How airlines are managing the labyrinth of aviation risk

In terms of negative, high profile events, the recent years have been challenging for the airline industry, primarily because of two incidents. In early March 2014, Malaysia Airlines Flight 370 mysteriously disappeared, with 239 passengers and crew on board, while en route from Kuala Lumpur to Beijing. And in July 2014, the same airline’s Flight 17 was shot down over war-torn Ukraine, shortly after departing Amsterdam en route to Kuala Lumpur. All 298 passengers and crewmembers were killed.

In terms of negative, high profile events, the recent years have been challenging for the airline industry, primarily because of two incidents. In early March 2014, Malaysia Airlines Flight 370 mysteriously disappeared, with 239 passengers and crew on board, while en route from Kuala Lumpur to Beijing. And in July 2014, the same airline’s Flight 17 was shot down over war-torn Ukraine, shortly after departing Amsterdam en route to Kuala Lumpur. All 298 passengers and crewmembers were killed.

These were obviously terrible human tragedies. But they were also highly unusual events, with at least one (the crash in Ukraine) not a “typical” airline accident at all.

Because they were so unusual, and because they were the first major commercial airline disasters in the five years since 2009, they serve as a reminder of the resiliency of the airline industry and its long-term gains in safety. So safe, in fact, that in 2013, The New York Times was prompted to publish an article entitled “Airline Industry at Its Safest Since the Dawn of the Jet Age.” The authors note that, on average, a passenger could fly every day for 123,000 years before encountering a fatal flight.

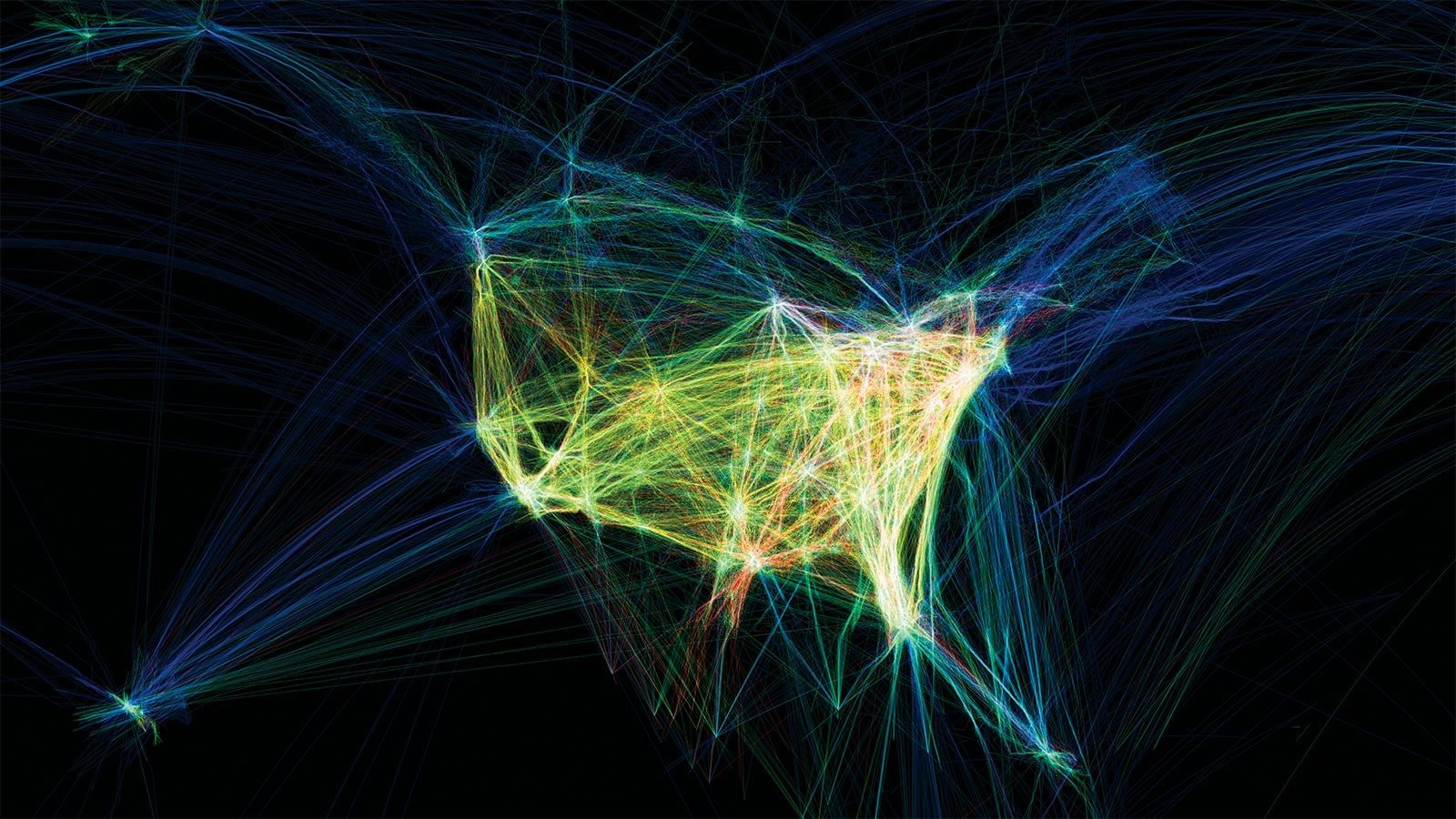

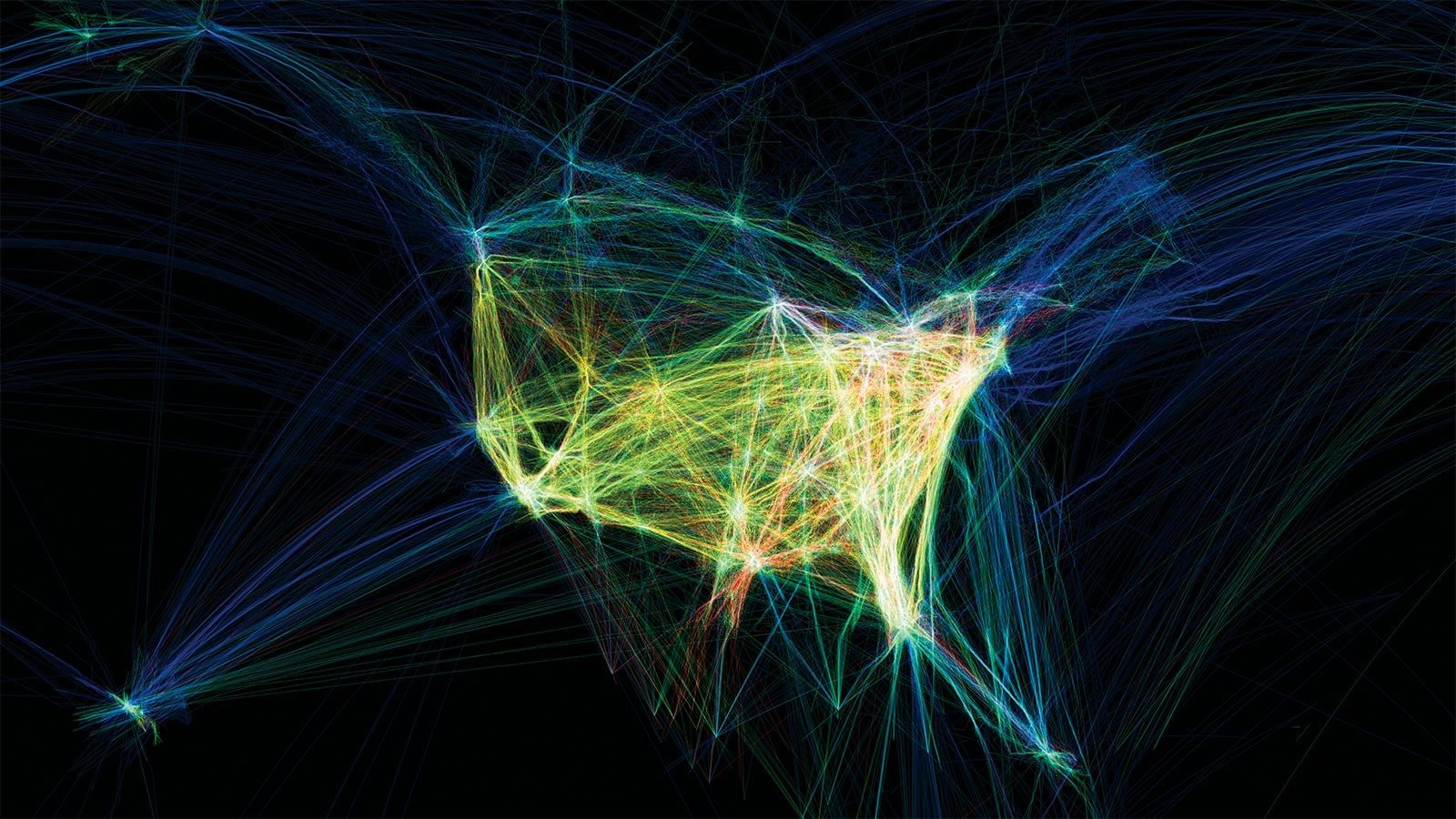

This kind of record has been a boon to the airline industry, and to travelers, with more and more passengers flying every year: almost 3.1 billion globally in 2013, according to the International Civil Aviation Organization (ICAO). That number marked a 4.5% increase over 2012, and the ICAO projects the number of annual passengers to reach 6 billion by 2030.

Competition for passengers is fierce, and airline margins, even in good years, remain tight, at around 2% to 3%. But despite last year’s two major tragedies, the industry’s singularly impressive safety record over the years has helped keep premiums at attractive levels. In fact, even though rates have climbed from where they were in 2013, they are less today than they were 10 or even 15 years ago.

Given the industry’s tight margins, pricing for aviation insurance will always be an important consideration for industry buyers. But it is not the only factor in purchasing decisions. Risk management among airline companies is highly sophisticated, and this sophistication is reflected in their demands for coverage.

Coverage for cyberthreats

One area of interest for many industry buyers has been protection against cyber attacks. Cyber threats have become ubiquitous across most, if not all, industry verticals, and aviation is no exception. It is not difficult to imagine the kinds of damage, and not just financial, that could be caused by a major security breach at an airline or airport. As the rate and sophistication of cybercrimes and the threat of cyber terrorism grow, the risk profiles of airlines and airports are changing, and industry buyers are adjusting their risk management strategies to accommodate those changes. A number of companies in the insurance industry, including AIG, have responded by providing a number of offerings to help meet these evolving needs.

In addition to cyber threats, risk managers in the aviation industry are seeking to broaden their coverage in other areas as well. These range from potential liabilities relating to pollution from de-icing and fuel storage to situations involving, for example, the loss of GPS satellite communications data, which airlines rely on for navigation and terrain mapping.

Importance of claims handling in aviation

As the aviation industry grows in both size and complexity, the importance of claims handling has been magnified. As the two horrific incidents discussed earlier illustrate, when things go wrong in the industry, they can go very wrong. Risk managers in the industry rely on insurance partners that help them navigate the labyrinth-like claims process quickly and as painlessly as possible. Some providers outsource the claims handling function, while others, such as AIG, handle it with experienced internal claims teams. Buyers should lean toward whichever provider they believe will partner with them best in a crisis.

The aviation industry will continue to evolve in order to meet the ever-increasing demands of the flying public. In the process, industry risk managers will need to continue to regularly assess their organizations’ risk profiles to ensure they have the breadth of coverage they need.

Learn more

about the importance of managing aviation risk and how AIG can help.

This article was written by AIG and not by the Quartz editorial staff.