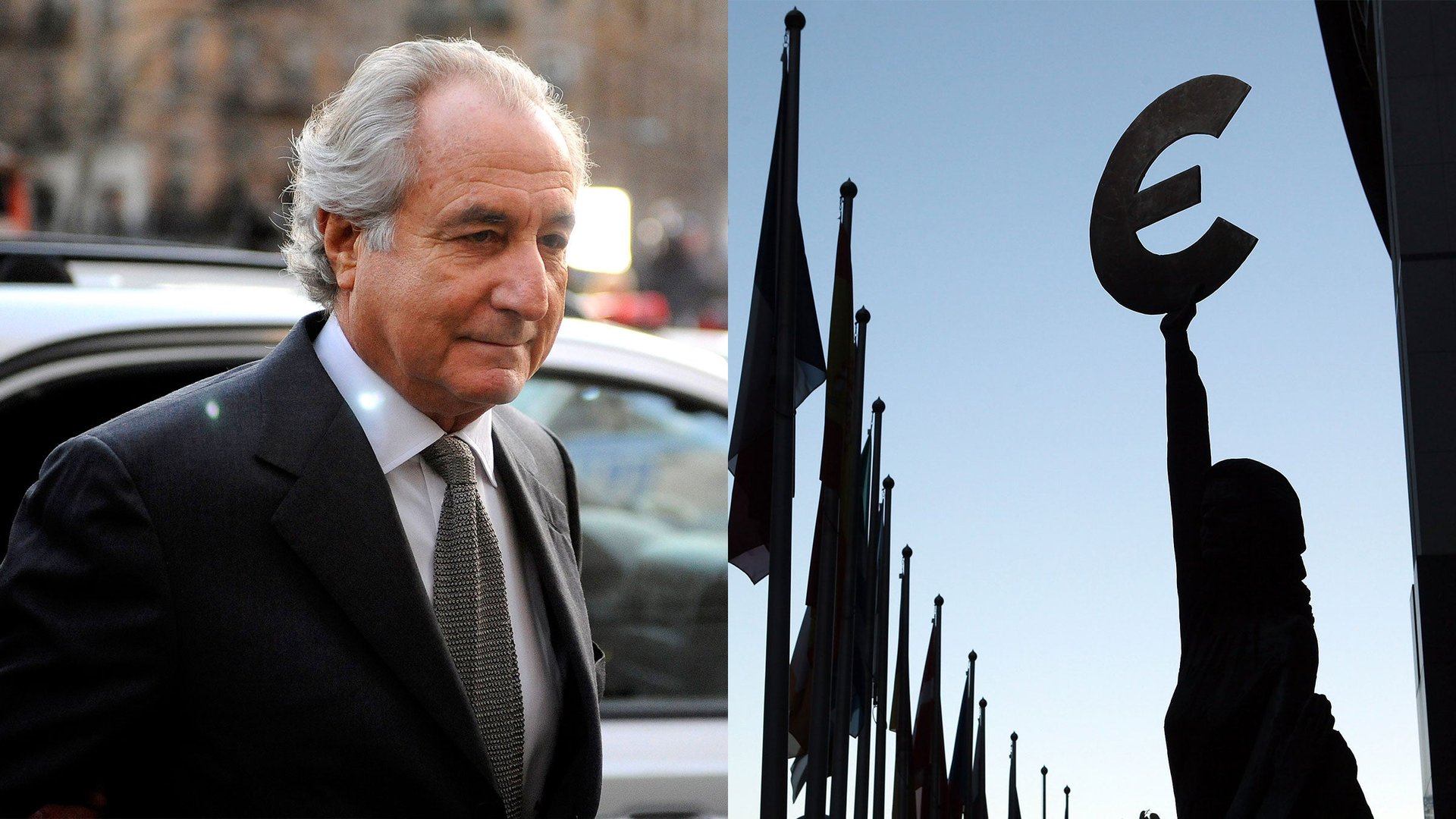

Why the EU crisis has a lot in common with Bernie Madoff’s Ponzi scheme

Bernie Madoff and the European Union have a lot more in common than you might think. In the private sector, when someone assumes new loans to cover earlier losses but still claims the money is well-invested it’s called fraud. All of the problems will be taken care of “in the future,” the same vaguely outlined future in which investors can expect handsome rewards. In the public sector it’s called a debt crisis.

Bernie Madoff and the European Union have a lot more in common than you might think. In the private sector, when someone assumes new loans to cover earlier losses but still claims the money is well-invested it’s called fraud. All of the problems will be taken care of “in the future,” the same vaguely outlined future in which investors can expect handsome rewards. In the public sector it’s called a debt crisis.

Precisely such a mess is brewing right now within the EU. The main difference is that the situation is much graver than in any corporate house of cards since so many more stakeholders are involved: every single EU citizen. Across Europe, overly indebted households, overly indebted banks and overly indebted states have been able to avoid the consequences of self-inflicted recklessness for years. This recklessness is of a scale that lacks historical comparison except perhaps to the lending practices of the war-prone monarchs during the preparliamentary age of absolutism, but that only extends to the state level.

The main reason for the mess is that governments on both sides of the aisle, as well as those lingering in between, have been angling for votes by proactively fuelling consumption through artificially low interest rates and by underwriting bad bank and household loans. Arguably, the ultimate responsibility rests with the heavily mortgaged homeowners, probably the strongest individual lobby group in today’s society. This lobby group has flexed its considerable political muscle to reward short-sightedness rather than realism.

Simultaneously, the EU has taken shape as the ultimate creditor, a seemingly well capitalized “holding company,” which proactively underpins the unreflecting level of consumption. “Refined” solutions are not wanting, arguably illustrating that we’re already in the manic stage. The new “European Stability Mechanism,” ratified a few months back, is a perfect example. This is a new EU entity that is mandated to capitalize banks in distress through individual governments. Thereby, poorly run governments can continue to prop up poorly run banks.

How is this possible even now? Because, and here goes a particularly refined bit, rules have been changed so fresh money can now to be supplied from the few remaining, relatively sound EU economies. The party of reckless lending and consumption can carry on yet further.

The latest example of a refined solution was offered by the banking union just before Christmas. The very same “EU visionaries” who have encouraged the unrestrained lending practices during the last decades have thereby managed to negotiate themselves into assuming the ultimate responsibility for overseeing the banking sector within the euro zone. Within this zone, politicians in all camps – and also many outside – are describing the banking union by using terms such as “necessary,” “ground breaking,” and “responsible.” Policies to seriously deal with the massive structural problems are postponed to a vaguely defined future.

An extenuating circumstance for a person such as Madoff is that he at least shared the risks with his investors. This is not the case with the driving “EU visionaries” of today. These include the government ministers in individual countries who repeatedly are invited to the lunch and negotiation meetings in Brussels to sign yet another treaty that “by necessity” centralizes power as well as expands the EU empire. Why are these government ministers, regardless of political color, almost always putting pen to paper? Because on the personal level only two outcomes are offered around the tables of “leading men”: to be hailed as a hero or ostracised. The latter also means kissing goodbye to all future international top jobs. Moreover, state pensions are ensured regardless of the responsibility for administering what might very well be the first peacetime fall in living standards since the start of the industrial revolution (given the absence of another “miracle” in the form of a major technological leap).

Who does assume the full economic risk? The few remaining oddballs who are still prudently paving taxpayers, as well as our children and grandchildren.