Choose your own adventure to avoid the US debt ceiling

The United States has reached its self-imposed limit on borrowing money, and its Treasury is slowly spending down the remaining cash on hand.

The United States has reached its self-imposed limit on borrowing money, and its Treasury is slowly spending down the remaining cash on hand.

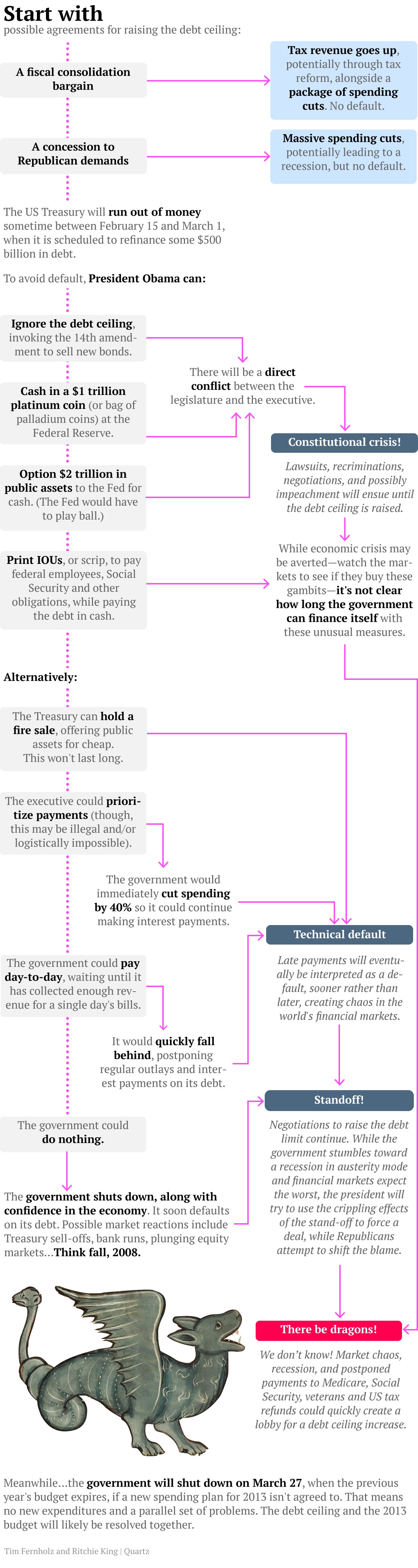

In the coming weeks, Congress will need to raise that limit or face a potential default on US debt, a potentially catastrophic event. Republicans have indicated that they’ll use the threat of default to spur spending cuts on their terms, but President Obama has said he won’t negotiate over raising the debt limit, preferring talks to determine a 2013 budget as a venue for Congress’ fiscal aspirations.

Efforts to game out the debt ceiling talks have resulted in fairly outlandish scenarios involving platinum coins and federal IOUs. We’ve gathered as many of the options as possible to come up with a a reasonable menu of the available outcomes. You may want to print this out to be ready for when things start heating up:

Our chart draws on conversations with present and former officials in the Treasury and both chambers of Congress; the Standard & Poor’s bond-rating agency; economists at financial institutions and universities; and lawyers. Particularly useful were reports by the Bipartisan Policy Center, the Brookings Institution, and the Congressional Budget Office, and op-eds by legal experts Jack Balkin, Edward Kleinbard, Eric Posner, and Laurence Tribe.