China’s newest corporate giant is selling cheap high-speed rail to the rest of the world

The merger of China’s two largest state-owned rail equipment makers has created an industry behemoth, second only to General Electric in size, that will be competing aggressively for projects across Africa, Southeast Asia, and Latin America.

The merger of China’s two largest state-owned rail equipment makers has created an industry behemoth, second only to General Electric in size, that will be competing aggressively for projects across Africa, Southeast Asia, and Latin America.

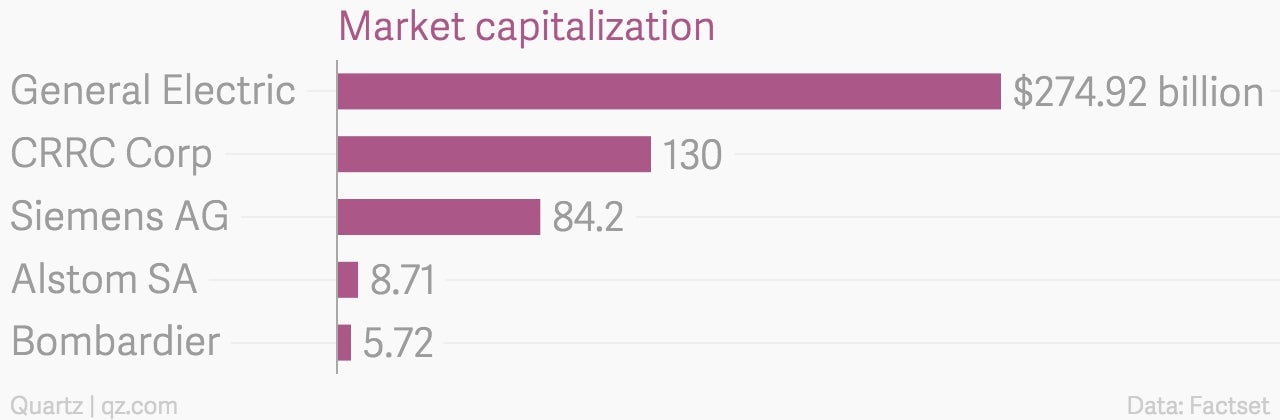

The dual-listed China Railway Construction Corp. began trading on June 8 in Hong Kong and Shanghai after CSR Corp Ltd and China CNR completed their merger last week. Shares jumped as much as 12% by mid-morning of their debut, bringing the company’s market capitalization to $130 billion, larger than that of many rail industry heavy hitters like Germany’s Siemens, France’s Alstom, or Canada’s Bombardier. And GE, the largest company in the business, also has finance, aviation, energy and other industries in its massive portfolio.

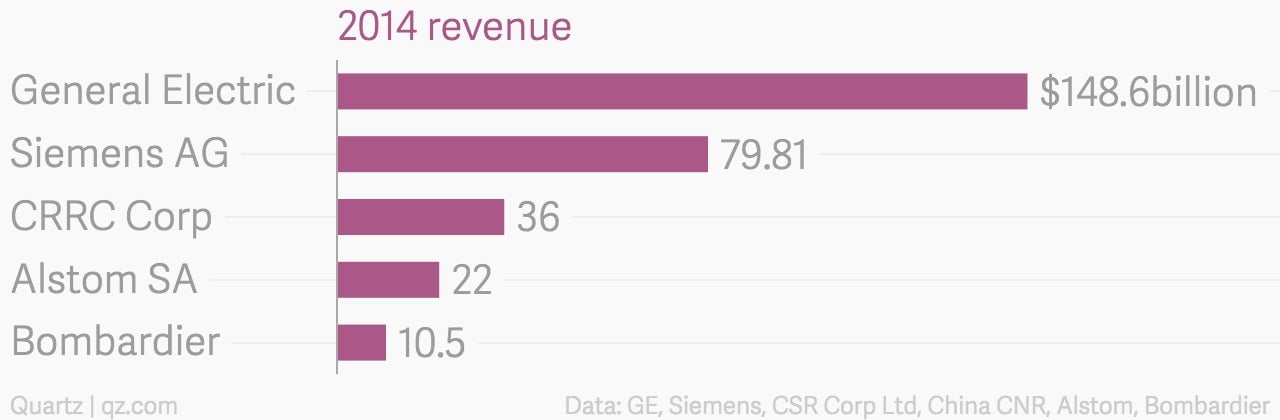

The combined CRCC has revenues of about $36 billion and a workforce of 118,000.

CRRC was created to allow China, home to the world’s largest network of high-speed rail, to become more competitive when it exports rail technology and manufacturing. China, once a major importer of rail technology, wants to be a world leader in high speed rail, with projects that span the globe, focusing especially on emerging markets.

“It used to be that CSR and CNR were competing against Bombardier and Alstom; now it has become China versus everybody else,” Alexious Lee, who leads industrials research for CLSA, told Bloomberg. “China’s products may not boast high-end specifications, but they provide value for money.”

Indeed, China’s advantage is that it offers a cheaper alternative than its rivals. Chinese rail costs, on average, between $17-21 million per km (pdf, p.7), compared to non-Chinese companies’ $25-39 million per km, according to World Bank estimates. Last year, CNR won a $567 million bid to build the subway system in Boston, Massachusetts after bidding 50% less than Bombardier.

Still, China’s global rail ambitions have also run into problems. Its $3.7 billion high speed rail contract in Mexico was abruptly scuppered due to internal politics. While China provides equipment and construction help, so far no mainland company has won any bid to export made-in-China bullet trains.