Cross-border deals between African businesses has been fueling local M&A activity this year

For a long while, cross-border merger and acquisitions activity in Africa has been a one-way street with buyers from outside Africa picking up ‘risky’ bargains on the continent. But increasingly, African companies are looking to expand from their respective countries and venturing into their neighboring countries in a sign of renewed self-confidence and belief in Africa’s economic prospects.

For a long while, cross-border merger and acquisitions activity in Africa has been a one-way street with buyers from outside Africa picking up ‘risky’ bargains on the continent. But increasingly, African companies are looking to expand from their respective countries and venturing into their neighboring countries in a sign of renewed self-confidence and belief in Africa’s economic prospects.

In one such example this week Nigeria’s No. 2 mobile phone firm Globacom said it plans to acquire the wireless company Comium Cote d’Ivoire in a $600 million deal for the cash-strapped operator with some 900,000 customers. By buying Cote d’Ivoire No.4 player it will expand Globacom’s operations in the West African region where it also has presence in the Republic of Benin and Ghana.

Last month, Atlas Mara, the financial services firm founded by former Barclays CEO Bob Diamond and Ugandan entrepreneur Ashish Thakkar, revealed that it was buying a 45% stake in Banque Populaire du Rwanda (BPR), a Rwandan bank. This will be its second bank acquisition in the country after it secured 75% ownership of Rwanda Development Bank (BRD) in 2014.

Meanwhile, private equity firm Carlyle dropped $150 million in September for a 18% stake in Diamond Bank, one of the bigger financial institutions in Nigeria. Elsewhere, in July of last year, Danone, the French food giant, bought a 40% stake in Kenya’s Brookside, East Africa’s top dairy producer. All this activity explains why in 2014, intra-regional M&A deals between African countries quadrupled to US$13.5 billion.

According to the Financial Times, 2014 saw over 631 deals, a 10% jump from the year before. In 2015, analysts predict a 53% rise in M&A deals on the continent. What is also worth noting is that a lot of these deals go beyond extractives and oil and gas, traditional areas of focus for investors. Telecoms, banking and consumer products are becoming more attractive spaces for deals.

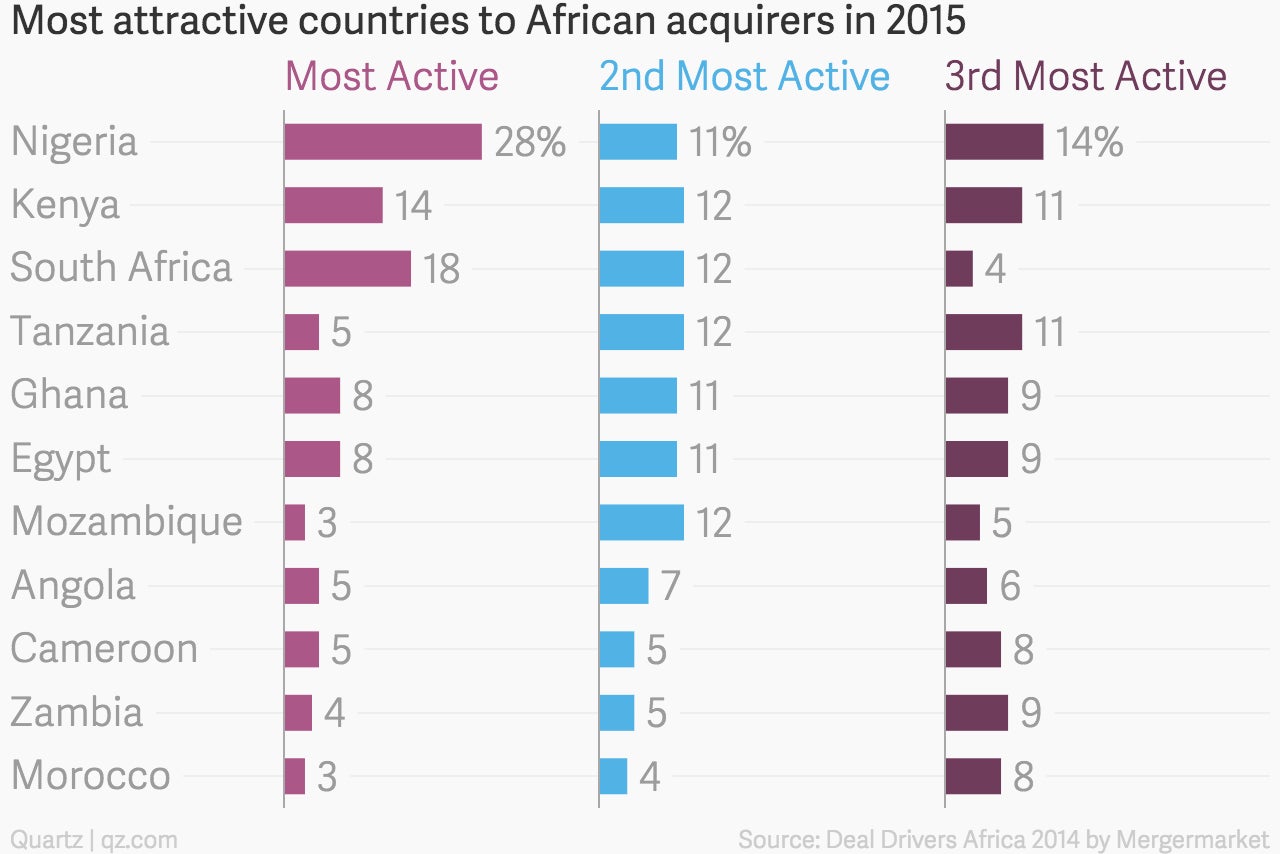

And analysts are optimistic that 2015 will see significant cross-border deals involving African companies. In a survey of M&A players in Africa (pdf) by the intelligence and news service firm Mergermarket, 92% of the respondents expect the trend to grow. Nigeria and South Africa were expected to be the lead acquirer in cross-border M&A activity by the analysts. As to what country would prove the most attractive to African investors, here is the breakdown of their responses.