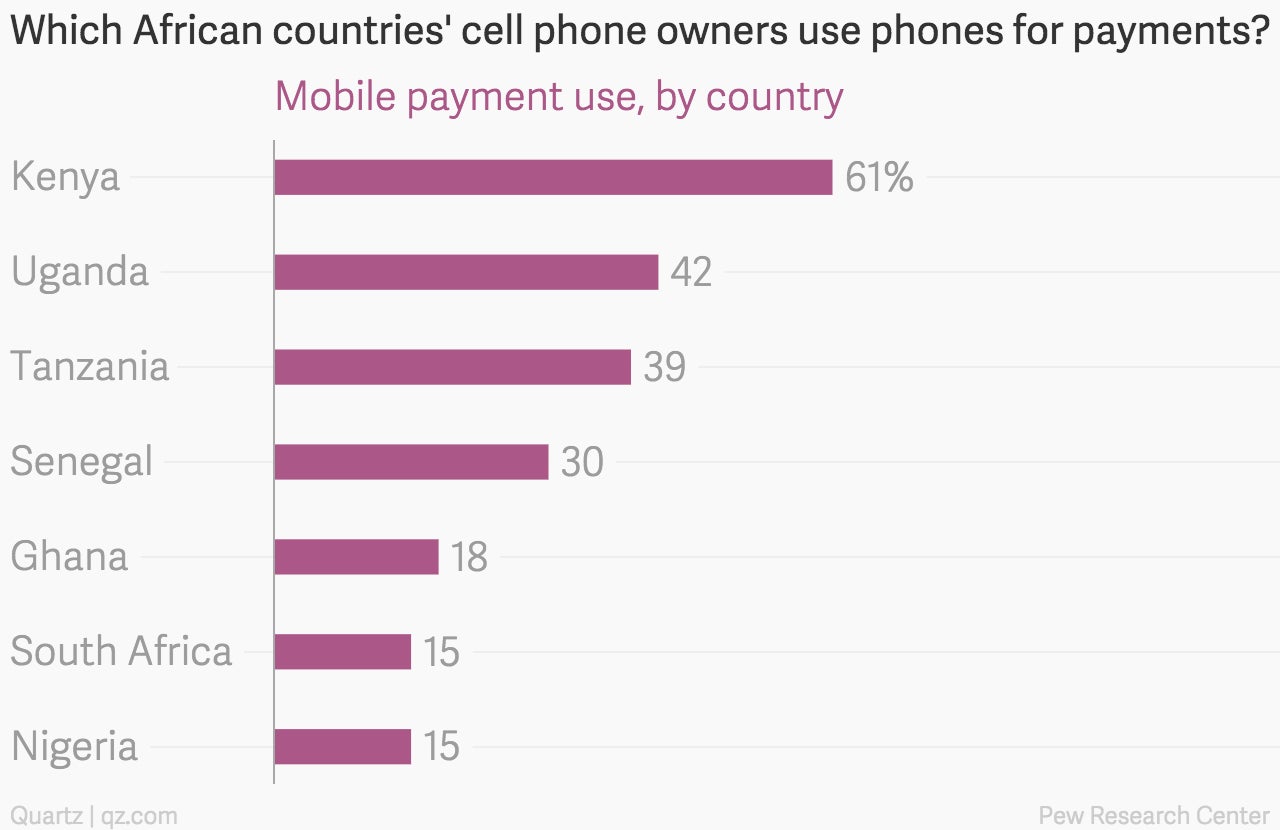

The organization surveyed mobile users in 7 countries in Sub-Saharan Africa, finding that two-thirds or more respondents said they owned a mobile phone. In South Africa and Nigeria, two of the continent’s largest economies, it was nine-in-ten. This is an enormous leap from just a decade ago. For instance, in 2002, 8% of Ghanians had mobiles. Now that number is 83%. But what they are used for could come as somewhat of a surprise: while most people make calls and text, 30% of mobile users said they used their phone to make a payment in the past 12 months.

The mobile banking industry is huge in several of the surveyed countries, most notably in Kenya, Tanzania and Uganda.

Mobile money services are a crucial tool for micro businesses in the country, touted as the way for companies to reach the global poor. In Kenya, where one-fourth of the GNP flows through mobile payments, you can pay for a cab ride with your cell or get a loan. Mobile payments in the country reach $320 million a month, according to 2010 data.