Defaulting on your student loans is not the right answer

Lee Siegel’s essay in the New York Times this weekend about why he walked away from his student loans was an act of misleading, irresponsible journalism.

Lee Siegel’s essay in the New York Times this weekend about why he walked away from his student loans was an act of misleading, irresponsible journalism.

He wrote of choices to forgo the state college he could afford in favor of going to a private liberal arts school, as well as choosing a less stable writing gig over a career that would yield more money. (He failed to mention his decision to obtain multiple degrees from an Ivy League school and to live in a high-priced New Jersey suburb where he shops at Whole Foods.)

He blames an education system for ruining his life “simply because I had the misfortune of coming from modest origins.” And he whines that the banks that got bailouts or the rich folks who commit tax fraud tend to get off without consequence; the argument being that he too should be able to walk away from his responsibilities.

To this I proffer two words: Grow up. ”That guy got away with bad stuff so I should too” didn’t cut it in Kindergarten. And it definitely doesn’t work in adulthood.

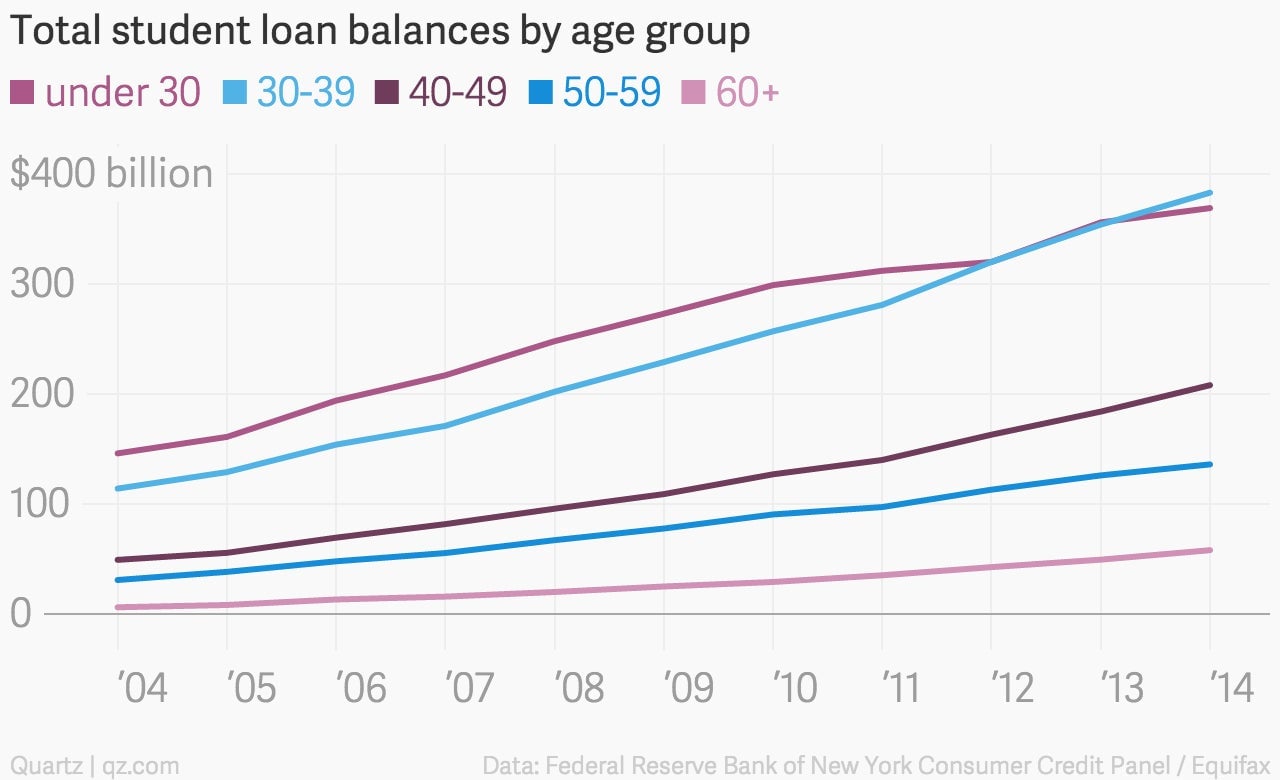

Yes, the student loan business is broken, and for many it’s a dirty, bad deal. Yes, college is expensive and getting pricier by the year. Yes, the banks and the government should be ashamed of themselves for engineering programs that have let America’s student debt load balloon to $1 trillion. Yes, many people got caught up in making very poor decisions and are suffering the consequences. Yes, life is hard and the student loan crisis is ugly. Yes, we should do something about it.

But willingly defaulting on your loans will not fix the system. And it certainly won’t make you better off. (Your chances of buying a home or car will be dashed, your taxes withheld, and your wages garnished, to name just a few consequences.) The rising default rate also harms the broader economy, landing people even deeper into debt and usurping the funds that millions of people would have spend on cars, homes, and other goods. It also saddles the American taxpayer, who now foots the bill for a majority of student loans, with an even bigger debt burden.

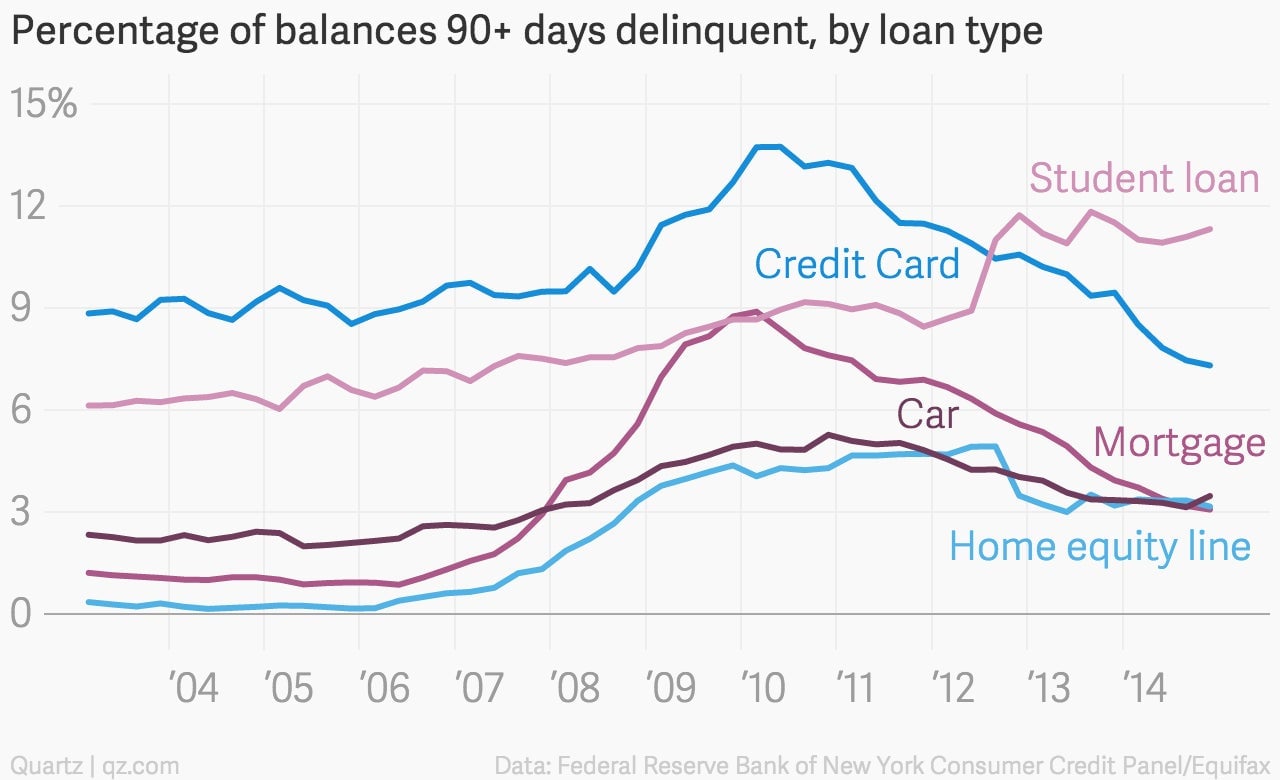

More than seven years after the 2008 financial crisis, which spurred a federal overhaul of the student loan business, the percentage of people not paying back their student loan has shot way past the percentage of people failing to pay their credit card bills, to reach 11.3%.

It still remains, however, the responsibility of the borrower to determine whether taking out a loan makes sense, and to make decisions with that debt burden in mind.

There are many resources out there today to estimate the size of your monthly loan payments and the annual salary required to manage them. If you find out that the loans you want are just too expensive, consider other options: If a scholarship is not available, perhaps a community college or a state school is a better choice? Maybe moving to Texas instead of New York after college could keep rent and living costs low enough to afford loan payments?

Take Erika Baroman, 28, who moved to the US in 2007 from the Philippines. Although she wanted to immediately go off to college, she stayed with her parents for a year in North Aurora, Ill. to earn money. She took classes at a nearby community college and worked nights at Sam’s Club.

When she decided on a major, she transferred to the University of Illinois at Chicago in 2010, and worked nights at Target.

She was “set on never getting a private loan,” Baroman told Quartz. “The summer of 2008 I even took a second job, a sales associate at Victoria’s Secret, just to make sure that I could use the money for books.”

When she graduated in May 2012, she took a job at a Chicago logistics company called Coyote and ended up paying her loans off by January 2013, going “very aggressive on the first year, most of the time paying $300 to $400 instead of paying the minimum of $25 per month,” she said, “I was determined to pay off the debt.”

So Lee is right about one thing—life isn’t fair. But the only way out of this mess is realizing that life isn’t about the cards we get dealt. Rather, it’s about the choices we make of how to play them.