The US stock rally is making it seem as if America is binging on debt

Americans, as a whole, are the world’s biggest debtors. But is that their fault, or even such a bad thing?

Americans, as a whole, are the world’s biggest debtors. But is that their fault, or even such a bad thing?

The US does some accounting to compare how many foreign assets Americans own to how many American assets foreigners own, including both governments and private citizens. In 2014, foreigners owned almost $7 trillion more US assets than Americans owned in the rest of the world:

That is quite a drop! And while not necessarily a positive thing, the $7 trillion difference is equal to a fairly manageable 40% of annual US economic output—the International Monetary Fund only gets worried (pdf) when net foreign liabilities exceed 60%, as they currently do for Spain and Poland. When countries owe that much to foreign investors, they can be vulnerable to sell-offs and shocks.

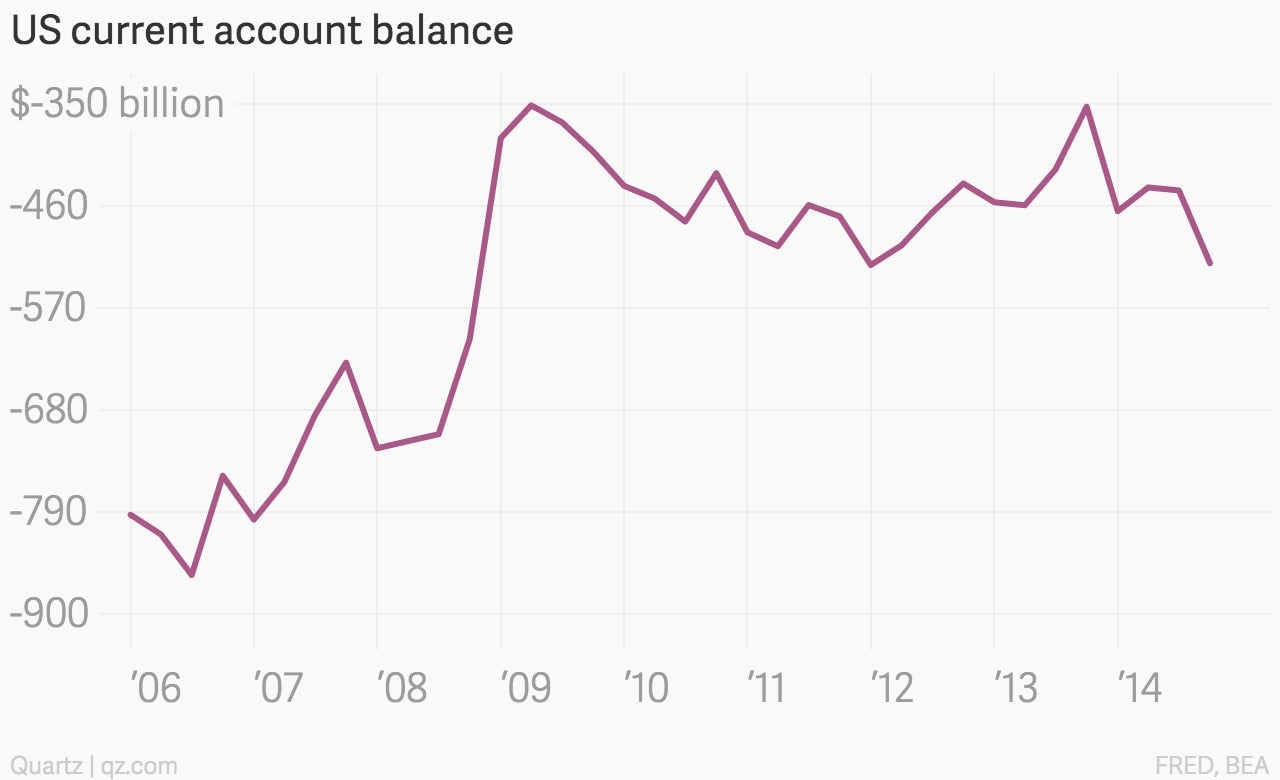

But there’s something weird about the recent US situation, as economists Timothy Taylor and Paul Krugman have noted. The US also keeps track of its balance of payments, netting out the goods and money that cross its borders each year:

In the same period in which the US investment position has fallen, the country actually has been keeping more money inside its borders—thanks to, among other things, rising oil exports and falling rates of government borrowing. The US also has been badgering other countries it sees as artificially inflating their current account surpluses in an effort to get to balance.

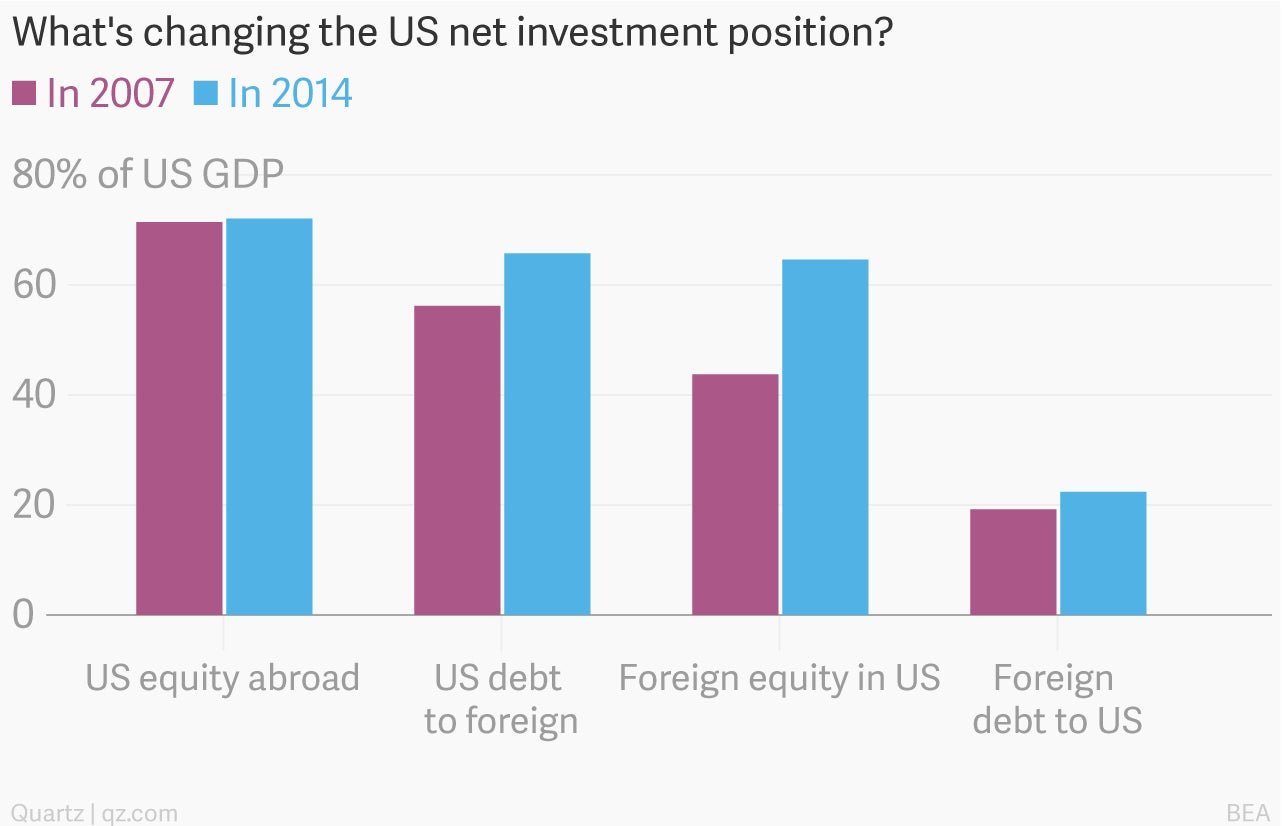

So what’s going on with the US investment position? Krugman has a theory: The US stock boom has been inflating the value of the assets owned by foreigners, while doldrums around the world haven’t led to boosts in US-owned assets abroad. Indeed, the major difference in the last seven years is the increase in foreign investment in US equities, not US borrowing from abroad:

Economists expect a rich nation like the US generally would send lots of capital abroad to places where it is scarce, and the US does send a significant amount of money chasing risk in the world. Meanwhile, the US, as Taylor puts it, is “a producer of what investors all around the world regard as safe financial assets.” That suggests all the US speculation into the rest of the world is being out-matched by every one else trying to get a bit of US (financial) security.

Either that, or maybe the US has a stock bubble big enough to distort international statistics.