Mexico, the economic dynamo of 2013, has some catching up to do in one very important sector

One of the big stories on our 2013 radar is Mexico, expected to become the world’s tenth-largest economy this year. Thanks to rising wages in China and Mexico’s proximity to the US and the South American markets, the country is becoming a favorite for manufacturers looking for production facilities: It’s now the fourth-biggest automotive exporter in the world.

One of the big stories on our 2013 radar is Mexico, expected to become the world’s tenth-largest economy this year. Thanks to rising wages in China and Mexico’s proximity to the US and the South American markets, the country is becoming a favorite for manufacturers looking for production facilities: It’s now the fourth-biggest automotive exporter in the world.

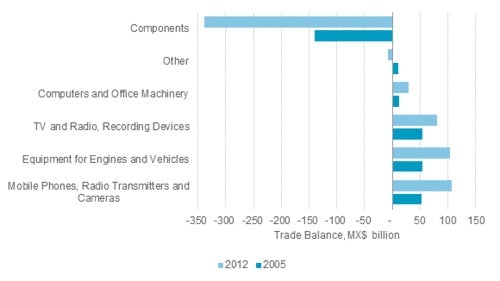

But despite above-average growth, there’s still a lot of ground to make up for Mexico when it comes to finding economic advantages over competitors like China, Indonesia and Costa Rica. The above chart from Euromonitor shows Mexico’s electronics trade deficit, which has grown for the fourth year running. If you’re a rising economy planning for the future, one sector you probably want to focus on is electronics, which is fast-growing in itself and underpins other advanced industry.

But in Mexico, nearly 68% of domestic demand for electronics components is met with imports, and despite the fact that it is the tenth-largest producer in the world, its per capita production lags behind China, the US and even Eastern European countries. Mexico’s industry is expected to only grow 5% per year in the medium term, compared to 11 to 17% in China.

While Euromonitor points to drug violence and struggles with labor unions as the problem, those factors don’t seem to be deterring other kinds of business investment. The bigger problem may be structural, as noted in this story about Mexico’s changing economy that quotes Enrique Dussel Peters, coordinator of the China-Mexico Study Center at the National Autonomous University of Mexico:

Unlike in China, where the Communist Party identifies “pillar industries” and orders banks to shovel loans their way, Dussel Peters said, Mexicans who are eager to start or grow businesses even in strategic sectors can’t get cash easily.

“Smaller businesses in Mexico don’t have access to financing, and those that have it get it at a very high cost,” Dussel Peters said.

Even with the North American Free Trade Agreement, the sweeping 1994 accord that ties Canada, the United States and Mexico together in the world’s biggest trade bloc, Mexico suffers from an “enclave economy,” of which the vast gated industrial parks along the U.S.-Mexico border are the most visible sign. Goods are assembled there for export, but rarely from parts manufactured in Mexico. That means the country’s economy doesn’t benefit as deeply as it might from its low-wage status.

In addition to the difficulty in financing small business, the monopolies that dominate the country’s tech sector, particularly the telecommunications empire of Carlos Slim, the world’s richest man add to the challenge of introducing competition to the tech sector. Mexico and its new president Enrique Peña Nieto also recognize a need to reform its education system, which is not giving workers the skills they need to perform more better paying technical labor.

Mexico has a unique opportunity to capitalize on economic trends and increase its prosperity, but only with renewed focus on electronics can it take best advantage.